- United States

- /

- Medical Equipment

- /

- NasdaqGS:ISRG

Intuitive Surgical (NasdaqGS:ISRG) Sees 10% Dip Despite Q4 Revenue Surge To US$2 Billion

Reviewed by Simply Wall St

In recent developments, Intuitive Surgical (NasdaqGS:ISRG) experienced a 10% price decline last quarter, a period that included substantial corporate activities and broader market volatility. The company's fourth-quarter results showed impressive growth, with a revenue increase to $2.4 billion and net income rising to $685.7 million. However, market sentiment was likely pressured by a lack of share repurchase activities and changes in executive leadership, which might have unsettled investors. Additionally, concerns about external economic forces, such as trade tensions and broader market declines, could have influenced this downturn. Notably, Trump's tariffs contributed to a general market decline of 4.6% over a week, exacerbated by volatility across tech-heavy indices like the Nasdaq, of which Intuitive Surgical is a part. These factors, combined with Intuitive Surgical's significant advancements throughout the quarter, paint a complex picture of its performance amidst changing external conditions.

Get an in-depth perspective on Intuitive Surgical's performance by reading our analysis here.

```html

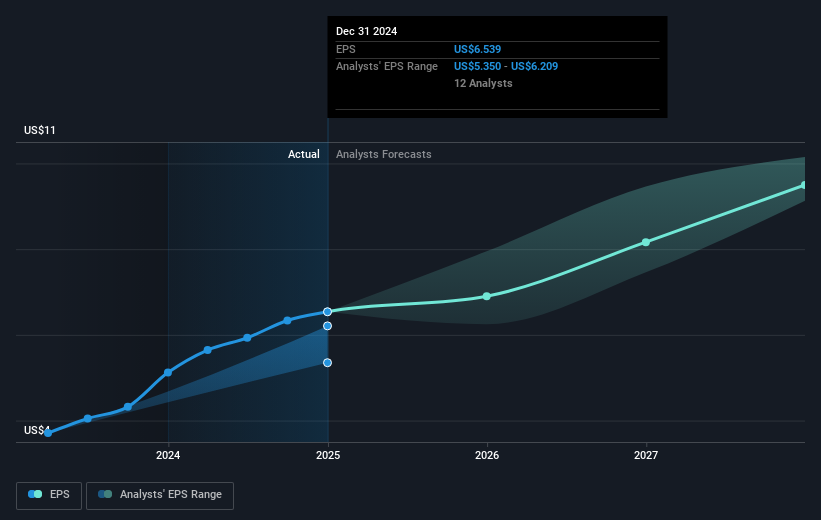

The past five years have seen Intuitive Surgical deliver impressive total shareholder returns of 258.12%. Key drivers of this growth include their consistent earnings performance, with earnings accelerating over the period, exemplified by a 2024 full-year net income of US$2.32 billion. This robust financial growth was supported by significant earnings increases year-over-year, cementing their leadership in the medical equipment sector, where they outperformed the industry and broader US market over the past year. Collaborations like the integration with Surgical Science Sweden AB in January 2025 have also contributed to their innovative edge and market presence.

Despite positive longer-term performance, recent executive changes and the lack of share repurchase in 2024 may have caused some investor reassessment. Nonetheless, the FDA approval for their da Vinci 5 system in March 2024 highlights continued product advancement, indicating strategic alignment with evolving healthcare demands. Such developments underscore Intuitive Surgical's status as a forward-thinking leader in medical technologies.

```- Analyze Intuitive Surgical's fair value against its market price in our detailed valuation report—access it here.

- Discover the key vulnerabilities in Intuitive Surgical's business with our detailed risk assessment.

- Already own Intuitive Surgical? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ISRG

Intuitive Surgical

Develops, manufactures, and markets products that enable physicians and healthcare providers to enhance the quality of and access to minimally invasive care in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives