- United States

- /

- Medical Equipment

- /

- NasdaqGM:RXST

Investors Don't See Light At End Of RxSight, Inc.'s (NASDAQ:RXST) Tunnel And Push Stock Down 39%

RxSight, Inc. (NASDAQ:RXST) shareholders that were waiting for something to happen have been dealt a blow with a 39% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 84% share price decline.

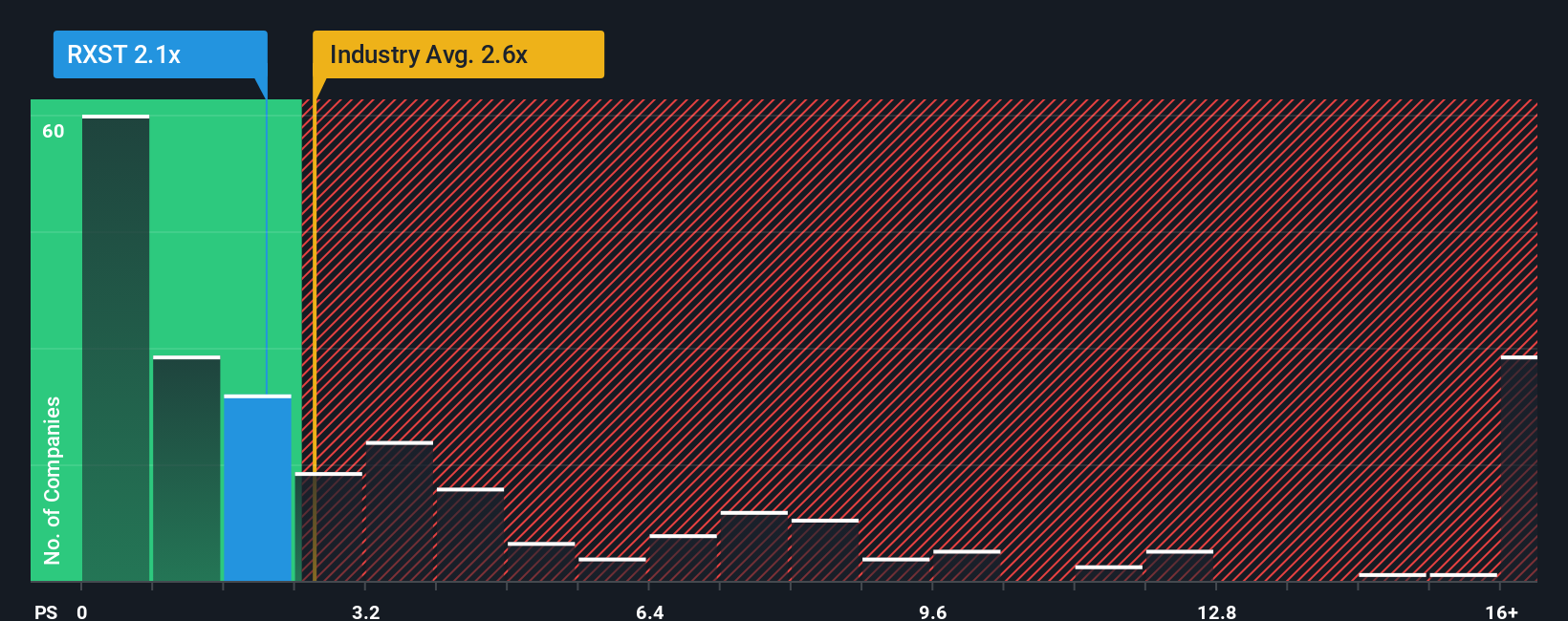

Since its price has dipped substantially, RxSight's price-to-sales (or "P/S") ratio of 2.1x might make it look like a buy right now compared to the Medical Equipment industry in the United States, where around half of the companies have P/S ratios above 2.6x and even P/S above 7x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for RxSight

What Does RxSight's Recent Performance Look Like?

Recent times have been advantageous for RxSight as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on RxSight.Is There Any Revenue Growth Forecasted For RxSight?

In order to justify its P/S ratio, RxSight would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company grew revenue by an impressive 47% last year. This great performance means it was also able to deliver immense revenue growth over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 5.3% per annum as estimated by the eleven analysts watching the company. With the industry predicted to deliver 9.8% growth per annum, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why RxSight's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What Does RxSight's P/S Mean For Investors?

RxSight's recently weak share price has pulled its P/S back below other Medical Equipment companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As expected, our analysis of RxSight's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

There are also other vital risk factors to consider and we've discovered 3 warning signs for RxSight (1 is concerning!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on RxSight, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:RXST

RxSight

A commercial-stage medical technology company, engages in the research and development, manufacture, and sale of light adjustable intraocular lenses (LAL) used in cataract surgery in the United States.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026