- United States

- /

- Medical Equipment

- /

- NasdaqGM:LMAT

LeMaitre Vascular, Inc.'s (NASDAQ:LMAT) Popularity With Investors Is Clear

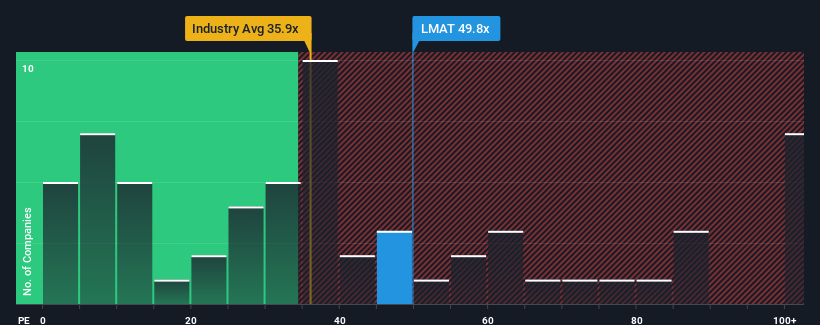

With a price-to-earnings (or "P/E") ratio of 49.8x LeMaitre Vascular, Inc. (NASDAQ:LMAT) may be sending very bearish signals at the moment, given that almost half of all companies in the United States have P/E ratios under 16x and even P/E's lower than 9x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

With its earnings growth in positive territory compared to the declining earnings of most other companies, LeMaitre Vascular has been doing quite well of late. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for LeMaitre Vascular

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, LeMaitre Vascular would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings growth, the company posted a terrific increase of 44%. The latest three year period has also seen a 28% overall rise in EPS, aided extensively by its short-term performance. Therefore, it's fair to say the earnings growth recently has been respectable for the company.

Shifting to the future, estimates from the eight analysts covering the company suggest earnings should grow by 14% per year over the next three years. That's shaping up to be materially higher than the 11% each year growth forecast for the broader market.

With this information, we can see why LeMaitre Vascular is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On LeMaitre Vascular's P/E

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of LeMaitre Vascular's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

We don't want to rain on the parade too much, but we did also find 1 warning sign for LeMaitre Vascular that you need to be mindful of.

You might be able to find a better investment than LeMaitre Vascular. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:LMAT

LeMaitre Vascular

Develops, manufactures, and markets medical devices and implants used in the field of vascular surgery in the Americas, Europe, the Middle Esat, Africa, and the Asia Pacific.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives