- United States

- /

- Medical Equipment

- /

- NasdaqCM:LFWD

Market Cool On Lifeward Ltd.'s (NASDAQ:LFWD) Revenues Pushing Shares 50% Lower

Lifeward Ltd. (NASDAQ:LFWD) shareholders won't be pleased to see that the share price has had a very rough month, dropping 50% and undoing the prior period's positive performance. For any long-term shareholders, the last month ends a year to forget by locking in a 80% share price decline.

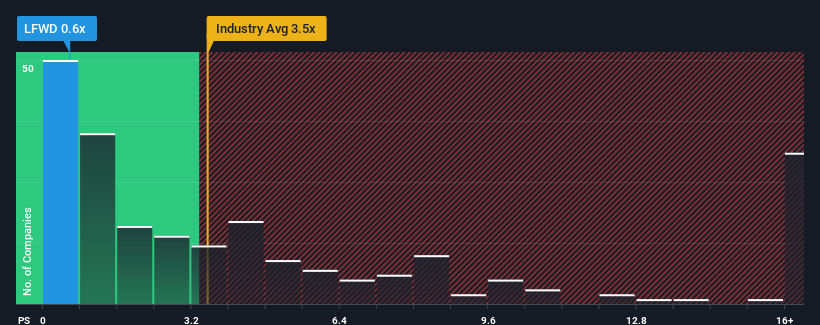

After such a large drop in price, Lifeward's price-to-sales (or "P/S") ratio of 0.6x might make it look like a strong buy right now compared to the wider Medical Equipment industry in the United States, where around half of the companies have P/S ratios above 3.5x and even P/S above 8x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Lifeward

What Does Lifeward's Recent Performance Look Like?

Recent times have been advantageous for Lifeward as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Lifeward will help you uncover what's on the horizon.How Is Lifeward's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as depressed as Lifeward's is when the company's growth is on track to lag the industry decidedly.

Taking a look back first, we see that the company grew revenue by an impressive 173% last year. This great performance means it was also able to deliver immense revenue growth over the last three years. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 58% per year as estimated by the two analysts watching the company. With the industry only predicted to deliver 9.4% per year, the company is positioned for a stronger revenue result.

With this information, we find it odd that Lifeward is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What Does Lifeward's P/S Mean For Investors?

Having almost fallen off a cliff, Lifeward's share price has pulled its P/S way down as well. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

A look at Lifeward's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Lifeward (1 is potentially serious!) that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:LFWD

Lifeward

A medical device company, designs, develops, and commercializes technologies that enable mobility and wellness in rehabilitation and daily life for individuals with physical and neurological conditions in the United States, Europe, the Asia-Pacific, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives