- United States

- /

- Medical Equipment

- /

- NasdaqCM:EKSO

Many Still Looking Away From Ekso Bionics Holdings, Inc. (NASDAQ:EKSO)

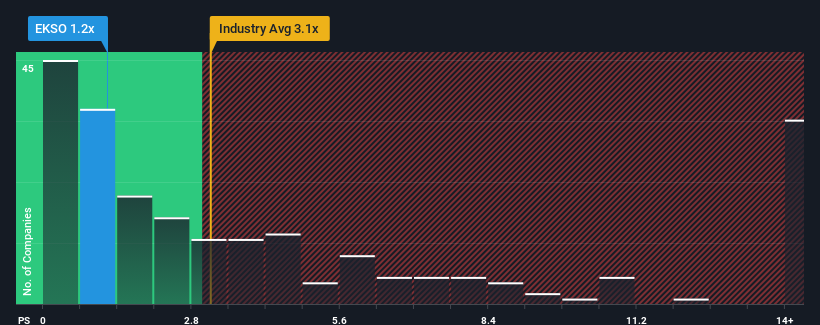

Ekso Bionics Holdings, Inc.'s (NASDAQ:EKSO) price-to-sales (or "P/S") ratio of 1.2x might make it look like a buy right now compared to the Medical Equipment industry in the United States, where around half of the companies have P/S ratios above 3.1x and even P/S above 7x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Ekso Bionics Holdings

What Does Ekso Bionics Holdings' Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Ekso Bionics Holdings has been doing relatively well. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Ekso Bionics Holdings.How Is Ekso Bionics Holdings' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Ekso Bionics Holdings' is when the company's growth is on track to lag the industry.

Taking a look back first, we see that the company grew revenue by an impressive 24% last year. Pleasingly, revenue has also lifted 92% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 28% per annum during the coming three years according to the dual analysts following the company. With the industry only predicted to deliver 10% per year, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Ekso Bionics Holdings' P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Ekso Bionics Holdings' analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Ekso Bionics Holdings (1 is a bit unpleasant!) that you should be aware of before investing here.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Ekso Bionics Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:EKSO

Ekso Bionics Holdings

Designs, develops, sells, and rents exoskeleton products in the Americas, Germany, Europe, the Middle East, Africa, the Asia Pacific, and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives