- United States

- /

- Medical Equipment

- /

- NasdaqGM:IRMD

Getting In Cheap On IRadimed Corporation (NASDAQ:IRMD) Is Unlikely

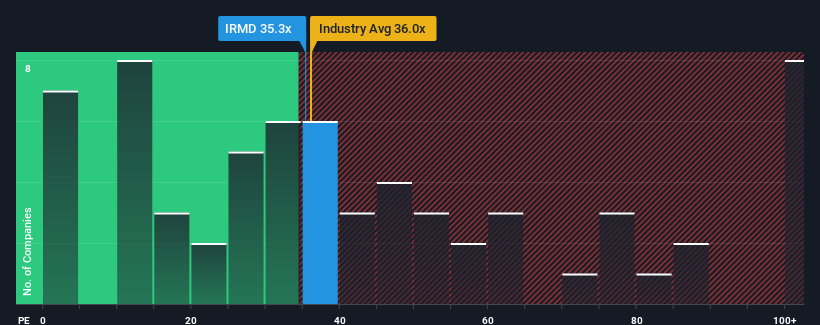

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 16x, you may consider IRadimed Corporation (NASDAQ:IRMD) as a stock to avoid entirely with its 35.3x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

IRadimed certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for IRadimed

Does Growth Match The High P/E?

In order to justify its P/E ratio, IRadimed would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered an exceptional 24% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 289% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 12% as estimated by the sole analyst watching the company. With the market predicted to deliver 13% growth , the company is positioned for a comparable earnings result.

In light of this, it's curious that IRadimed's P/E sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

The Bottom Line On IRadimed's P/E

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that IRadimed currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Plus, you should also learn about these 2 warning signs we've spotted with IRadimed (including 1 which is concerning).

If you're unsure about the strength of IRadimed's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:IRMD

IRADIMED

Develops, manufactures, markets, and distributes magnetic resonance imaging (MRI) compatible medical devices and related accessories, and disposables and services in the United States and internationally.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion