- United States

- /

- Medical Equipment

- /

- NasdaqCM:RMTI

Why Investors Shouldn't Be Surprised By Rockwell Medical, Inc.'s (NASDAQ:RMTI) 32% Share Price Plunge

Rockwell Medical, Inc. (NASDAQ:RMTI) shares have had a horrible month, losing 32% after a relatively good period beforehand. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 68% loss during that time.

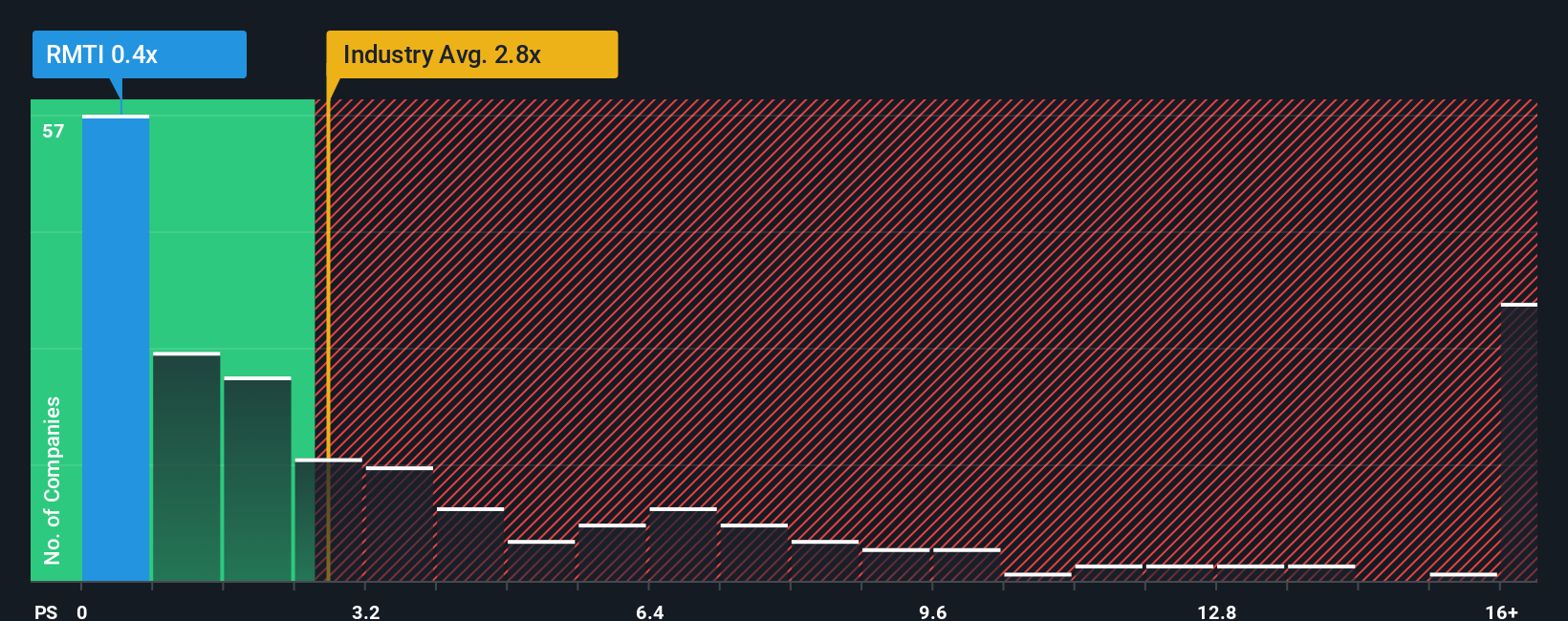

Following the heavy fall in price, Rockwell Medical may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.4x, considering almost half of all companies in the Medical Equipment industry in the United States have P/S ratios greater than 2.8x and even P/S higher than 8x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Rockwell Medical

What Does Rockwell Medical's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Rockwell Medical's revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Rockwell Medical will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

Rockwell Medical's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Retrospectively, the last year delivered a frustrating 6.8% decrease to the company's top line. Even so, admirably revenue has lifted 33% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue growth is heading into negative territory, declining 18% over the next year. With the industry predicted to deliver 9.9% growth, that's a disappointing outcome.

In light of this, it's understandable that Rockwell Medical's P/S would sit below the majority of other companies. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Final Word

Having almost fallen off a cliff, Rockwell Medical's share price has pulled its P/S way down as well. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It's clear to see that Rockwell Medical maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Having said that, be aware Rockwell Medical is showing 4 warning signs in our investment analysis, and 1 of those shouldn't be ignored.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:RMTI

Rockwell Medical

Develops, manufactures, commercializes, and distributes various hemodialysis products for dialysis providers worldwide.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives