- United States

- /

- Medical Equipment

- /

- NasdaqCM:MDAI

Many Still Looking Away From Spectral AI, Inc. (NASDAQ:MDAI)

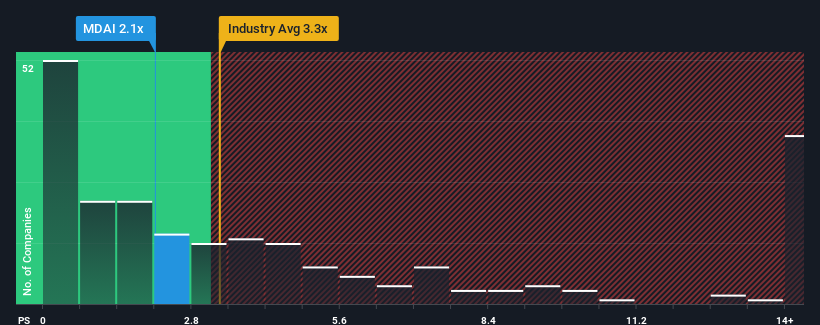

Spectral AI, Inc.'s (NASDAQ:MDAI) price-to-sales (or "P/S") ratio of 2.1x might make it look like a buy right now compared to the Medical Equipment industry in the United States, where around half of the companies have P/S ratios above 3.3x and even P/S above 8x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Spectral AI

How Has Spectral AI Performed Recently?

While the industry has experienced revenue growth lately, Spectral AI's revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think Spectral AI's future stacks up against the industry? In that case, our free report is a great place to start.How Is Spectral AI's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Spectral AI's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 19% decrease to the company's top line. Regardless, revenue has managed to lift by a handy 9.0% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 103% over the next year. With the industry only predicted to deliver 8.8%, the company is positioned for a stronger revenue result.

In light of this, it's peculiar that Spectral AI's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What Does Spectral AI's P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

To us, it seems Spectral AI currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. There could be some major risk factors that are placing downward pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Spectral AI (3 are potentially serious) you should be aware of.

If you're unsure about the strength of Spectral AI's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:MDAI

Spectral AI

An artificial intelligence (AI) company, focuses on developing predictive medical diagnostics in the United States.

High growth potential slight.