- United States

- /

- Medical Equipment

- /

- NasdaqGS:ISRG

Intuitive Surgical (NasdaqGS:ISRG) Announces Leadership Transition With Dave Rosa as New CEO

Reviewed by Simply Wall St

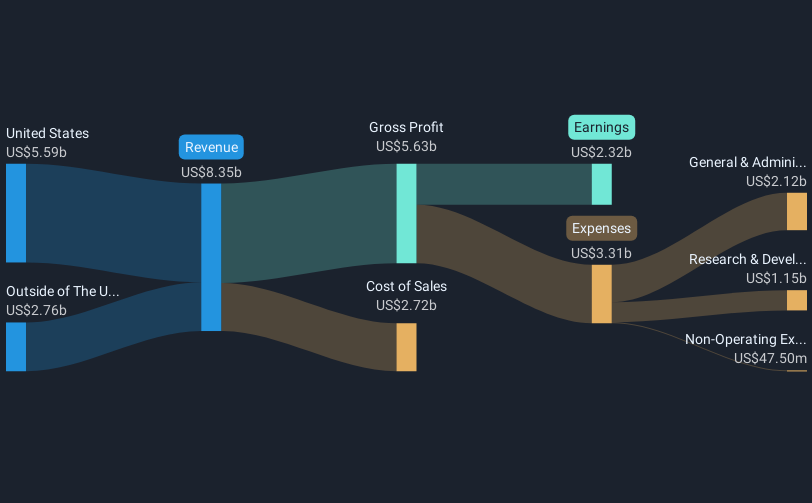

Intuitive Surgical (NasdaqGS:ISRG) recently announced executive changes with David J. Rosa appointed as CEO, effective July 2025. These leadership transitions come alongside FDA clearance of the da Vinci SP surgical system for specific procedures. Over the past month, the company's stock price rose 14.75%, a move consistent with broader market gains seen in the technology sector. Despite strong quarterly earnings and product developments that could have influenced investor sentiment, the gain aligns with the general uplift in the tech-heavy Nasdaq index, which benefitted from renewed investor interest amid positive economic signals.

The recent executive announcements and FDA clearance for Intuitive Surgical are poised to bolster its strategic direction and operational capabilities. Both developments could enhance the company's product appeal with the new da Vinci SP system potentially boosting adoption rates and procedure volumes globally. This aligns with the narrative of driving revenue growth through technological advancements and operational expansion. The leadership transition anticipates long-term strategic clarity, as David J. Rosa is set to steer the company towards these goals, ensuring continuity and potentially bolstering confidence among stakeholders.

Over the last five years, Intuitive Surgical's total shareholder return, including dividends, soared by 207.87%. This period marked substantial growth as the company's pioneering efforts in minimally invasive surgery gained traction globally. In a more recent context, the company's stock exceeded the US Medical Equipment industry's one-year return of 8.3%, showcasing resilience and strong performance amid industry dynamics. Over the past year alone, Intuitive Surgical has outpaced broader market returns of 11.2%.

Looking ahead, the FDA clearance could positively influence revenue growth forecasts, potentially by increasing system placements and procedural uptake. Meanwhile, earnings expectations might benefit from enhanced operational efficiencies and higher utilization rates. The current share price of US$530.46 shows a 7.9% discount to the consensus analyst price target of US$576.03, implying limited upside based on current valuations. However, continued product innovations and strategic expansions, as outlined in the narrative, could further influence future valuations and stakeholder expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ISRG

Intuitive Surgical

Develops, manufactures, and markets products that enable physicians and healthcare providers to enhance the quality of and access to minimally invasive care in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives