- United States

- /

- Healthtech

- /

- NasdaqCM:OPRX

Even With A 33% Surge, Cautious Investors Are Not Rewarding OptimizeRx Corporation's (NASDAQ:OPRX) Performance Completely

OptimizeRx Corporation (NASDAQ:OPRX) shares have continued their recent momentum with a 33% gain in the last month alone. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 9.2% in the last twelve months.

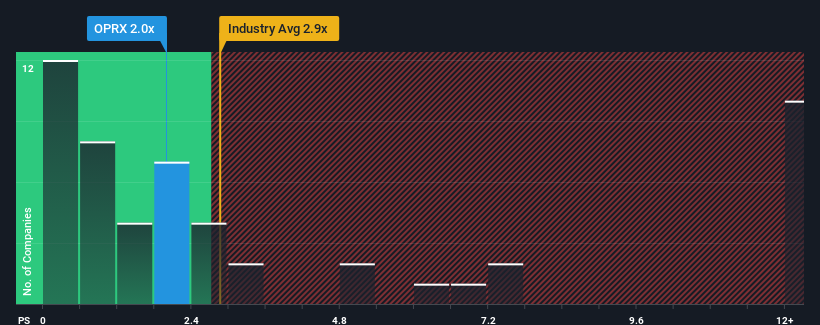

In spite of the firm bounce in price, OptimizeRx may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 2x, since almost half of all companies in the Healthcare Services industry in the United States have P/S ratios greater than 2.9x and even P/S higher than 8x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for OptimizeRx

What Does OptimizeRx's Recent Performance Look Like?

Recent times have been advantageous for OptimizeRx as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on OptimizeRx.How Is OptimizeRx's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as OptimizeRx's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered an exceptional 29% gain to the company's top line. Pleasingly, revenue has also lifted 50% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 9.9% during the coming year according to the seven analysts following the company. That's shaping up to be similar to the 9.9% growth forecast for the broader industry.

In light of this, it's peculiar that OptimizeRx's P/S sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

The Key Takeaway

Despite OptimizeRx's share price climbing recently, its P/S still lags most other companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've seen that OptimizeRx currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Having said that, be aware OptimizeRx is showing 2 warning signs in our investment analysis, and 1 of those can't be ignored.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:OPRX

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success