- United States

- /

- Healthcare Services

- /

- NasdaqGS:LFST

How a New Board Member With Digital Expertise Has Changed LifeStance Health Group’s (LFST) Investment Story

Reviewed by Simply Wall St

- LifeStance Health Group announced that Sarah Personette, chief executive officer of Puck and former senior executive at X and Facebook, joined its board of directors on August 22, 2025, while William Miller departed after five years of board service.

- Personette's extensive background in customer experience, digital media, and technology could influence LifeStance Health Group’s approach to innovation and patient engagement.

- We'll explore how the appointment of a leader with digital and customer experience expertise could influence LifeStance’s investment outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

LifeStance Health Group Investment Narrative Recap

To be a shareholder in LifeStance Health Group, you typically need to believe in the expanding demand for mental health services and the company's ability to scale sustainably in a competitive sector. The appointment of Sarah Personette to the board is unlikely to quickly shift the company’s most important short-term catalyst, technology-driven patient engagement and operational efficiency, or meaningfully alter the key risk of reimbursement pressure from insurers, though her expertise enhances the board’s digital capabilities.

One of the more relevant recent announcements is the appointment of a new Chief Technology Officer in May 2025. This move, together with Personette’s background, may strengthen LifeStance’s execution on digital initiatives, which are core to efforts at improving patient experiences and operational productivity, areas that underpin both revenue and earnings growth.

Yet, what remains concerning for investors is how ongoing shifts in public and private insurance reimbursement rates could...

Read the full narrative on LifeStance Health Group (it's free!)

LifeStance Health Group's narrative projects $2.0 billion in revenue and $111.6 million in earnings by 2028. This requires 14.6% yearly revenue growth and a $127.8 million earnings increase from current earnings of $-16.2 million.

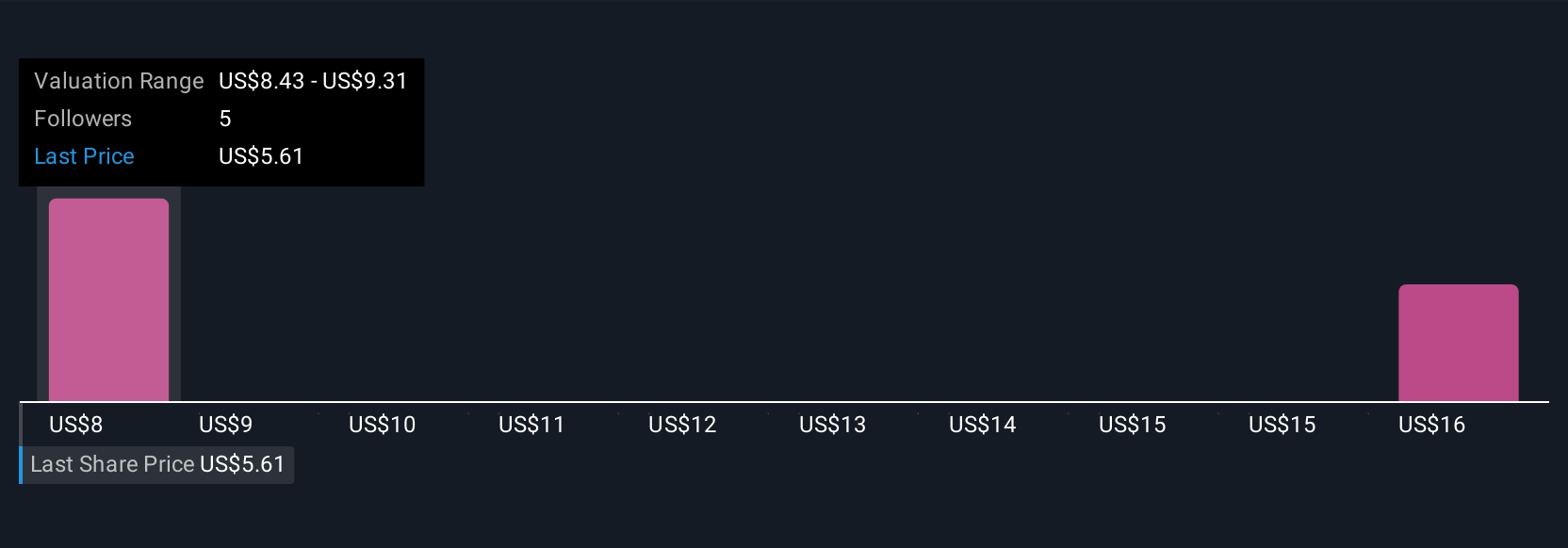

Uncover how LifeStance Health Group's forecasts yield a $8.43 fair value, a 50% upside to its current price.

Exploring Other Perspectives

Three members of the Simply Wall St Community placed their fair value estimates for LifeStance between US$8.43 and US$17.21 per share. While investors weigh these views, competitive pressures from larger healthcare entrants continue to raise questions about LifeStance’s ability to protect market share and margins.

Explore 3 other fair value estimates on LifeStance Health Group - why the stock might be worth just $8.43!

Build Your Own LifeStance Health Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your LifeStance Health Group research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free LifeStance Health Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate LifeStance Health Group's overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 29 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LFST

LifeStance Health Group

Through its subsidiaries, provides outpatient mental health services to children, adolescents, adults, and geriatrics in the United States.

Excellent balance sheet and good value.

Market Insights

Community Narratives