- United States

- /

- Medical Equipment

- /

- NasdaqGS:OM

Outset Medical, Inc.'s (NASDAQ:OM) Earnings Haven't Escaped The Attention Of Investors

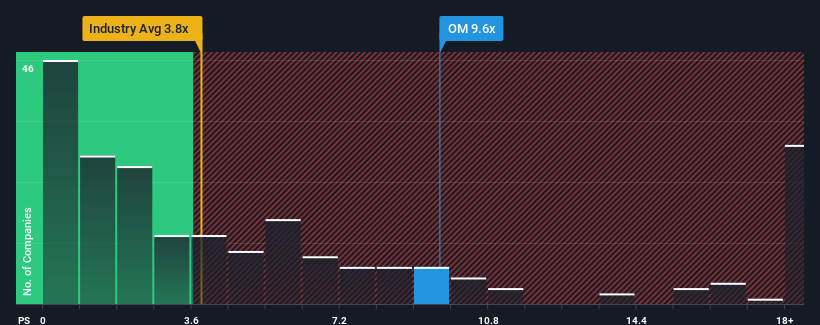

You may think that with a price-to-sales (or "P/S") ratio of 9.6x Outset Medical, Inc. (NASDAQ:OM) is a stock to avoid completely, seeing as almost half of all the Medical Equipment companies in the United States have P/S ratios under 3.8x and even P/S lower than 1.4x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Outset Medical

How Has Outset Medical Performed Recently?

There hasn't been much to differentiate Outset Medical's and the industry's revenue growth lately. Perhaps the market is expecting future revenue performance to improve, justifying the currently elevated P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Outset Medical will help you uncover what's on the horizon.How Is Outset Medical's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Outset Medical's to be considered reasonable.

Retrospectively, the last year delivered a decent 7.3% gain to the company's revenues. The latest three year period has seen an incredible overall rise in revenue, even though the last 12 month performance was only fair. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 38% per annum during the coming three years according to the six analysts following the company. That's shaping up to be materially higher than the 10.0% each year growth forecast for the broader industry.

With this in mind, it's not hard to understand why Outset Medical's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Outset Medical's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

You always need to take note of risks, for example - Outset Medical has 3 warning signs we think you should be aware of.

If you're unsure about the strength of Outset Medical's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade Outset Medical, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:OM

Outset Medical

A medical technology company, engages in the development of a hemodialysis system for hemodialysis in the United States.

Adequate balance sheet slight.