- United States

- /

- Medical Equipment

- /

- NasdaqGS:IDXX

IDEXX Laboratories (IDXX): Valuation Insights After Strong Analyst Upgrades and New Board Appointment

Reviewed by Kshitija Bhandaru

IDEXX Laboratories (IDXX) has added Karen Peacock, former CEO of Intercom, to its board of directors. This move has caught the eye of investors looking for signs of strategic change and enhanced governance.

See our latest analysis for IDEXX Laboratories.

After a standout year punctuated by expanding international business and now the addition of an accomplished tech leader to the board, IDEXX Laboratories has kept its momentum rolling with a 54.9% share price return year-to-date. While the latest 1-year total shareholder return sits at an impressive 32.5%, recent weeks have seen investors respond favorably as excitement builds for the next quarterly results and the company’s evolving leadership. This hints at further strategic opportunities ahead.

If this kind of momentum in diagnostics piques your interest, it's a great moment to see what else is happening in healthcare. See the full list for free.

But with shares up so sharply this year and anticipation running high before earnings, investors may be wondering if IDEXX Laboratories is still flying under the radar or if the market has already priced in all that future growth. This presents a tough call for prospective buyers.

Most Popular Narrative: 8.9% Undervalued

Compared to the last closing price of $633.32, the most widely followed narrative sets fair value near $695, reflecting further upside potential if expectations are met. This narrative leans toward optimism in the company’s recurring growth drivers, placing the spotlight on the next phase of market expansion.

Expansion in innovative diagnostic platforms and international markets is driving recurring revenue growth, margin expansion, and enhanced geographic diversification. Strong customer retention and broader adoption of cloud solutions create stable, high-margin revenue streams and position the company for sustained long-term earnings growth.

Want to know what justifies this bullish price target? The narrative is built on standout revenue growth, rising profit margins, and a premium multiple that stands out even in a high-growth sector. Which projections support such a high standard? Click through to uncover the quantitative details that power this valuation.

Result: Fair Value of $695.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a sustained slowdown in U.S. veterinary visits or rapid shifts in competitive technology could quickly challenge these upbeat expectations and valuations.

Find out about the key risks to this IDEXX Laboratories narrative.

Another View: Multiples Suggest a Premium Valuation

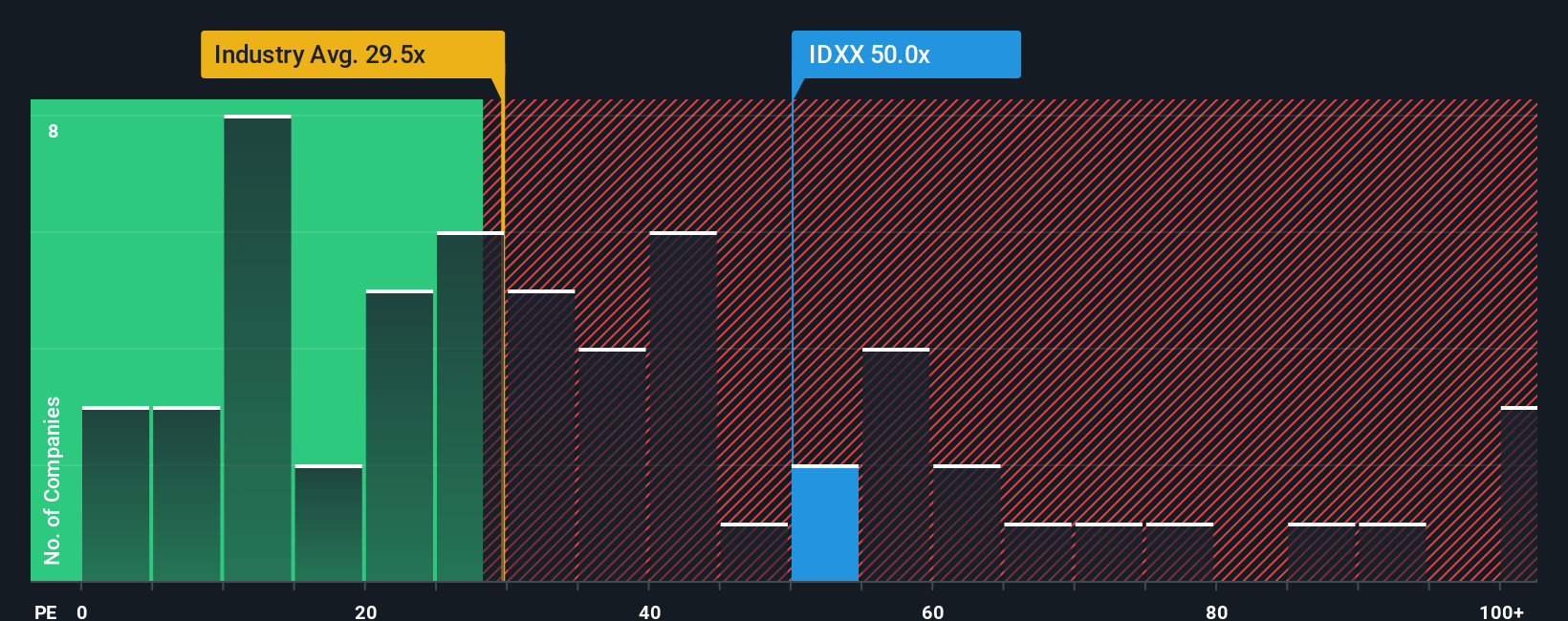

Looking at how the company is priced versus others, IDEXX Laboratories trades on a price-to-earnings ratio of 51.4x. This is far above both its sector average of 26.8x and the current industry norm of 29.5x. Even compared to its fair ratio of 31.2x, the shares reflect a steep premium, which leaves less room for error if growth does not live up to bullish forecasts. Does this lofty price signal confidence, or is it a warning sign for cautious investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own IDEXX Laboratories Narrative

If you see the story differently or want hands-on insight from the numbers, it's quick and easy to construct your own view in just a few minutes with the tools available: Do it your way

A great starting point for your IDEXX Laboratories research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t settle for just one opportunity when there are bigger gains, stronger yields, and tomorrow’s winners waiting. Find investments that match your goals right now.

- Capture hidden value by reviewing these 891 undervalued stocks based on cash flows to spot companies trading below their potential before the rest of the market catches on.

- Maximize your income by locking in reliable payouts with these 18 dividend stocks with yields > 3% to see which stocks are delivering yields above 3% and consistent growth.

- Stay ahead of market shifts by targeting these 26 quantum computing stocks for leading breakthroughs in quantum computing and powering the next wave of technology innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IDXX

IDEXX Laboratories

Develops, manufactures, and distributes products for the companion animal veterinary, livestock and poultry, dairy, and water testing industries in the United States and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives