- United States

- /

- Medical Equipment

- /

- NasdaqGS:INMD

Investors three-year losses continue as InMode (NASDAQ:INMD) dips a further 4.6% this week, earnings continue to decline

Every investor on earth makes bad calls sometimes. But you have a problem if you face massive losses more than once in a while. So spare a thought for the long term shareholders of InMode Ltd. (NASDAQ:INMD); the share price is down a whopping 73% in the last three years. That'd be enough to cause even the strongest minds some disquiet.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

Check out our latest analysis for InMode

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

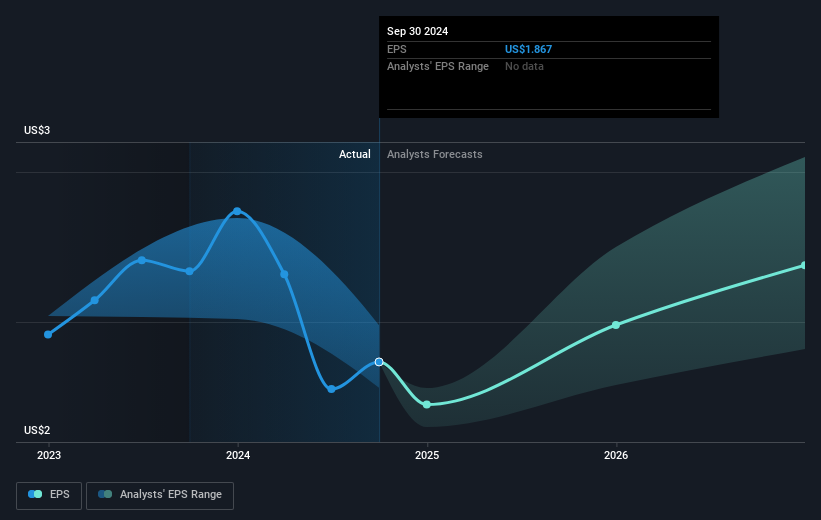

InMode saw its EPS decline at a compound rate of 0.9% per year, over the last three years. The share price decline of 35% is actually steeper than the EPS slippage. So it seems the market was too confident about the business, in the past. This increased caution is also evident in the rather low P/E ratio, which is sitting at 9.90.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It might be well worthwhile taking a look at our free report on InMode's earnings, revenue and cash flow.

A Different Perspective

Investors in InMode had a tough year, with a total loss of 20%, against a market gain of about 29%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 2% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. Before forming an opinion on InMode you might want to consider these 3 valuation metrics.

But note: InMode may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:INMD

InMode

Designs, develops, manufactures, and markets minimally invasive aesthetic medical products based on its proprietary radiofrequency assisted lipolysis and deep subdermal fractional radiofrequency technologies in the United States and internationally.

Flawless balance sheet and undervalued.