- United States

- /

- Medical Equipment

- /

- NasdaqGS:OMCL

Exploring May 2025's Undervalued Small Caps With Insider Activity

Reviewed by Simply Wall St

Over the last 7 days, the United States market has experienced a slight decline of 1.4%, yet it has shown resilience with an 11% rise over the past year, and earnings are anticipated to grow by 14% annually in the coming years. In this context, identifying stocks that exhibit strong insider activity can be crucial for investors seeking opportunities amidst current market conditions.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| PCB Bancorp | 10.1x | 2.9x | 47.50% | ★★★★★☆ |

| S&T Bancorp | 10.5x | 3.6x | 44.44% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.8x | 26.03% | ★★★★☆☆ |

| Niagen Bioscience | 56.9x | 7.4x | 25.11% | ★★★☆☆☆ |

| Columbus McKinnon | 50.6x | 0.5x | 34.92% | ★★★☆☆☆ |

| MVB Financial | 12.9x | 1.7x | 39.64% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -59.76% | ★★★☆☆☆ |

| Tandem Diabetes Care | NA | 1.4x | -2728.75% | ★★★☆☆☆ |

| Montrose Environmental Group | NA | 0.9x | 6.87% | ★★★☆☆☆ |

| Titan Machinery | NA | 0.2x | -422.82% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

Domo (NasdaqGM:DOMO)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Domo is a software company that specializes in cloud-based business intelligence and data visualization solutions, with a market cap of approximately $0.28 billion.

Operations: Domo generates revenue primarily through its operations, with a significant portion allocated to sales and marketing expenses, which reached $151.51 million as of January 2025. The company has experienced fluctuations in its gross profit margin, which was 74.46% at the end of April 2025. Operating expenses are another major cost component, amounting to $289.10 million in the same period.

PE: -5.9x

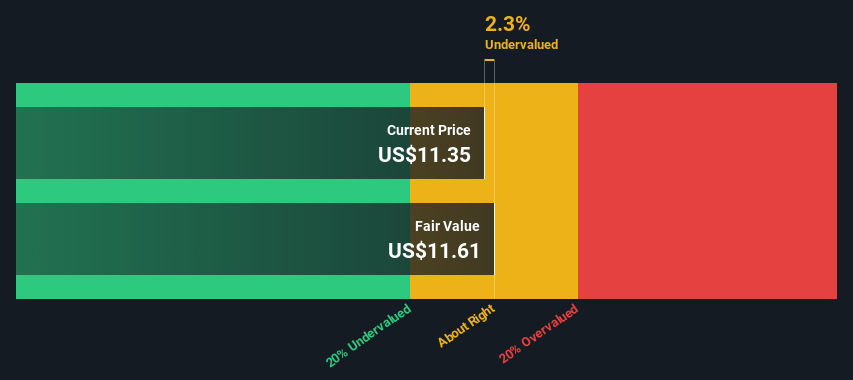

Domo's recent earnings report for Q1 2025 showed steady revenue at US$80.11 million, with a reduced net loss of US$18.05 million compared to the previous year. The company has been actively expanding its partnerships, notably with Weather Trends International and Human Capital Vue, leveraging its AI and data products to enhance client operations across various sectors. Insider confidence is evident as executives have shown interest in share purchases over recent months. While Domo remains unprofitable and reliant on external borrowing, its strategic collaborations suggest potential growth avenues despite current volatility in share price.

- Click to explore a detailed breakdown of our findings in Domo's valuation report.

Examine Domo's past performance report to understand how it has performed in the past.

Omnicell (NasdaqGS:OMCL)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Omnicell is a healthcare technology company specializing in medication management solutions and automation systems, with a market capitalization of approximately $2.42 billion.

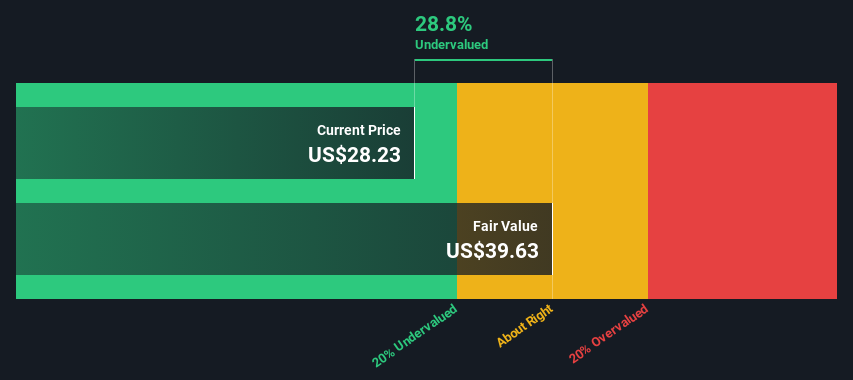

Operations: Omnicell's revenue is primarily driven by its healthcare software segment, with a recent quarterly revenue of $1.14 billion. The gross profit margin has shown fluctuations, reaching 43.24% in the latest period. Operating expenses have been significant, with research and development costs consistently contributing to these figures. The company experienced varying net income margins over time, recently recording a positive margin of 1.87%.

PE: 63.8x

Omnicell, a company focusing on medication management solutions, is navigating financial challenges with an anticipated earnings decline of 41.1% annually over the next three years. Despite this, insider confidence is evident as Randall Lipps recently purchased 10,561 shares worth approximately US$350K. The company's new share repurchase program aims to buy back up to US$75 million in stock without a set expiration date. Recent product innovations like MedTrack and MedVision aim to enhance operational efficiency and patient care through advanced RFID technology and inventory management tools.

- Delve into the full analysis valuation report here for a deeper understanding of Omnicell.

Evaluate Omnicell's historical performance by accessing our past performance report.

LSB Industries (NYSE:LXU)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: LSB Industries operates in the chemical manufacturing sector, with a focus on producing and selling chemical products, and has a market capitalization of approximately $1.46 billion.

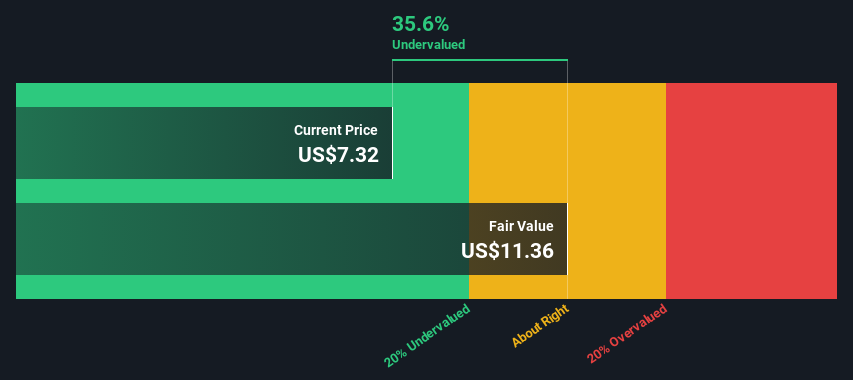

Operations: LSB Industries primarily generates revenue from its chemical manufacturing operations. Over time, the company's gross profit margin has shown significant fluctuation, with a notable high of 41.13% in Q2 2022 and a low of -9.93% in Q4 2016. Operating expenses have generally remained consistent, with general and administrative expenses being a significant component. The net income margin has varied widely, reflecting both profits and losses across different periods.

PE: -19.8x

LSB Industries, a small company in the U.S., has shown insider confidence with recent share purchases. Despite reporting a net loss of US$1.64 million for Q1 2025, down from a net income of US$5.62 million the previous year, earnings are projected to grow by 50.67% annually. The company's reliance on external borrowing presents higher risk but aligns with their focus on energy transition and decarbonization efforts, highlighted at an upcoming New York conference on May 14, 2025.

- Click here to discover the nuances of LSB Industries with our detailed analytical valuation report.

Assess LSB Industries' past performance with our detailed historical performance reports.

Make It Happen

- Discover the full array of 107 Undervalued US Small Caps With Insider Buying right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OMCL

Omnicell

Provides medication management solutions and adherence tools for healthcare systems and pharmacies the United States and internationally.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives