- United States

- /

- Medical Equipment

- /

- NasdaqGS:ISRG

Does FDA Clearance of AI-Powered Ion Software Transform the Growth Story for Intuitive Surgical (ISRG)?

Reviewed by Sasha Jovanovic

- In October 2025, Intuitive Surgical announced that the U.S. FDA cleared new artificial intelligence-powered software and advanced imaging enhancements for their Ion robotic-assisted bronchoscopy system, enabling more precise and efficient navigation for lung biopsies.

- This advancement incorporates real-time imaging updates and AI-driven workflow support, strengthening Intuitive's offering in minimally invasive lung diagnostics and potentially broadening clinical adoption worldwide.

- We'll examine how FDA clearance of AI software for Ion could impact Intuitive Surgical's investment outlook and future revenue growth potential.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Intuitive Surgical Investment Narrative Recap

Shareholders in Intuitive Surgical typically buy into the vision that continued innovation in robotic surgery platforms and software will drive strong, recurring revenue growth from a growing installed base and procedure volumes. The recent FDA clearance of AI-powered navigation and imaging upgrades for its Ion system adds to Intuitive’s clinical attractiveness, but is not expected to materially shift the most important near-term catalyst: ongoing global procedure growth, nor does it resolve the key risk of mounting international financial and budgetary pressures that could limit system placements.

Among other recent developments, the September 2025 launch of advanced software features for da Vinci 5 stands out, with tools like Force Gauge and In-Console Video Replay designed to further improve surgical workflow and system utilization. These types of advancements remain closely linked to the company’s core growth catalyst: expanding procedure volumes and recurring revenue from its installed robotic systems.

However, with growing optimism around new product launches, it is crucial investors remain alert to the reality of...

Read the full narrative on Intuitive Surgical (it's free!)

Intuitive Surgical's outlook anticipates $13.4 billion in revenue and $3.7 billion in earnings by 2028. This assumes a 13.5% annual revenue growth rate and a $1.1 billion increase in earnings from the current $2.6 billion level.

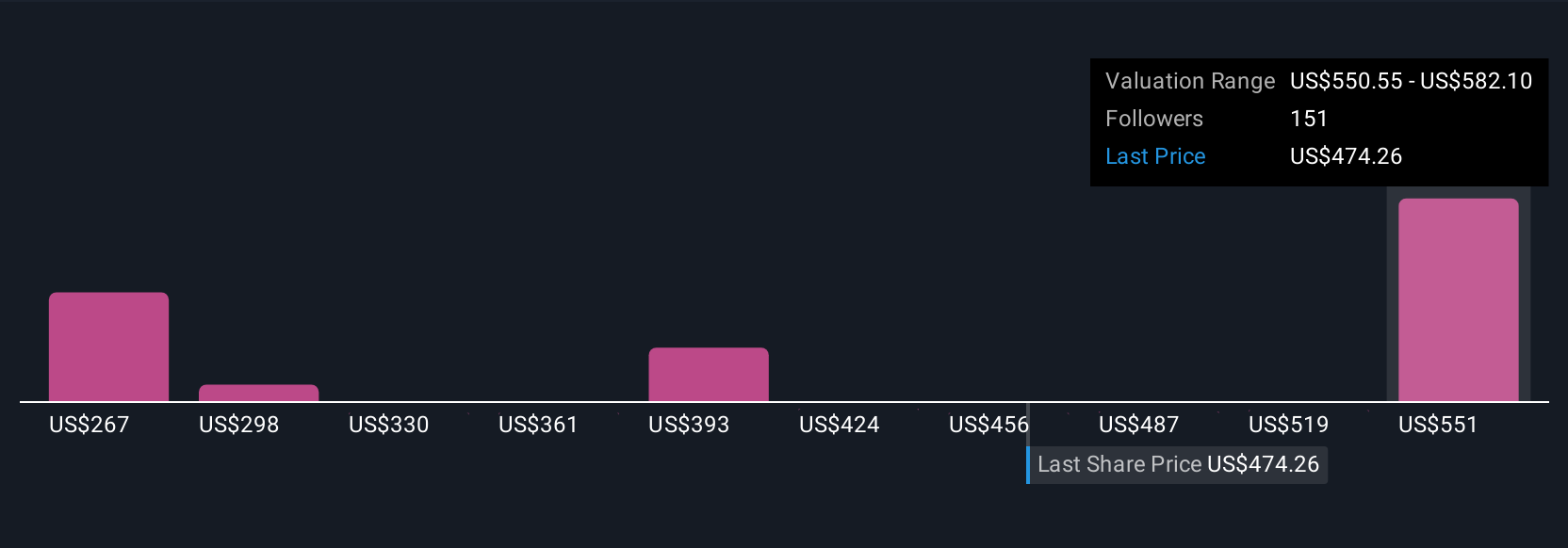

Uncover how Intuitive Surgical's forecasts yield a $582.10 fair value, a 36% upside to its current price.

Exploring Other Perspectives

Fifteen individual fair value estimates from the Simply Wall St Community range from US$273 to US$582, reflecting broad differences in outlook. While many voice optimism about future innovation, sharply rising financial constraints in key global markets could weigh on system expansion and future returns; explore multiple perspectives to understand how opinions diverge.

Explore 15 other fair value estimates on Intuitive Surgical - why the stock might be worth 36% less than the current price!

Build Your Own Intuitive Surgical Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Intuitive Surgical research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Intuitive Surgical research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Intuitive Surgical's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ISRG

Intuitive Surgical

Develops, manufactures, and markets products that enable physicians and healthcare providers to enhance the quality of and access to minimally invasive care in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

The "End-to-End" Space Prime – The Only Real Competitor to SpaceX

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026