- United States

- /

- Healthcare Services

- /

- NasdaqGS:OPK

OPKO Health (OPK): Assessing Valuation After BioReference Lab Sale and Strategic Shift Toward Pharma Growth

Reviewed by Kshitija Bhandaru

OPKO Health (OPK) is making headlines after announcing the sale of its BioReference Lab assets. This strategic shift is intended to strengthen its balance sheet and allow greater focus on its drug development pipeline.

See our latest analysis for OPKO Health.

After a rocky few years, OPKO Health’s recent asset sale comes on the back of positive momentum, with an 8.6% 1-month share price return and a year-to-date gain of nearly 5%. Still, the longer-term total shareholder return shows deep scars, with a five-year total return deeply negative. However, the past quarter’s upward move hints that sentiment could be stabilizing as the company sharpens its strategic focus.

If OPKO’s turnaround is on your radar, now’s the perfect time to see who else is innovating in healthcare — See the full list for free.

With shares still trading well below analyst price targets and the company shifting to a leaner, growth-focused model, the big question is whether OPKO Health is now undervalued or if the market is already factoring in its recovery. Is this a buying opportunity, or is future growth already priced in?

Most Popular Narrative: 58% Undervalued

With OPKO Health finishing at $1.52 in the last session and the most widely followed narrative landing on a $3.62 fair value, the spread is noteworthy. The market might be missing something transformative that runs counter to today’s cautious trading range.

The sale of BioReference's oncology and related clinical testing assets to Labcorp is expected to sharpen OPKO Health's focus on its core testing business, drive significant cost savings, and support the Diagnostics segment's transition to cash flow positive and profitability in 2025. This could provide margin expansion and stabilize earnings.

Curious why this narrative points to a valuation leap more than double the current price? One crucial factor: it is not just about estimates for sales or losses, but the scale of future margin growth built into the story. The key financial assumptions could turn traditional valuation thinking upside down. Uncover them inside the full narrative.

Result: Fair Value of $3.62 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent net losses and heavy R&D spending could undermine the bullish case if new products fail to deliver as expected.

Find out about the key risks to this OPKO Health narrative.

Another View: A Look at Sales Ratios

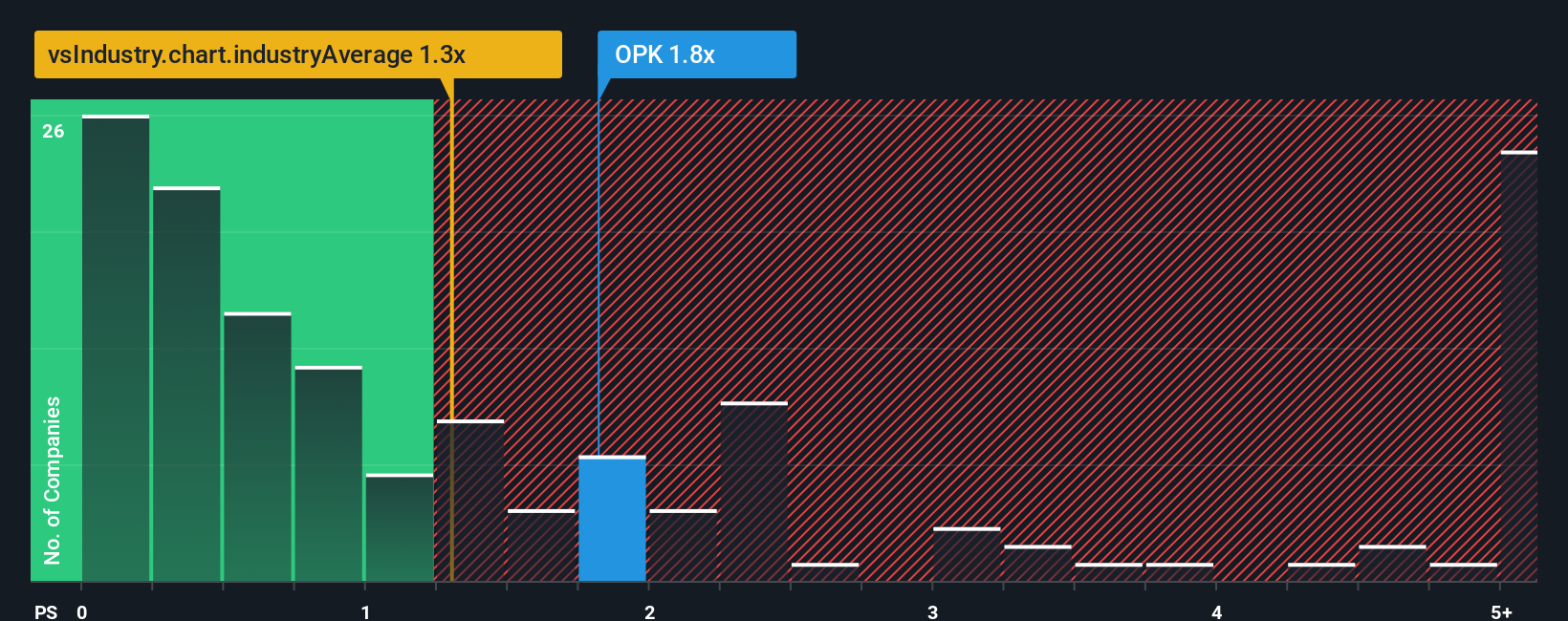

Not everyone agrees with the narrative-based price target. Looking at OPKO Health’s price-to-sales ratio, the company trades at 1.8x, which is well above the estimated fair ratio of 0.5x and the industry average of 1.3x, though it is cheaper than the peer average of 2.4x. This gap signals a risk that shares may be valued for more growth than the business delivers today. Could this premium mean investors are getting ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own OPKO Health Narrative

If you see the story unfolding differently or want to dive into the numbers yourself, it only takes a few minutes to shape your own perspective and narrative. Do it your way

A great starting point for your OPKO Health research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never rely on just one stock. Level up your strategy by using the Simply Wall Street Screener to lock onto unique opportunities tailored to your goals.

- Spot untapped bargains by reviewing these 877 undervalued stocks based on cash flows that have strong fundamentals and genuine upside potential.

- Grow your passive income stream and boost portfolio resilience by checking out these 18 dividend stocks with yields > 3% that offer yields above 3%.

- Ride the wave of innovation by backing these 25 AI penny stocks set to lead breakthroughs in artificial intelligence and next-gen tech.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OPK

OPKO Health

A healthcare company, engages in the diagnostics and pharmaceuticals businesses in the United States, Ireland, Chile, Spain, Israel, Mexico, and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives