- United States

- /

- Medical Equipment

- /

- NasdaqGS:IDXX

Is Now the Right Moment to Revisit IDEXX Laboratories After Strong 54% Year to Date Rally?

Reviewed by Bailey Pemberton

Thinking about IDEXX Laboratories stock and wondering if now is the right time to act? You are definitely not alone. With shares closing recently at $631.19, IDEXX has been giving investors plenty to consider. In the past year, the stock has soared by an impressive 33.6%, outpacing many of its healthcare peers. The surge is even more dramatic over three years, with returns reaching 94.4%. Even so, the past month brought a modest dip of -1.8%, though in the short run, the stock eked out a small gain of 0.1% in the last week.

What is driving the action? Investors seem increasingly optimistic about the long-term promise of animal health diagnostics as pet ownership rises and veterinary care evolves. Recent shifts in market risk appetite, particularly for growth and innovation-focused companies, also seem to have helped IDEXX maintain momentum since the start of the year. Its year-to-date gains sit at a notable 54.4%.

For those weighing their options, valuation remains a key consideration. At a glance, IDEXX receives a value score of 0 out of 6, meaning it does not currently look undervalued by standard checks. However, as any savvy investor knows, surface-level metrics rarely tell the full story. Next, we will examine the main valuation approaches used for stocks like IDEXX, and later, a different angle on valuation will be explored that could be even more insightful.

IDEXX Laboratories scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: IDEXX Laboratories Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company is worth by projecting its future cash flows and then discounting them back to their present value. For IDEXX Laboratories, the DCF approach begins with its latest reported Free Cash Flow (FCF) of $755.7 million. Analysts predict FCF will rise steadily in the coming years, with projections reaching $1.59 billion by the end of 2029. The ten-year outlook, blending analyst consensus with longer-term extrapolations, suggests continued robust growth driven by the company’s core business.

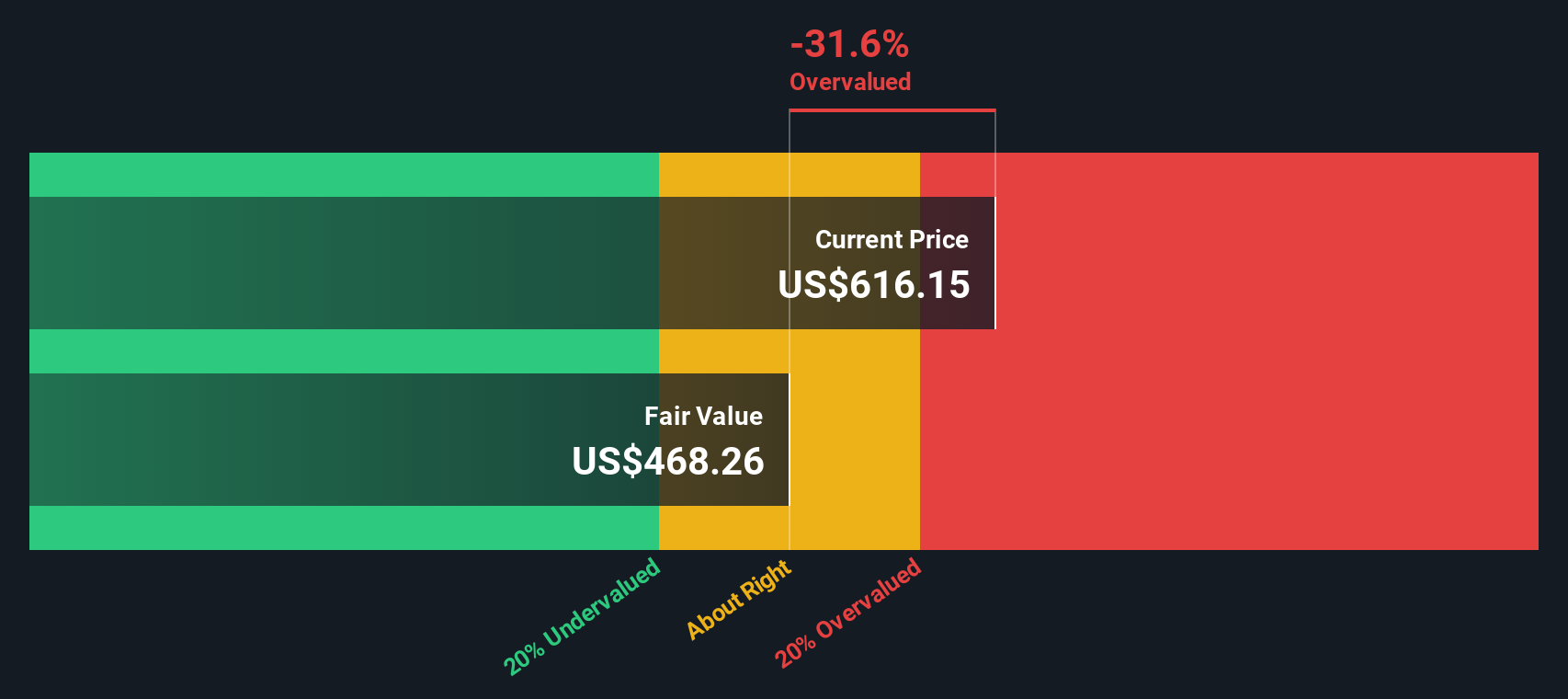

Ideally, these growing cash flows paint a picture of underlying business strength. However, when discounted to today’s dollars, the fair value per share calculated by this DCF model comes in at $467.46. Compared to the recent share price of $631.19, IDEXX Laboratories appears about 35% overvalued based on this metric.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests IDEXX Laboratories may be overvalued by 35.0%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: IDEXX Laboratories Price vs Earnings (P/E)

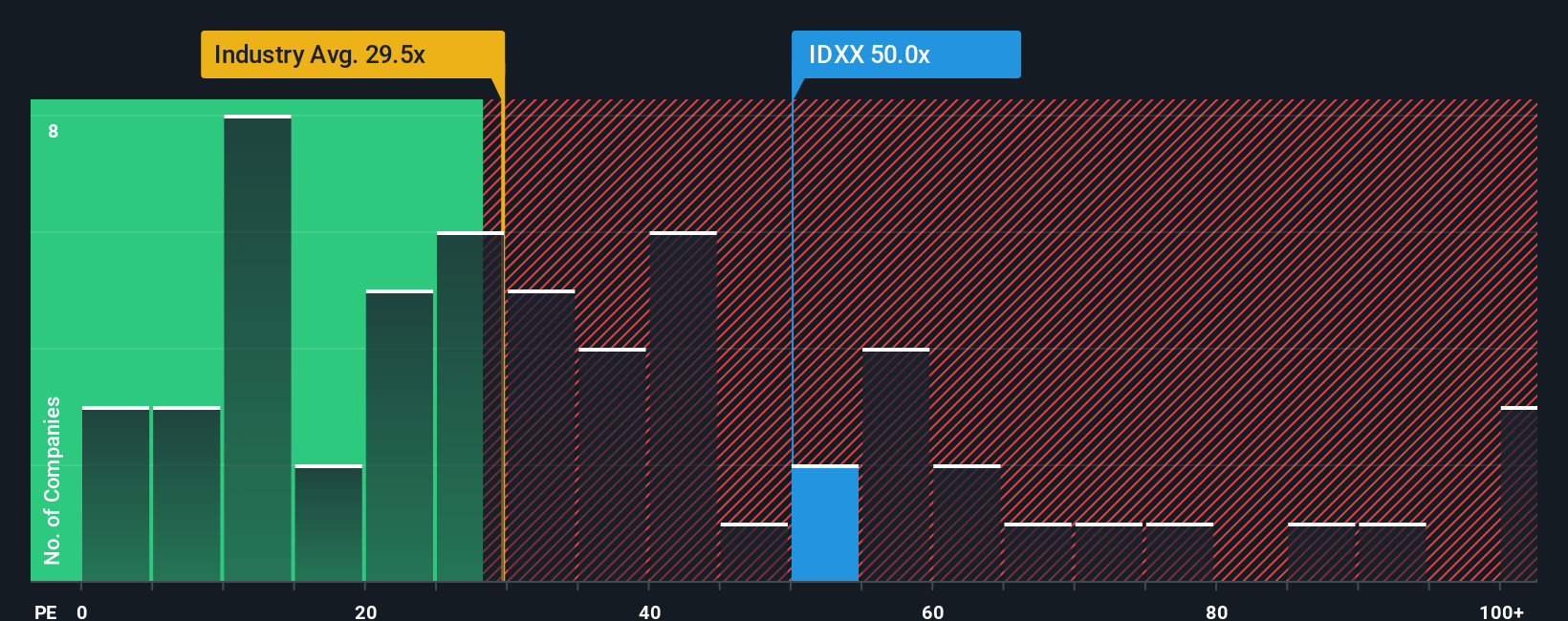

For profitable companies like IDEXX Laboratories, the Price-to-Earnings (P/E) ratio is a widely used valuation tool. The P/E ratio helps investors gauge how much they are paying for each dollar of current earnings, making it especially relevant for firms with established earnings streams and visibility into future profitability.

Growth prospects and perceived risk play a crucial role in what is considered a “normal” or “fair” P/E ratio. High-growth and lower-risk companies often justify higher P/E multiples because investors are willing to pay a premium for future earning potential and stability. Conversely, lower growth or higher risk tends to push fair P/E ratios downward.

Currently, IDEXX Laboratories trades at a P/E ratio of 51.2x. This is well above the Medical Equipment industry average of 31.1x and also higher than the average for its peers at 27.9x. To provide a more tailored benchmark, Simply Wall St uses the Fair Ratio. The Fair Ratio for IDEXX, based on its unique qualities such as earnings growth, profit margins, market capitalization, industry, and risk profile, is calculated at 31.3x. This proprietary metric offers a much more nuanced evaluation compared to basic industry or peer comparisons.

Comparing IDEXX's actual P/E of 51.2x to its Fair Ratio of 31.3x suggests that shares are priced well above what would typically be warranted for a company with its outlook and risk factors. In other words, the stock currently appears overvalued on this measure.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your IDEXX Laboratories Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story about a company, combining your beliefs and expectations for IDEXX Laboratories, such as future revenue, earnings, and margins, into a coherent perspective that drives your own estimate of fair value. Rather than just relying on static ratios or analyst targets, Narratives connect these forecasts directly to what you think the business can achieve and what that means for the share price today.

Narratives make investing more accessible by helping you translate qualitative insights (like trends in diagnostic technology or risks from competition) into numbers you can compare to the current market price. On Simply Wall St’s Community page, millions of investors use Narratives to refine their decisions, seeing instantly how changes in the business or new information, such as quarterly earnings or fresh news, may shift the company’s outlook and fair value estimate.

For IDEXX Laboratories, consider that some investors believe global expansion and strong recurring revenue streams justify a fair value as high as $785. Others, more cautious about market saturation and competition, estimate it could be as low as $420. These narratives directly influence investors' perspectives about whether to buy, hold, or sell.

Do you think there's more to the story for IDEXX Laboratories? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IDXX

IDEXX Laboratories

Develops, manufactures, and distributes products for the companion animal veterinary, livestock and poultry, dairy, and water testing industries in the United States and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives