- United States

- /

- Healthcare Services

- /

- NasdaqGS:PINC

Assessing Premier (PINC) Valuation After Recent Share Price Momentum

Reviewed by Kshitija Bhandaru

See our latest analysis for Premier.

Premier’s strong share price return of 33% over the past three months has sparked investor optimism, especially with its year-to-date gain now north of 31%. Total shareholder return for the past twelve months comes in at an impressive 50%, suggesting that recent momentum is more than just a short-term bounce. While the three- and five-year total returns have not kept pace, the latest price action hints at renewed confidence around Premier’s outlook.

If the market action in Premier has you thinking bigger, why not see what else is on the move and discover See the full list for free.

With Premier trading just above its latest analyst price targets and modest growth in revenue and profits, investors may wonder whether current momentum signals an undervalued buy or if the market has already priced in future gains.

Most Popular Narrative: Fairly Valued

Premier’s most-followed narrative puts its fair value at $27.50, just under the last close of $28. The closeness between market and narrative suggests a delicate balance of expectations and risks.

Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years, which would further boost future earnings per share. To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Are you curious if shrinking the share count is really the secret sauce behind Premier’s current price estimate? The narrative’s valuation hinges on bold predictions for both profits and what investors are willing to pay in a few years. Wondering which future financial metrics make or break this case? Peek inside the full narrative to discover what’s driving the consensus fair value.

Result: Fair Value of $27.50 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, strong demand for Premier’s advisory and analytics solutions, or a shift in healthcare cost pressures, could quickly change the current narrative.

Find out about the key risks to this Premier narrative.

Another View: Our DCF Model Points to Undervaluation

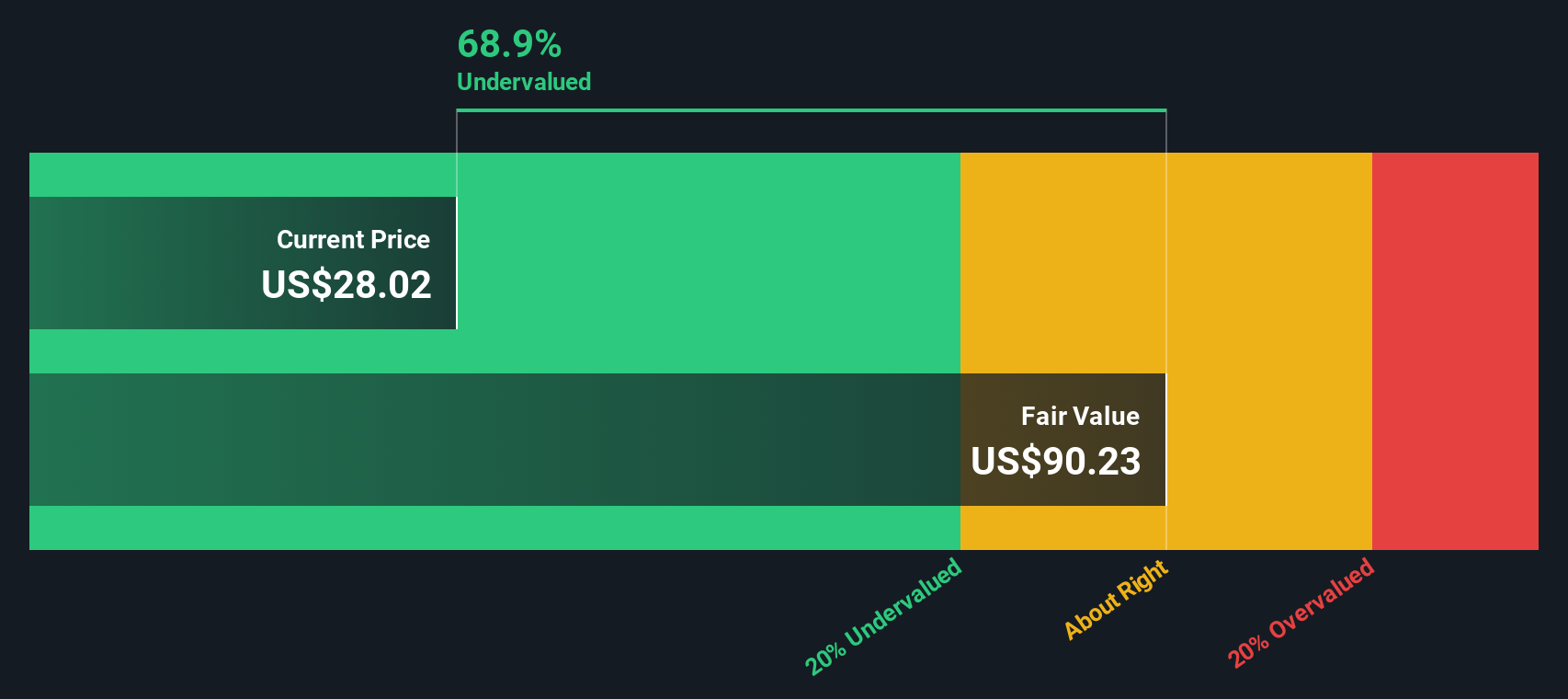

Looking at Premier through the lens of our SWS DCF model, the picture shifts dramatically. While market multiples and analyst targets suggest shares are about fairly valued, our discounted cash flow approach indicates the stock is trading well below its estimated fair value. This model could be highlighting overlooked upside, or it may rely on assumptions the broader market is discounting.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Premier for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Premier Narrative

If you see things differently or would rather dig deeper on your own, you can shape your own narrative using our tools in just a few minutes, and Do it your way

A great starting point for your Premier research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

If you’re seeking even more ways to grow your portfolio, don’t wait to act. These fresh ideas could be the edge you need this year.

- Maximize your passive income streams when you review these 18 dividend stocks with yields > 3% offering reliable yields above 3% with the potential for long-term stability.

- Supercharge your exposure to cutting-edge technology trends and artificial intelligence by checking out these 25 AI penny stocks making headlines for innovation and performance.

- Unlock hidden value by targeting these 881 undervalued stocks based on cash flows that our analysis suggests may be trading below their fair worth right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PINC

Premier

Operates as a healthcare improvement company in the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives