- United States

- /

- Healthtech

- /

- NasdaqGS:HCAT

What Health Catalyst, Inc.'s (NASDAQ:HCAT) 25% Share Price Gain Is Not Telling You

Those holding Health Catalyst, Inc. (NASDAQ:HCAT) shares would be relieved that the share price has rebounded 25% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 7.1% in the last twelve months.

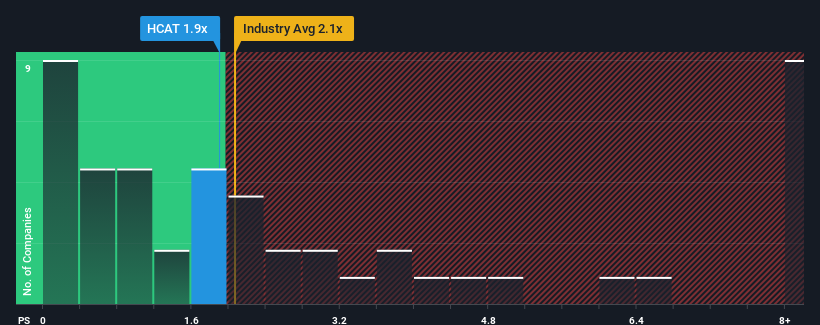

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Health Catalyst's P/S ratio of 1.9x, since the median price-to-sales (or "P/S") ratio for the Healthcare Services industry in the United States is also close to 2.1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Health Catalyst

What Does Health Catalyst's P/S Mean For Shareholders?

Health Catalyst could be doing better as it's been growing revenue less than most other companies lately. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Health Catalyst's future stacks up against the industry? In that case, our free report is a great place to start.How Is Health Catalyst's Revenue Growth Trending?

In order to justify its P/S ratio, Health Catalyst would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 6.7%. The latest three year period has also seen an excellent 62% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

Turning to the outlook, the next year should generate growth of 10% as estimated by the analysts watching the company. With the industry predicted to deliver 12% growth, the company is positioned for a weaker revenue result.

With this information, we find it interesting that Health Catalyst is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What We Can Learn From Health Catalyst's P/S?

Health Catalyst's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

When you consider that Health Catalyst's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Before you take the next step, you should know about the 2 warning signs for Health Catalyst that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Health Catalyst might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:HCAT

Health Catalyst

Provides data and analytics technology and services to healthcare organizations in the United States.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives