- United States

- /

- Medical Equipment

- /

- NasdaqGS:IRTC

Don't Ignore The Insider Selling In iRhythm Technologies

Anyone interested in iRhythm Technologies, Inc. (NASDAQ:IRTC) should probably be aware that the Chief Commercial Officer, Chad Patterson, recently divested US$445k worth of shares in the company, at an average price of US$164 each. The eyebrow raising move amounted to a reduction of 15% in their holding.

The Last 12 Months Of Insider Transactions At iRhythm Technologies

Over the last year, we can see that the biggest insider sale was by the President, Quentin Blackford, for US$2.5m worth of shares, at about US$112 per share. That means that even when the share price was below the current price of US$161, an insider wanted to cash in some shares. As a general rule we consider it to be discouraging when insiders are selling below the current price, because it suggests they were happy with a lower valuation. However, while insider selling is sometimes discouraging, it's only a weak signal. It is worth noting that this sale was only 18% of Quentin Blackford's holding.

In total, iRhythm Technologies insiders sold more than they bought over the last year. The chart below shows insider transactions (by companies and individuals) over the last year. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

See our latest analysis for iRhythm Technologies

If you are like me, then you will not want to miss this free list of small cap stocks that are not only being bought by insiders but also have attractive valuations.

Insider Ownership

Many investors like to check how much of a company is owned by insiders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. iRhythm Technologies insiders own about US$60m worth of shares. That equates to 1.2% of the company. This level of insider ownership is good but just short of being particularly stand-out. It certainly does suggest a reasonable degree of alignment.

What Might The Insider Transactions At iRhythm Technologies Tell Us?

Insiders sold iRhythm Technologies shares recently, but they didn't buy any. Despite some insider buying, the longer term picture doesn't make us feel much more positive. Insider ownership isn't particularly high, so this analysis makes us cautious about the company. We'd practice some caution before buying! In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing iRhythm Technologies. In terms of investment risks, we've identified 1 warning sign with iRhythm Technologies and understanding this should be part of your investment process.

But note: iRhythm Technologies may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

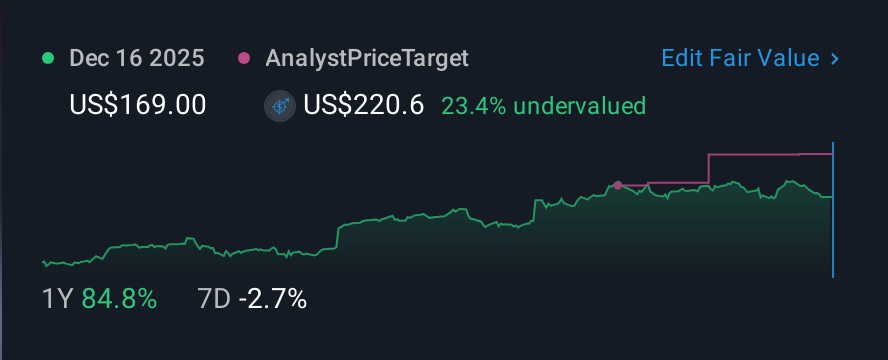

Discover if iRhythm Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:IRTC

iRhythm Technologies

A digital healthcare company, engages in the design, development, and commercialization of device-based technology that provides ambulatory cardiac monitoring services to diagnose arrhythmias in the United States.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion