- United States

- /

- Healthcare Services

- /

- NasdaqGS:HSIC

Is Henry Schein’s Streamlined Distribution Strategy Creating Value at Around $74 a Share in 2025?

Reviewed by Bailey Pemberton

- Wondering if Henry Schein at around $74 a share is a quietly undervalued play in healthcare rather than a sleepy distributor? That is exactly what we are going to unpack here.

- The stock has crept up about 2.1% over the last week and 2.0% over the past month, and is up 8.6% year to date, even though the 1 year return is still slightly negative at around 3.1% and the 3 year return sits near 10.5% in the red.

- Recent headlines have focused on Henry Schein sharpening its focus on dental and medical distribution, including portfolio tweaks and strategic investments aimed at higher margin, tech enabled services. At the same time, ongoing commentary around healthcare supply chains and practice consolidation has kept investors debating whether the company is set up for steadier growth or more volatility ahead.

- Right now, Henry Schein scores a 4 out of 6 on our valuation checks, suggesting pockets of undervaluation that do not fully line up with the stock's mixed return profile. Next, we will walk through the main valuation lenses investors use and finish with a more complete way to think about what the shares are really worth.

Approach 1: Henry Schein Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting the cash it can generate in the future and then discounting those dollars back to today in dollar terms.

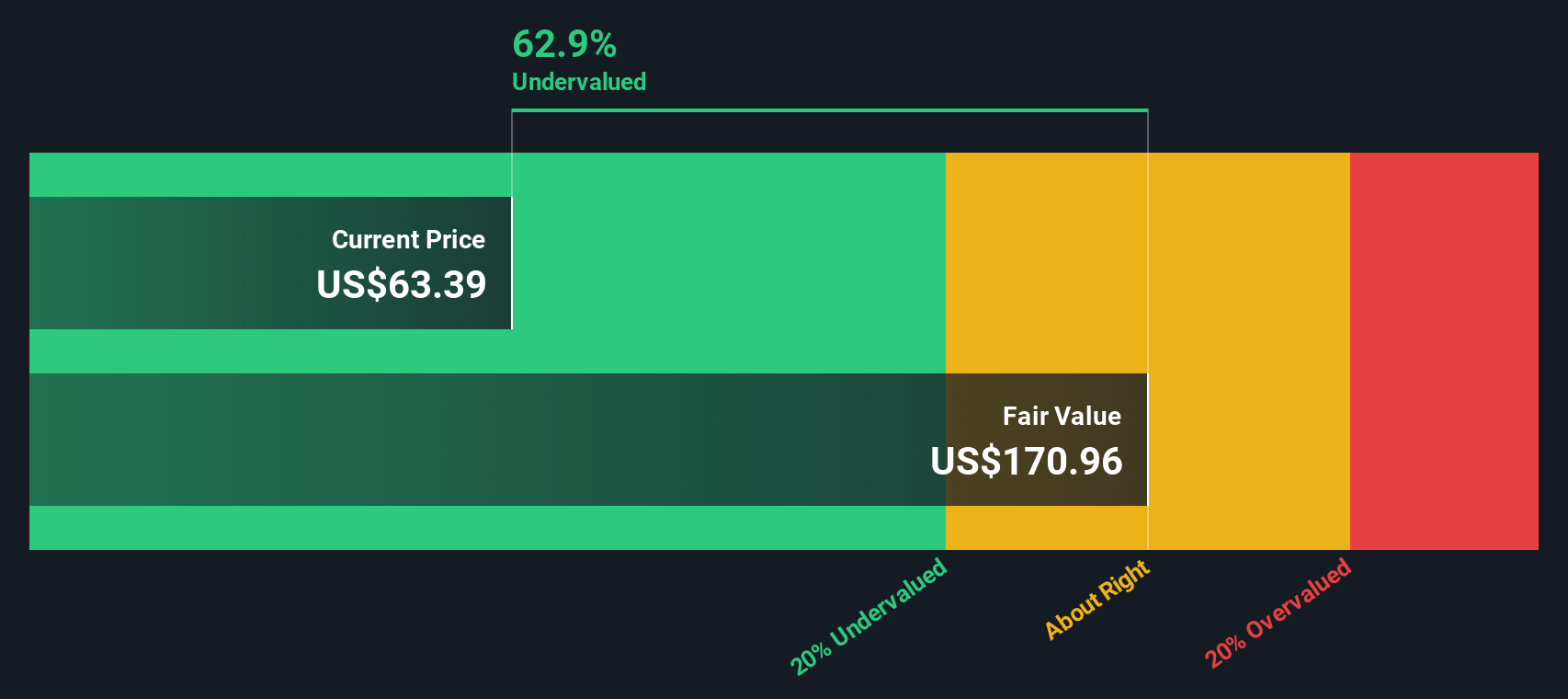

For Henry Schein, the latest twelve month Free Cash Flow sits at about $342 million. Analysts and extrapolated forecasts see this growing steadily, with Free Cash Flow projected to reach roughly $1.03 billion by 2035, based on a 2 Stage Free Cash Flow to Equity model that blends analyst estimates for the next few years with longer term growth assumptions.

When these cash flows from 2026 to 2035 are discounted back, Simply Wall St’s DCF points to an intrinsic value of about $174.11 per share. Versus a market price around $74, this implies the stock is trading at roughly a 57.2% discount to its estimated fair value. This suggests the market is pricing in much weaker growth or higher risk than the cash flow outlook implies.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Henry Schein is undervalued by 57.2%. Track this in your watchlist or portfolio, or discover 895 more undervalued stocks based on cash flows.

Approach 2: Henry Schein Price vs Earnings

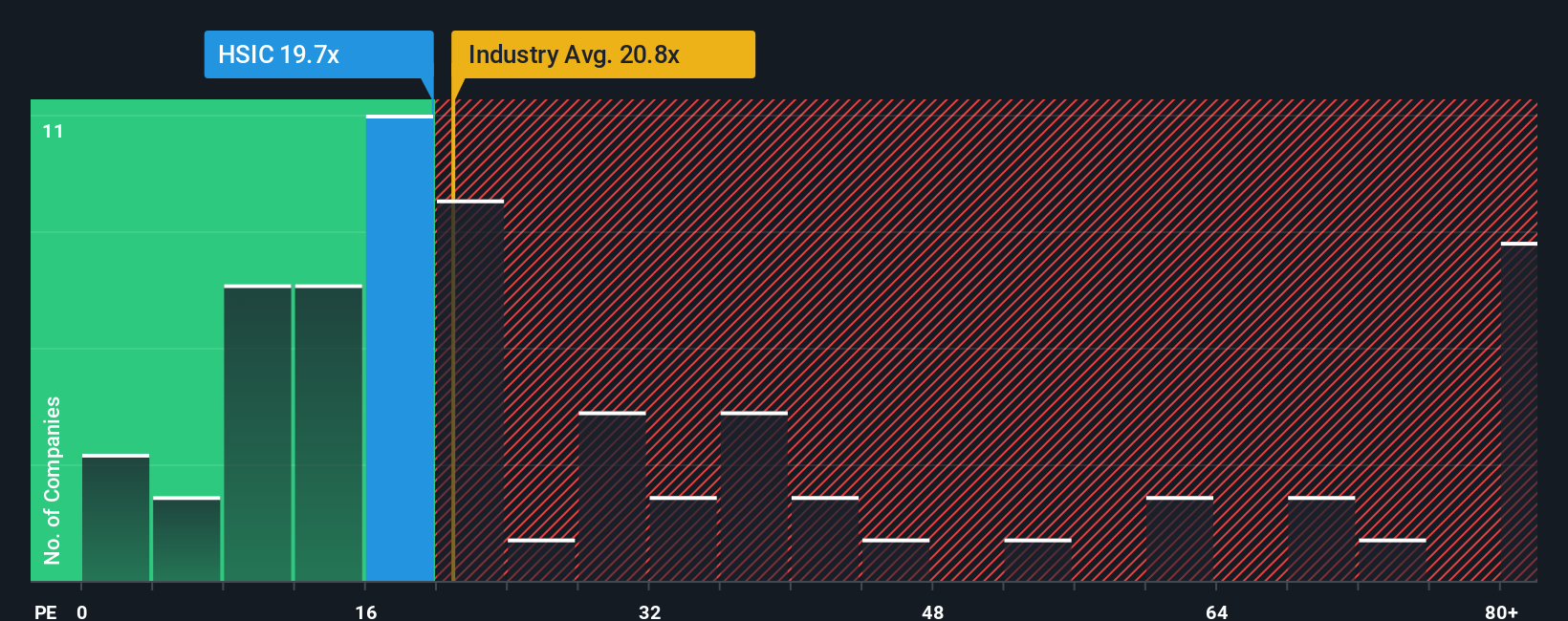

For a consistently profitable business like Henry Schein, the Price to Earnings, or PE, ratio is a useful way to gauge how much investors are paying for each dollar of current earnings. In general, faster growing and less risky companies tend to command higher PE ratios, while slower growth or higher perceived risk usually deserves a lower, more cautious multiple.

Henry Schein currently trades on about 22.4x earnings, roughly in line with the broader Healthcare industry average of around 22.4x but below the 28.2x average of its peer group. To sharpen that view, Simply Wall St calculates a Fair Ratio, a proprietary PE level that reflects the company’s earnings growth outlook, profit margins, risk profile, industry positioning and market cap. This is more tailored than a simple peer or sector comparison, which can be skewed by outliers or very different business models.

Henry Schein’s Fair Ratio is estimated at about 25.0x, above its current 22.4x multiple, implying the shares trade at a discount to what its fundamentals would typically justify.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1450 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Henry Schein Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, a simple way to connect your view of Henry Schein’s story with the numbers. You can turn your assumptions about future revenue, earnings and margins into a forecast, link that forecast to a Fair Value, and then compare that Fair Value to today’s price to decide whether you think the stock is a buy, hold or sell.

On Simply Wall St’s Community page, millions of investors can easily build and share these Narratives. They then update dynamically as new information like news or earnings comes in, so that your Fair Value moves with the story rather than staying frozen.

For Henry Schein, for example, one investor might lean toward the more optimistic Narrative implied by the highest analyst target of about 83 dollars, assuming that digital tools, specialty products and cost savings drive steady growth and margin expansion. Another might anchor on the more cautious 55 dollar low target if they think competitive and regulatory pressures will cap growth. Narratives let you see, tweak and compare both perspectives in a structured, numbers backed way.

Do you think there's more to the story for Henry Schein? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Henry Schein might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HSIC

Henry Schein

Provides health care products and services to office-based dental and medical practitioners, and alternate sites of care worldwide.

Undervalued with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion