- United States

- /

- Medical Equipment

- /

- NasdaqGM:IRMD

IRADIMED (IRMD): Assessing Valuation After Strong Multi‑Year Share Price Gains

Reviewed by Simply Wall St

IRADIMED (IRMD) has quietly turned into a strong long term winner, with the stock up about 86% over the past year and roughly 3.5x over five years, outpacing many healthcare peers.

See our latest analysis for IRADIMED.

That momentum is not just a blip. IRADIMED’s 30 day share price return of about 15 percent and 90 day gain near 37 percent sit on top of an impressive multi year total shareholder return profile.

If IRADIMED’s run has you rethinking your healthcare exposure, it might be worth seeing what else is out there via healthcare stocks.

With shares hovering just shy of analyst targets after years of outsized gains and solid double digit profit growth, investors now face a tougher question: is IRADIMED still a buy or is future growth already priced in?

Most Popular Narrative: 2.2% Undervalued

With IRADIMED last closing at about 97 dollars against a narrative fair value near 99 dollars, the story leans toward modest upside driven by execution.

The analysts have a consensus price target of 73.5 dollars for IRADIMED based on their expectations of its future earnings growth, profit margins and other risk factors.

In order for you to agree with the analyst's consensus, you would need to believe that by 2028, revenues will be 104.0 million dollars, earnings will come to 28.3 million dollars, and it would be trading on a PE ratio of 38.5x, assuming you use a discount rate of 7.4 percent.

Curious how steady double digit growth, thick margins, and a lofty future earnings multiple all add up to today’s fair value call? Want to see the full playbook behind that confidence?

Result: Fair Value of $99 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps around the new 3870 pump, or prolonged supply chain and backlog issues, could quickly challenge today’s premium growth narrative.

Find out about the key risks to this IRADIMED narrative.

Another View: Rich Multiples Signal Less Obvious Value

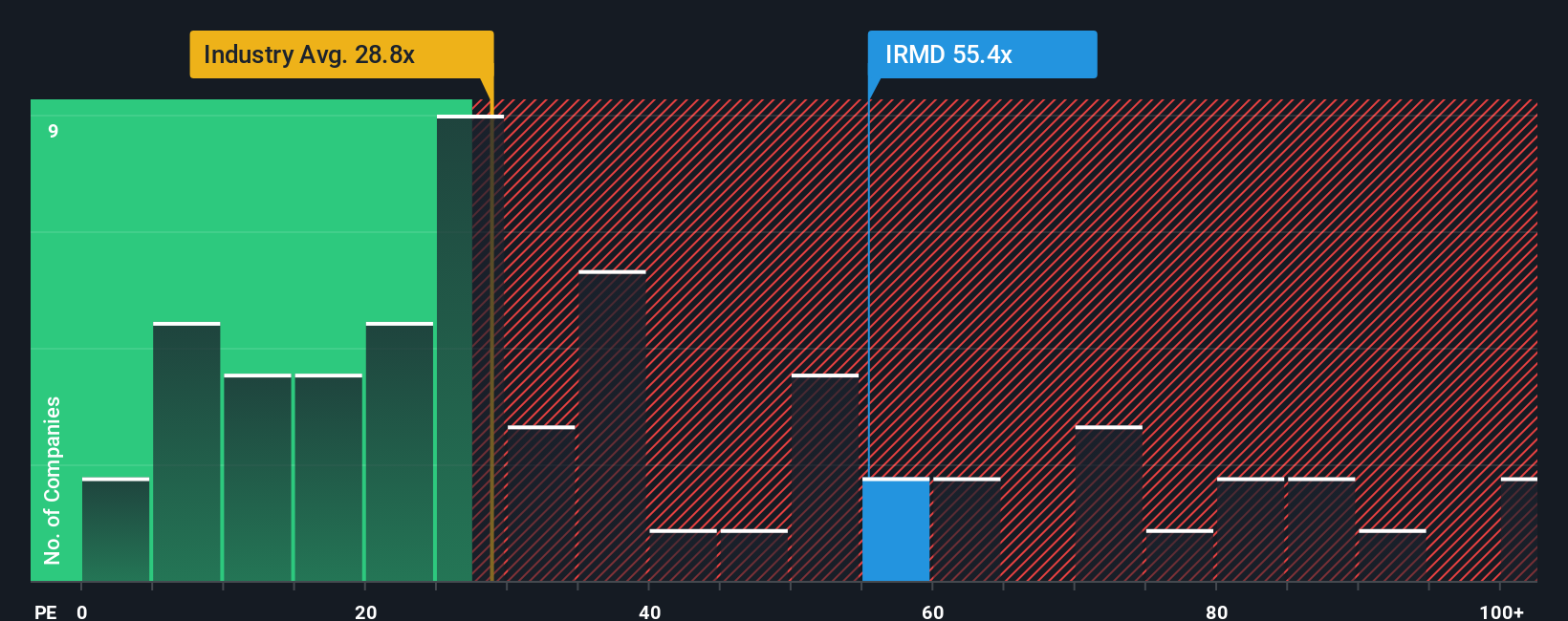

Step away from the narrative fair value and the picture looks tougher. On earnings, IRADIMED trades around 58 times versus roughly 30 times for the US medical equipment group and a fair ratio near 20 times, a gap that hints at valuation risk if growth ever cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own IRADIMED Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just minutes: Do it your way.

A great starting point for your IRADIMED research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Put your research momentum to work and lock in your next move with targeted stock ideas from the Simply Wall Street Screener before the crowd catches on.

- Capture potential high growth at early stages by scanning these 3625 penny stocks with strong financials for smaller companies backed by solid fundamentals and room to scale.

- Position yourself at the forefront of innovation by using these 25 AI penny stocks to pinpoint businesses involved in the next wave of artificial intelligence developments.

- Strengthen your portfolio’s income stream by uncovering established companies in these 13 dividend stocks with yields > 3% that combine dividend yields with payout profiles assessed as sustainable.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:IRMD

IRADIMED

Develops, manufactures, markets, and distributes magnetic resonance imaging (MRI) compatible medical devices and related accessories, and disposables and services in the United States and internationally.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)