- United States

- /

- Medical Equipment

- /

- NasdaqGS:LIVN

LivaNova (NASDAQ:LIVN) shareholders have endured a 35% loss from investing in the stock three years ago

For many investors, the main point of stock picking is to generate higher returns than the overall market. But if you try your hand at stock picking, you risk returning less than the market. Unfortunately, that's been the case for longer term LivaNova PLC (NASDAQ:LIVN) shareholders, since the share price is down 35% in the last three years, falling well short of the market return of around 42%.

So let's have a look and see if the longer term performance of the company has been in line with the underlying business' progress.

See our latest analysis for LivaNova

While LivaNova made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last three years, LivaNova saw its revenue grow by 6.9% per year, compound. That's not a very high growth rate considering it doesn't make profits. The stock dropped 10% during that time. Shareholders will probably be hoping growth picks up soon. But ultimately the key will be whether the company can become profitability.

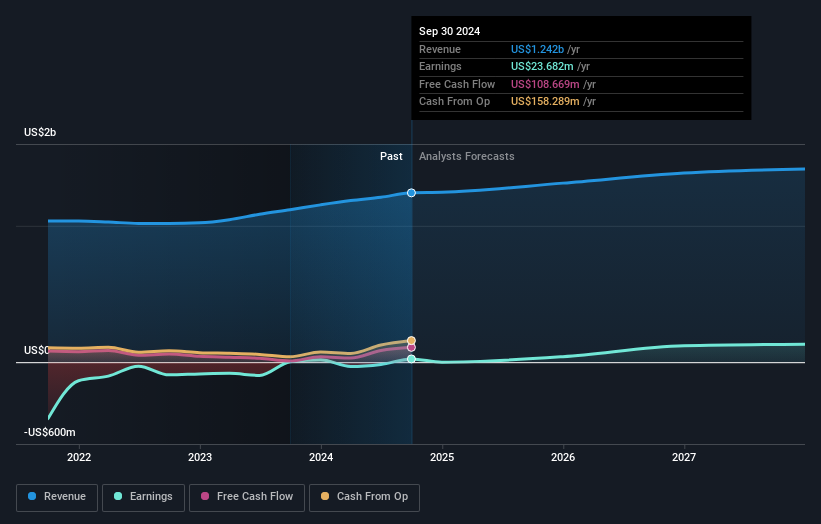

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

LivaNova is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

A Different Perspective

LivaNova shareholders are down 0.6% for the year, but the market itself is up 27%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, longer term shareholders are suffering worse, given the loss of 5% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. It's always interesting to track share price performance over the longer term. But to understand LivaNova better, we need to consider many other factors. Case in point: We've spotted 1 warning sign for LivaNova you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:LIVN

LivaNova

A medical device company, designs, develops, manufactures, and sells therapeutic solutions worldwide.

Excellent balance sheet with proven track record.