- United States

- /

- Aerospace & Defense

- /

- NYSE:HWM

3 US Stocks Trading At Estimated Discounts Up To 45.2%

Reviewed by Simply Wall St

The U.S. stock market has been on an impressive winning streak, with the S&P 500 and Nasdaq Composite extending their gains as investor sentiment improves and economic concerns ease. As major indices approach record highs, it presents a compelling opportunity to explore stocks that may still be trading at significant discounts. In this favorable market environment, identifying undervalued stocks can offer potential for substantial returns, particularly when these companies are poised to benefit from broader economic trends and sector-specific growth drivers.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Kaspi.kz (NasdaqGS:KSPI) | $128.12 | $253.16 | 49.4% |

| EQT (NYSE:EQT) | $33.72 | $66.17 | 49% |

| Owens Corning (NYSE:OC) | $162.58 | $316.40 | 48.6% |

| Oracle (NYSE:ORCL) | $137.92 | $268.56 | 48.6% |

| Fluence Energy (NasdaqGS:FLNC) | $18.01 | $35.75 | 49.6% |

| EVERTEC (NYSE:EVTC) | $33.34 | $66.46 | 49.8% |

| QuinStreet (NasdaqGS:QNST) | $17.40 | $34.43 | 49.5% |

| MaxLinear (NasdaqGS:MXL) | $12.79 | $24.95 | 48.7% |

| Sportradar Group (NasdaqGS:SRAD) | $11.51 | $22.40 | 48.6% |

| SunOpta (NasdaqGS:STKL) | $6.36 | $12.65 | 49.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

DexCom (NasdaqGS:DXCM)

Overview: DexCom, Inc. is a medical device company that designs, develops, and commercializes continuous glucose monitoring (CGM) systems in the United States and internationally, with a market cap of $29.91 billion.

Operations: DexCom generates its revenue primarily from the sale of patient monitoring equipment, amounting to $3.93 billion.

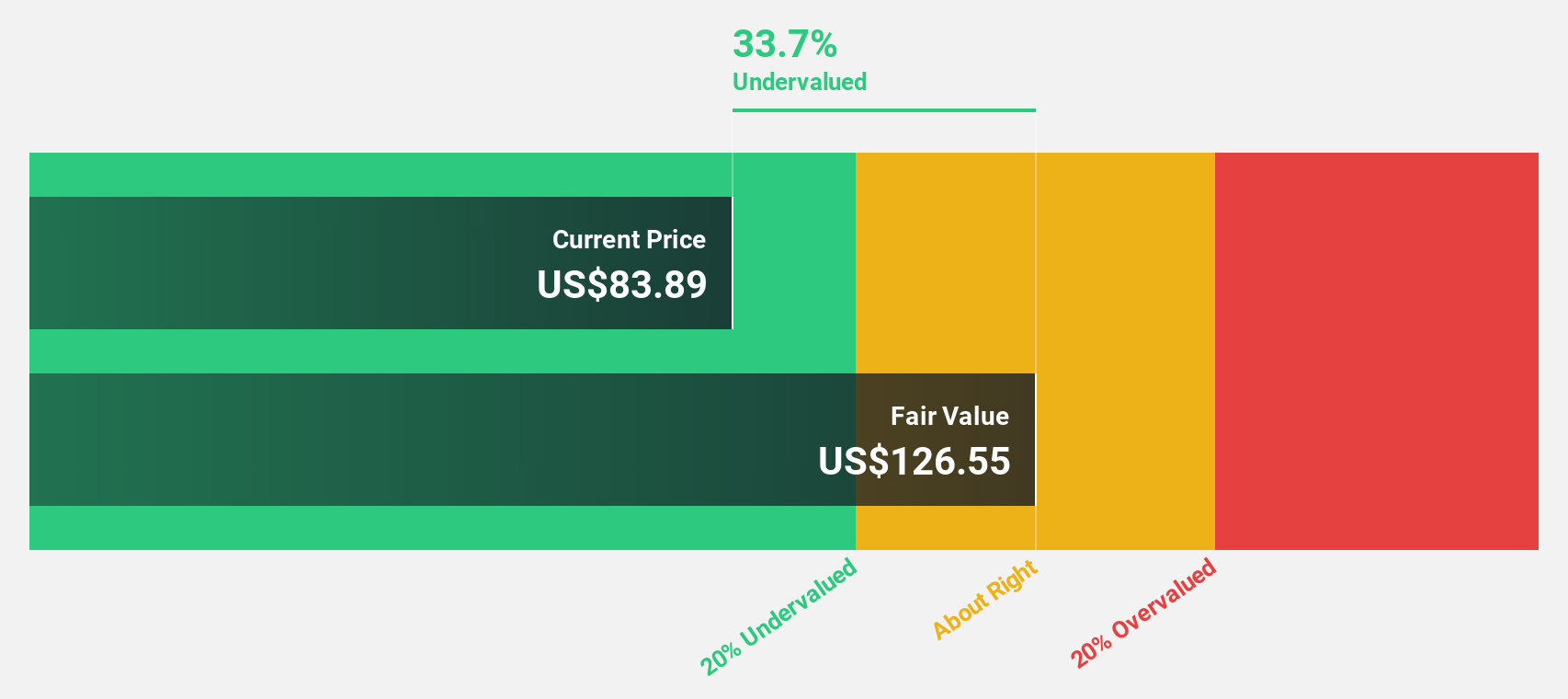

Estimated Discount To Fair Value: 35.2%

DexCom's recent integration of the G7 CGM with Tandem Diabetes' t:slim X2 pump and its strong Q2 earnings, reporting US$1.00 billion in sales and US$143.5 million in net income, highlight its robust cash flow potential. Despite shareholder dilution over the past year, DexCom is trading at 35.2% below its estimated fair value of US$119.89 per share, suggesting it may be undervalued based on discounted cash flow analysis.

- Our comprehensive growth report raises the possibility that DexCom is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of DexCom stock in this financial health report.

Howmet Aerospace (NYSE:HWM)

Overview: Howmet Aerospace Inc. offers advanced engineered solutions for the aerospace and transportation industries globally, with a market cap of $39.11 billion.

Operations: The company's revenue segments include Forged Wheels ($1.13 billion), Engine Products ($3.48 billion), Fastening Systems ($1.49 billion), and Engineered Structures ($1.01 billion).

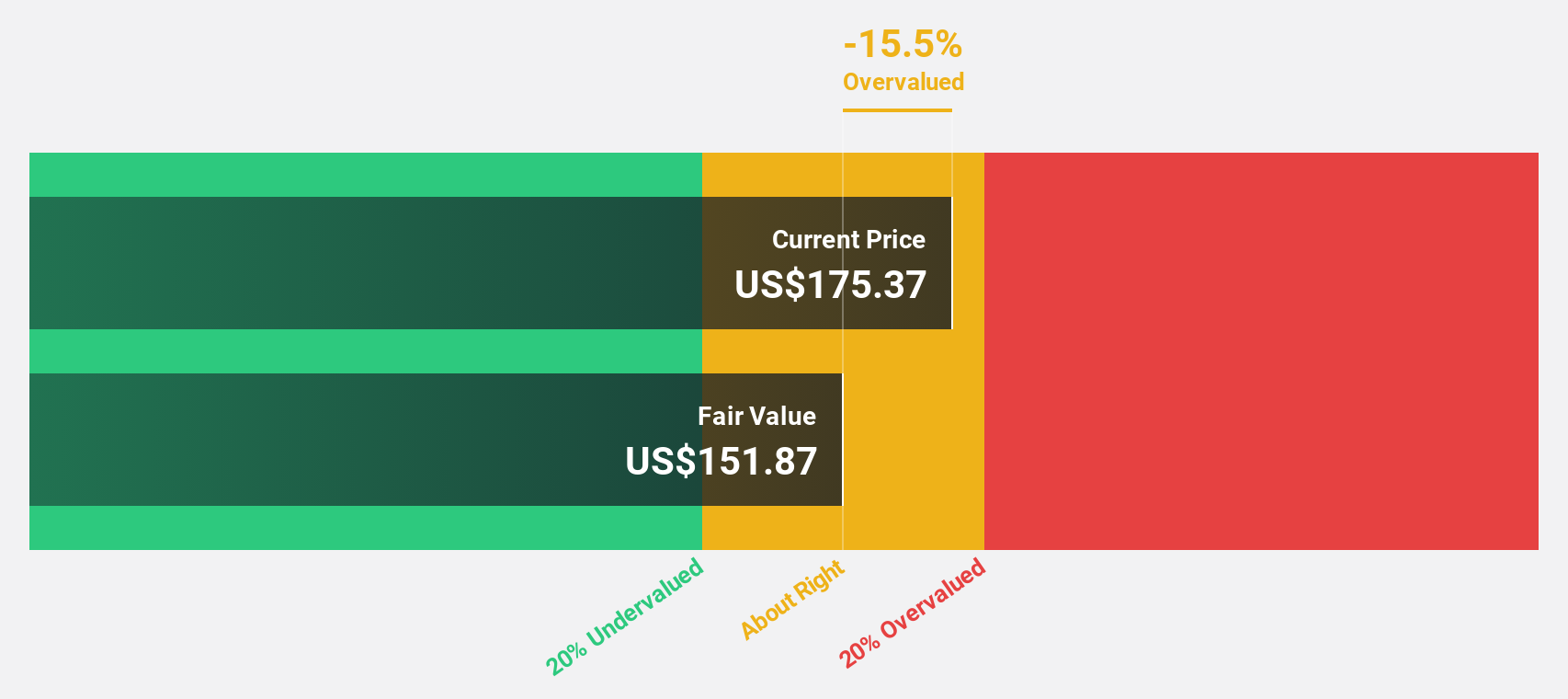

Estimated Discount To Fair Value: 45.2%

Howmet Aerospace's recent financial maneuvers, including the issuance of $498.87 million in senior unsecured notes and the redemption of $577 million in 6.875% notes due 2025, highlight its strategic focus on managing debt. The company reported strong Q2 earnings with US$1.88 billion in sales and US$266 million in net income, reflecting robust cash flows. Trading at approximately 45% below its estimated fair value of US$175.84 per share, Howmet appears undervalued based on discounted cash flow analysis.

- The growth report we've compiled suggests that Howmet Aerospace's future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in Howmet Aerospace's balance sheet health report.

Vertiv Holdings Co (NYSE:VRT)

Overview: Vertiv Holdings Co (NYSE: VRT) designs, manufactures, and services critical digital infrastructure technologies and life cycle services for data centers, communication networks, and commercial and industrial environments globally, with a market cap of approximately $29.79 billion.

Operations: The company's revenue segments consist of $4.11 billion from the Americas, $1.68 billion from the Asia Pacific, and $1.95 billion from Europe, the Middle East, and Africa.

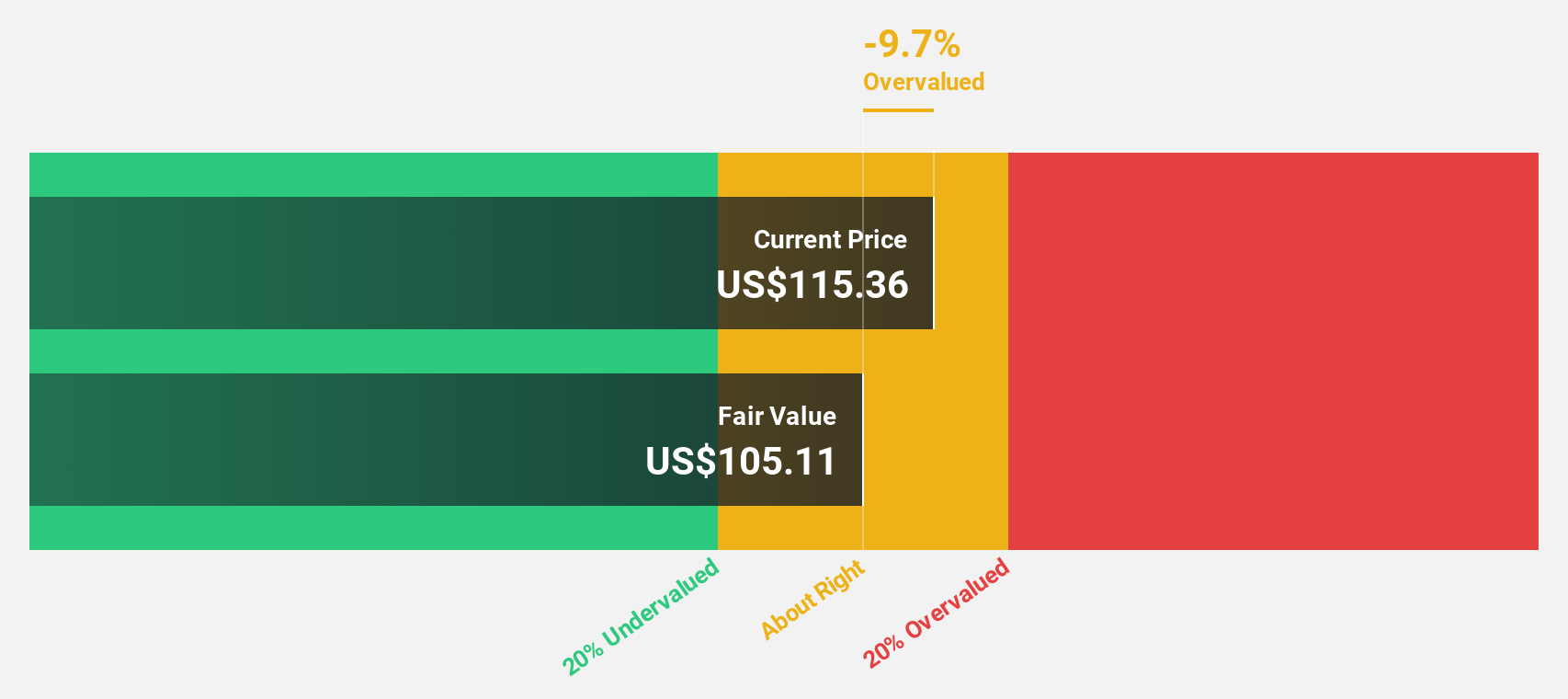

Estimated Discount To Fair Value: 44.5%

Vertiv Holdings Co's recent financial performance shows strong cash flow generation, with Q2 2024 revenue at US$1.95 billion and net income of US$178.1 million, significantly up from the previous year. The company raised its full-year 2024 sales guidance to a midpoint of $7.67 billion and operating profit to $1.26 billion, indicating robust growth prospects. Despite being dropped from multiple Russell indexes, Vertiv remains highly undervalued based on discounted cash flow analysis, trading well below its fair value estimate of $142.17 per share at $78.88 per share currently.

- The analysis detailed in our Vertiv Holdings Co growth report hints at robust future financial performance.

- Click here to discover the nuances of Vertiv Holdings Co with our detailed financial health report.

Next Steps

- Unlock our comprehensive list of 182 Undervalued US Stocks Based On Cash Flows by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Howmet Aerospace might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HWM

Howmet Aerospace

Provides advanced engineered solutions for the aerospace and transportation industries in the United States, Japan, France, Germany, the United Kingdom, Mexico, Italy, Canada, Poland, China, and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.