- United States

- /

- Medical Equipment

- /

- NasdaqCM:ESTA

Establishment Labs Holdings Inc. (NASDAQ:ESTA) Shares Slammed 27% But Getting In Cheap Might Be Difficult Regardless

Establishment Labs Holdings Inc. (NASDAQ:ESTA) shares have had a horrible month, losing 27% after a relatively good period beforehand. The recent drop has obliterated the annual return, with the share price now down 4.9% over that longer period.

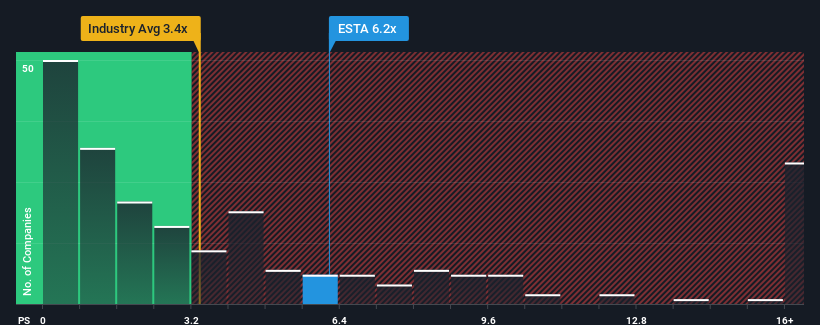

In spite of the heavy fall in price, Establishment Labs Holdings' price-to-sales (or "P/S") ratio of 6.2x might still make it look like a strong sell right now compared to other companies in the Medical Equipment industry in the United States, where around half of the companies have P/S ratios below 3.4x and even P/S below 1.2x are quite common. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Establishment Labs Holdings

What Does Establishment Labs Holdings' P/S Mean For Shareholders?

Establishment Labs Holdings hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Establishment Labs Holdings will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Establishment Labs Holdings?

The only time you'd be truly comfortable seeing a P/S as steep as Establishment Labs Holdings' is when the company's growth is on track to outshine the industry decidedly.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 14%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 29% overall rise in revenue. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 33% per year over the next three years. With the industry only predicted to deliver 9.7% per year, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why Establishment Labs Holdings' P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Even after such a strong price drop, Establishment Labs Holdings' P/S still exceeds the industry median significantly. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look into Establishment Labs Holdings shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

You should always think about risks. Case in point, we've spotted 2 warning signs for Establishment Labs Holdings you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

If you're looking to trade Establishment Labs Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Establishment Labs Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:ESTA

Establishment Labs Holdings

A medical technology company, manufactures and markets medical devices for aesthetic and reconstructive plastic surgeries.

High growth potential with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives