- United States

- /

- Medical Equipment

- /

- NasdaqCM:RMTI

Rockwell Medical, Inc.'s (NASDAQ:RMTI) Subdued P/S Might Signal An Opportunity

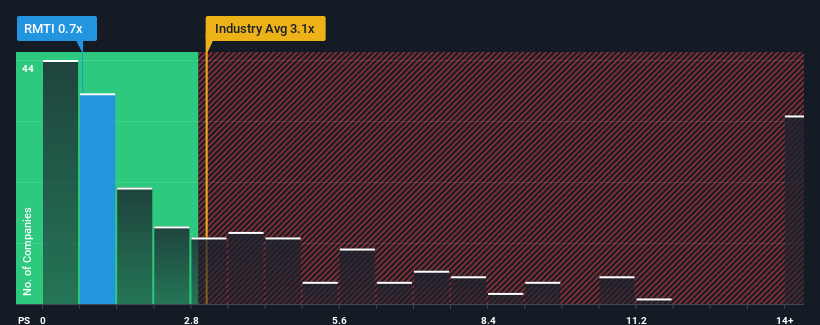

Rockwell Medical, Inc.'s (NASDAQ:RMTI) price-to-sales (or "P/S") ratio of 0.7x might make it look like a strong buy right now compared to the Medical Equipment industry in the United States, where around half of the companies have P/S ratios above 3.1x and even P/S above 7x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

Check out our latest analysis for Rockwell Medical

How Rockwell Medical Has Been Performing

Recent times have been advantageous for Rockwell Medical as its revenues have been rising faster than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Rockwell Medical will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as depressed as Rockwell Medical's is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered a decent 13% gain to the company's revenues. Pleasingly, revenue has also lifted 40% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 9.7% during the coming year according to the dual analysts following the company. That's shaping up to be similar to the 9.4% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Rockwell Medical's P/S is lagging behind its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Final Word

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It looks to us like the P/S figures for Rockwell Medical remain low despite growth that is expected to be in line with other companies in the industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Having said that, be aware Rockwell Medical is showing 4 warning signs in our investment analysis, and 1 of those is a bit unpleasant.

If you're unsure about the strength of Rockwell Medical's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade Rockwell Medical, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RMTI

Rockwell Medical

Develops, manufactures, commercializes, and distributes various hemodialysis products for dialysis providers worldwide.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives