- United States

- /

- Medical Equipment

- /

- NasdaqGS:ISRG

FDA Expands Intuitive Surgical (NasdaqGS:ISRG) da Vinci SP System for Advanced Colorectal Surgeries

Reviewed by Simply Wall St

Intuitive Surgical's (NasdaqGS:ISRG) recent FDA clearance of the da Vinci Single Port surgical system for transanal local precision marks a significant enhancement in their product lineup for colorectal procedures. This latest advancement complements positive earnings results, which showed a year-over-year increase in both revenue and net income, reflecting solid operational performance. The company's shares rose 3.92% over the past month, closely aligning with market trends driven by overall robust earnings reports from major tech companies. While market conditions were generally favorable, Intuitive Surgical's specific product announcements might have added strength to its stock performance during this period.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The FDA clearance of Intuitive Surgical's da Vinci Single Port surgical system for transanal local precision could significantly bolster the company's narrative of growth and innovation, potentially enhancing its competitive positioning and market adoption. These developments are aligned with key elements of the company's strategic goals, notably the full launch of da Vinci 5 and its anticipated positive impact on surgical outcomes worldwide.

Over the longer term, Intuitive Surgical has experienced substantial growth, with its total shareholder return reaching 188.73% over the past five years. This growth context highlights the company's strong performance relative to broader market indicators. For comparison, Intuitive Surgical managed to exceed the US Medical Equipment industry's one-year return of 7.7% and the US market's return of 9.6% during the same period.

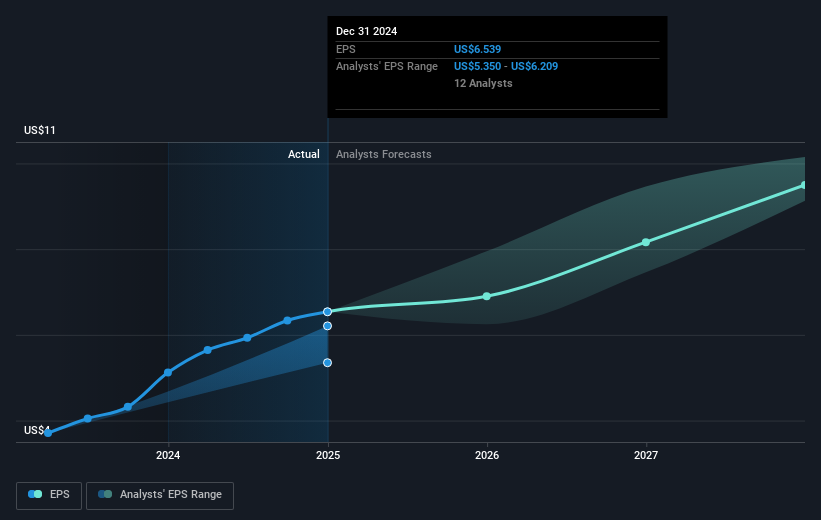

The recent product enhancements could have a positive impact on revenue and earnings projections, aligning with analysts’ expectations for revenue growth, although the potential challenges from trade tensions and capital spending constraints remain a concern. The company's current stock price of US$514.89 represents a discount to the consensus price target of US$576.03, suggesting upside potential according to analysts. However, investors should consider this in the context of projected earnings and market-based valuations as shared previously.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ISRG

Intuitive Surgical

Develops, manufactures, and markets products that enable physicians and healthcare providers to enhance the quality of and access to minimally invasive care in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives