- United States

- /

- Medical Equipment

- /

- NasdaqGS:OM

Investors Still Aren't Entirely Convinced By Outset Medical, Inc.'s (NASDAQ:OM) Revenues Despite 30% Price Jump

Those holding Outset Medical, Inc. (NASDAQ:OM) shares would be relieved that the share price has rebounded 30% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the last month did very little to improve the 84% share price decline over the last year.

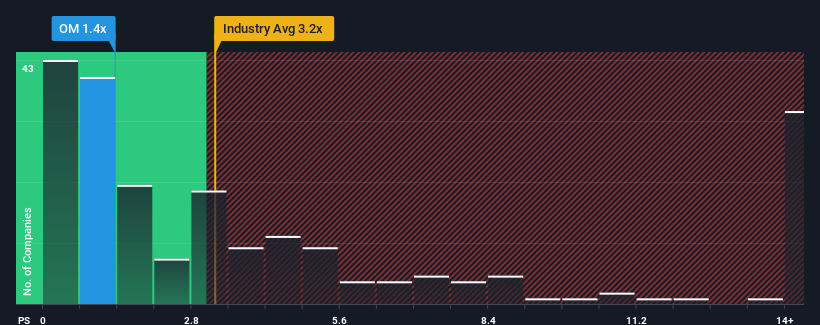

Even after such a large jump in price, Outset Medical may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 1.4x, considering almost half of all companies in the Medical Equipment industry in the United States have P/S ratios greater than 3.2x and even P/S higher than 7x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Outset Medical

How Outset Medical Has Been Performing

Outset Medical could be doing better as it's been growing revenue less than most other companies lately. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Outset Medical will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Outset Medical?

The only time you'd be truly comfortable seeing a P/S as low as Outset Medical's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a decent 5.7% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 90% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 20% each year as estimated by the eight analysts watching the company. That's shaping up to be materially higher than the 10% per year growth forecast for the broader industry.

In light of this, it's peculiar that Outset Medical's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

Outset Medical's stock price has surged recently, but its but its P/S still remains modest. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

A look at Outset Medical's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Before you take the next step, you should know about the 4 warning signs for Outset Medical (1 can't be ignored!) that we have uncovered.

If you're unsure about the strength of Outset Medical's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:OM

Outset Medical

A medical technology company, engages in the development of a hemodialysis system for hemodialysis in the United States.

Excellent balance sheet low.

Similar Companies

Market Insights

Community Narratives