- United States

- /

- Healthcare Services

- /

- NasdaqCM:NEO

NeoGenomics (NEO): Assessing Valuation After Legal Win Over Natera and New Oncology Data Releases

Reviewed by Simply Wall St

NeoGenomics (NEO) just cleared a major legal overhang, as Natera dropped its appeal and left intact a court ruling that invalidated Natera patents, while fresh clinical data spotlights NeoGenomics assays at key oncology meetings.

See our latest analysis for NeoGenomics.

After a tough stretch where the year to date share price return is still down 27.7 percent, the recent 30 day and 90 day share price returns of 15.3 percent and 47.0 percent suggest momentum is rebuilding as legal risks ease and new clinical data roll out, even though the 1 year total shareholder return remains negative and the 3 year total shareholder return is still modestly positive.

If this kind of oncology testing story has your attention, it is also worth scanning other specialist names using our curated list of healthcare stocks to spot similar opportunities.

With shares still well below prior highs despite double digit revenue and profit growth, plus a modest discount to analyst targets, is NeoGenomics now a mispriced oncology platform, or is the market already discounting its next leg of growth?

Most Popular Narrative: 11.3% Undervalued

At 11.92 dollars, the most followed narrative sees NeoGenomics worth closer to 13.44 dollars, hinging on steady top line growth and a richer future earnings multiple.

The analysts have a consensus price target of 9.778 dollars for NeoGenomics based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of 14.0 dollars, and the most bearish reporting a price target of just 6.5.

Curious how a still unprofitable cancer testing company earns a premium style future earnings multiple and higher long term growth profile than the market? The narrative leans on a compounding revenue glide path, a sharp swing in margins, and a punchy valuation multiple years down the road. Wonder which assumptions have to hit perfectly for that upside to hold together? Read on and see what is really baked into this price.

Result: Fair Value of 13.44 dollars (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent pharma funding pressure and any stumble in launching or reimbursing key assays like PanTracer could quickly puncture that upbeat growth story.

Find out about the key risks to this NeoGenomics narrative.

Another Take on Valuation

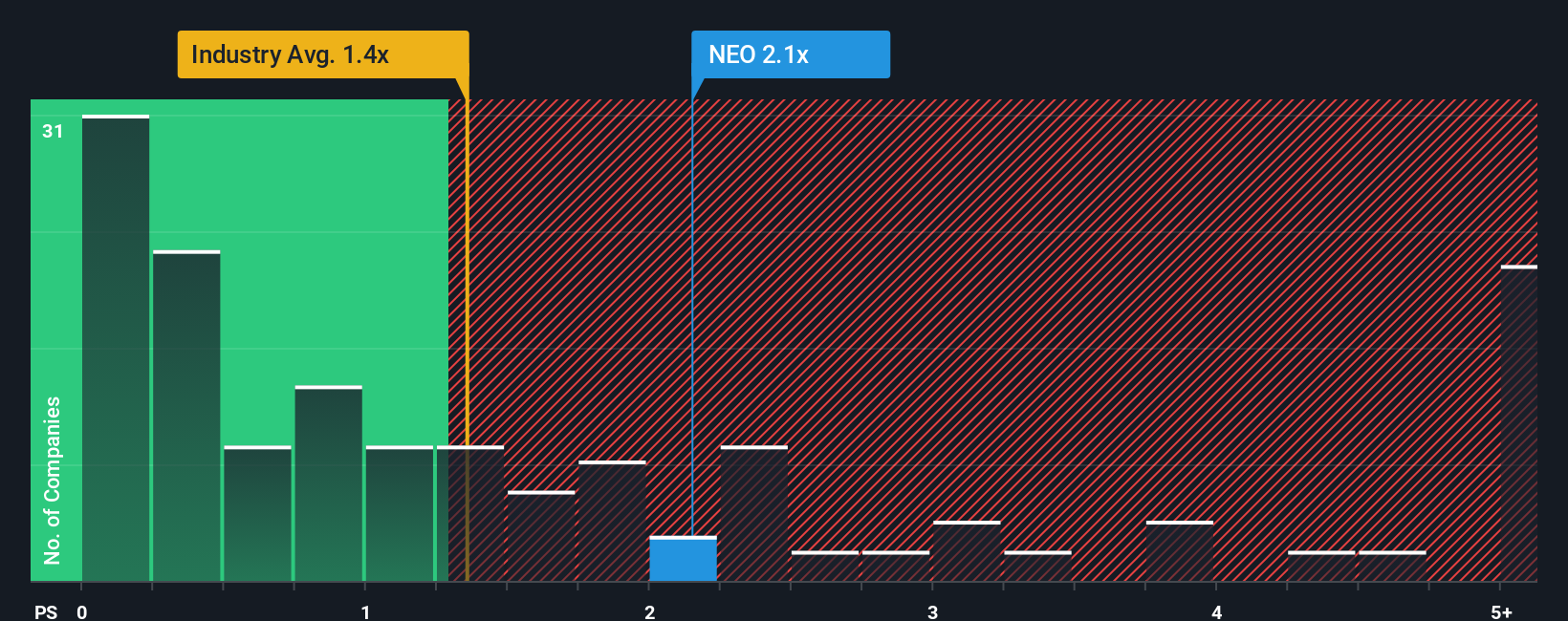

While the narrative model argues NeoGenomics is about 11 percent undervalued, the price to sales picture looks harsher. At roughly 2.2 times sales versus 1.3 times for the US healthcare sector and 1.4 times for peers, and above a 1.5 times fair ratio, the stock already bakes in superior execution that its loss making history has yet to prove. Are investors being paid enough for that risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own NeoGenomics Narrative

And if this view does not quite fit your own, dig into the numbers yourself and build a custom thesis in minutes: Do it your way.

A great starting point for your NeoGenomics research is our analysis highlighting 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, give yourself an edge by checking a few more focused stock ideas so you are not leaving potential winners on the table.

- Boost your return potential by targeting cash rich bargains through these 906 undervalued stocks based on cash flows that trade below what their future cash flows may justify.

- Level up your growth exposure with these 26 AI penny stocks capturing companies at the forefront of artificial intelligence innovation.

- Strengthen your income stream with these 13 dividend stocks with yields > 3% offering reliable yields above 3 percent backed by established businesses.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NeoGenomics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NEO

NeoGenomics

Operates a network of cancer-focused testing laboratories in the United States and the United Kingdom.

Adequate balance sheet with minimal risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)