- United States

- /

- Medical Equipment

- /

- NasdaqGM:LNTH

Class Action Lawsuits Over Pylarify Disclosures Could Be a Game Changer for Lantheus Holdings (LNTH)

Reviewed by Sasha Jovanovic

- In recent weeks, multiple law firms have announced class action lawsuits against Lantheus Holdings, alleging the company made false or misleading statements about the competitive position and revenue outlook for its core Pylarify product, following missed financial estimates and reduced full-year guidance.

- This wave of litigation highlights growing concerns over the company's reliance on a single product and its disclosures regarding market competition and pricing dynamics.

- We'll examine how mounting legal actions related to Pylarify's market disclosures could shift the risk profile within Lantheus Holdings' investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Lantheus Holdings Investment Narrative Recap

To own shares in Lantheus Holdings, investors need to believe the company can reduce its dependence on Pylarify by delivering new product growth and defending its pricing power despite intensifying competition in PSMA PET imaging. The recent wave of class action lawsuits surrounding Pylarify’s revenue outlook and competitive disclosures poses a significant near-term risk, overshadowing expected catalysts like new radiodiagnostic launches and FDA decisions for expanded product labels.

Among recent developments, Lantheus’s exclusive licensing agreement with GE HealthCare to commercialize PYLARIFY in Japan stands out. This deal could open new growth opportunities internationally, yet the immediate impact is muted as legal and pricing pressures in the core U.S. market remain the main short-term influencer of investor sentiment.

However, what matters most for shareholders right now is whether recent legal scrutiny will further accelerate price compression and margin risk for...

Read the full narrative on Lantheus Holdings (it's free!)

Lantheus Holdings' narrative projects $1.8 billion revenue and $419.8 million earnings by 2028. This requires 5.7% yearly revenue growth and a $148.8 million earnings increase from $271.0 million currently.

Uncover how Lantheus Holdings' forecasts yield a $84.29 fair value, a 57% upside to its current price.

Exploring Other Perspectives

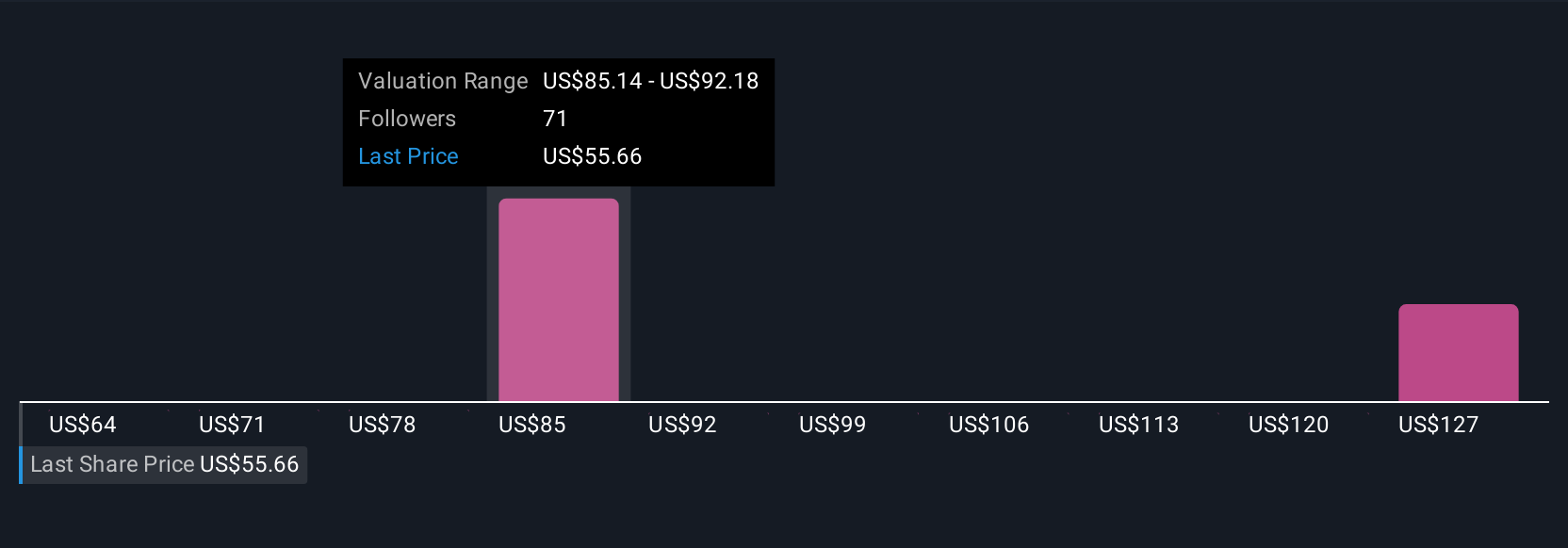

The Simply Wall St Community sees fair value for Lantheus Holdings ranging widely from US$63 to US$162 among 9 different estimates. With growing concern around ongoing price competition and margin pressure, consider how far opinions can vary depending on which risks or opportunities you view as most important.

Explore 9 other fair value estimates on Lantheus Holdings - why the stock might be worth just $63.00!

Build Your Own Lantheus Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lantheus Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Lantheus Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lantheus Holdings' overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:LNTH

Lantheus Holdings

Develops, manufactures, and commercializes diagnostic and therapeutic products that assist clinicians in diagnosis and treatment of heart, cancer, and other diseases worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives