- United States

- /

- Healthcare Services

- /

- NasdaqGS:HSIC

Henry Schein (HSIC) Expands SolutionsHub With Colaborate And Increases US$750 Million Buyback

Reviewed by Simply Wall St

On September 9, 2025, Henry Schein (HSIC) announced two major developments: the expansion of its SolutionsHub™ with Colaborate to enhance U.S. medical laboratories' efficiency, and a $750 million increase in its equity buyback plan. Over the last month, HSIC shares rose 3% amidst these initiatives, aligning them with a general upward market trend. These strategic announcements likely reinforced shareholder confidence during a period where broader market indices, including the S&P 500 and Nasdaq, reached all-time highs, suggesting that these actions supported HSIC's price move in tandem with market dynamics.

We've spotted 1 warning sign for Henry Schein you should be aware of.

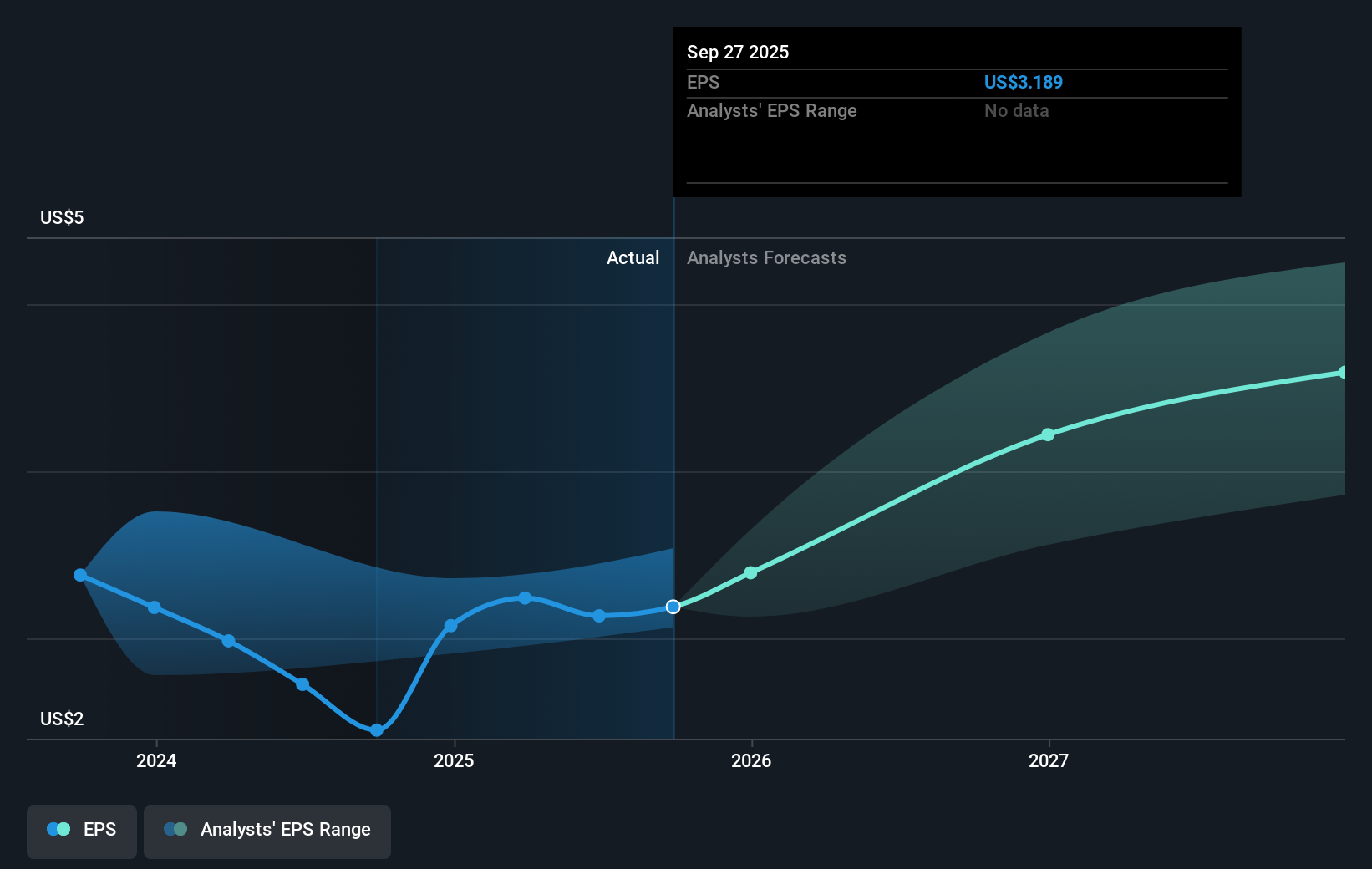

The recent developments at Henry Schein, including the SolutionsHub expansion and increased equity buyback, potentially bolster the company's strategic focus on high-margin segments and digital transformation. These initiatives align with the company's broader goals of operational efficiency and margin improvement, potentially enhancing revenue and earnings growth expectations. The equity buyback could reduce the share count, supporting future earnings per share growth. Analysts' revenue and earnings forecasts might see upward revisions if these initiatives prove successful.

Over a five-year period, Henry Schein's total shareholder return was 6.12%, including dividends. This performance establishes a more modest long-term growth trajectory compared to the U.S. market, which returned 20.5% over the past year alone, highlighting recent underperformance relative to broader market trends. The company's recent one-year rebound reflects its resilience in a challenging market environment.

The current share price of $67.65 is below the consensus analyst price target of $73.23, indicating an anticipated potential upside of 8.3%. This suggests that analysts maintain a positive outlook on Henry Schein's long-term strategies and growth prospects, provided the company can navigate the competitive pressures and potential execution risks outlined by analysts. The market's reaction to strategic initiatives will be crucial in achieving these targets.

Examine Henry Schein's past performance report to understand how it has performed in prior years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Henry Schein might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HSIC

Henry Schein

Provides health care products and services to office-based dental and medical practitioners, and alternate sites of care worldwide.

Undervalued with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion