- United States

- /

- Medical Equipment

- /

- NasdaqGM:LNTH

Lantheus Holdings (NasdaqGM:LNTH) Adjusts 2025 Earnings Guidance

Reviewed by Simply Wall St

Lantheus Holdings (NasdaqGM:LNTH) recently adjusted its earnings guidance for 2025, reducing anticipated revenues, which has coincided with a 4% decline in its share price over the last quarter. In Q1 2025, the company reported a significant drop in net income and earnings per share, a factor that could influence investor sentiment negatively. Despite promising developments in product diagnostics, Lantheus's lowered guidance and governance changes may have added weight against broader market gains, as the market rose 4% in the same period. These factors underscore the complex environment the company is navigating as it addresses financial and operational challenges.

The recent adjustment in Lantheus Holdings' earnings guidance for 2025 and the resulting 4% decline in its share price underscore the immediate challenges the company faces. On a broader horizon, Lantheus has delivered significant returns with a total shareholder return exceeding 500% over the past five years. This substantial gain highlights the potential resilience and growth capacity of the company despite recent setbacks. However, in the past year, Lantheus underperformed relative to both the US Medical Equipment industry, which returned 11%, and the broader US market's 11.6% gain.

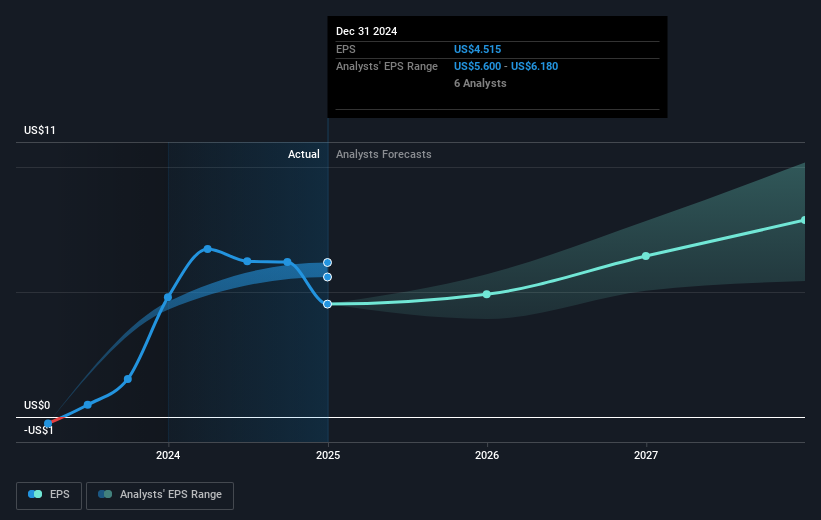

The revision in earnings guidance reflects potential implications for future revenue and earnings projections. Analysts anticipate revenue growth at 8.2% annually over three years, lower than the US market's 8.4%. Earnings, forecasted to grow 21.16% annually, hinge on the success of new market expansions and product launches. Despite the current share price of US$104.84 being below the consensus price target of US$129.31, it represents a discount, suggesting room for potential price appreciation based on future growth prospects. This context is crucial for investors assessing the current position and outlook of Lantheus within the market.

Understand Lantheus Holdings' earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:LNTH

Lantheus Holdings

Develops, manufactures, and commercializes diagnostic and therapeutic products that assist clinicians in diagnosis and treatment of heart, cancer, and other diseases worldwide.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives