- United States

- /

- Biotech

- /

- NasdaqGM:XGN

US Penny Stocks To Watch In January 2025

Reviewed by Simply Wall St

As the United States market experiences a surge, with major indices like the S&P 500 and Dow Jones Industrial Average posting their best weekly gains in months, investors are on the lookout for opportunities beyond big-tech stocks. Penny stocks, often representing smaller or newer companies, continue to capture attention due to their potential for growth and affordability. Despite being considered a dated term, penny stocks remain relevant as they offer unique investment opportunities when backed by solid financials and clear growth prospects.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $108.36M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.89 | $6.46M | ★★★★★★ |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.91 | $11.73M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.73 | $2.08B | ★★★★☆☆ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.275 | $10.12M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $3.57 | $61.94M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.13 | $20.04M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8937 | $80.38M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.42 | $365.18M | ★★★★☆☆ |

Click here to see the full list of 709 stocks from our US Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

DocGo (NasdaqCM:DCGO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: DocGo Inc. offers mobile health and medical transportation services to healthcare providers in the United States and the United Kingdom, with a market cap of $423.37 million.

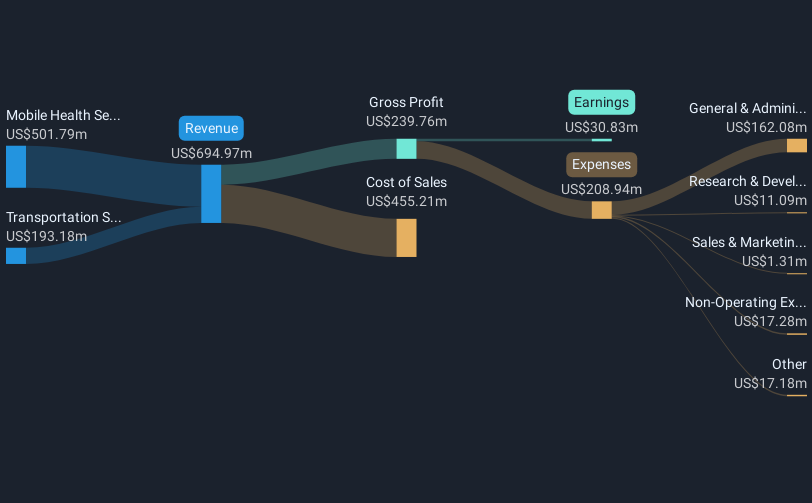

Operations: The company's revenue is primarily derived from Mobile Health Services, accounting for $501.79 million, and Transportation Services, contributing $193.18 million.

Market Cap: $423.37M

DocGo Inc., with a market cap of US$423.37 million, has shown significant earnings growth over the past year, outpacing the healthcare industry. The company reported net income of US$23.25 million for the first nine months of 2024, reversing a loss from the previous year. DocGo's financial stability is supported by short-term assets exceeding liabilities and debt well-covered by cash flow. Recent strategic moves include an expanded partnership with SHL Telemedicine and a renewed contract with a major Tennessee healthcare system, enhancing service delivery in underserved areas and driving demand for its mobile health services.

- Unlock comprehensive insights into our analysis of DocGo stock in this financial health report.

- Explore DocGo's analyst forecasts in our growth report.

Exagen (NasdaqGM:XGN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Exagen Inc. develops and commercializes testing products under the AVISE brand in the United States, with a market cap of $70.37 million.

Operations: The company's revenue is primarily generated from its Diagnostic Kits and Equipment segment, totaling $55.75 million.

Market Cap: $70.37M

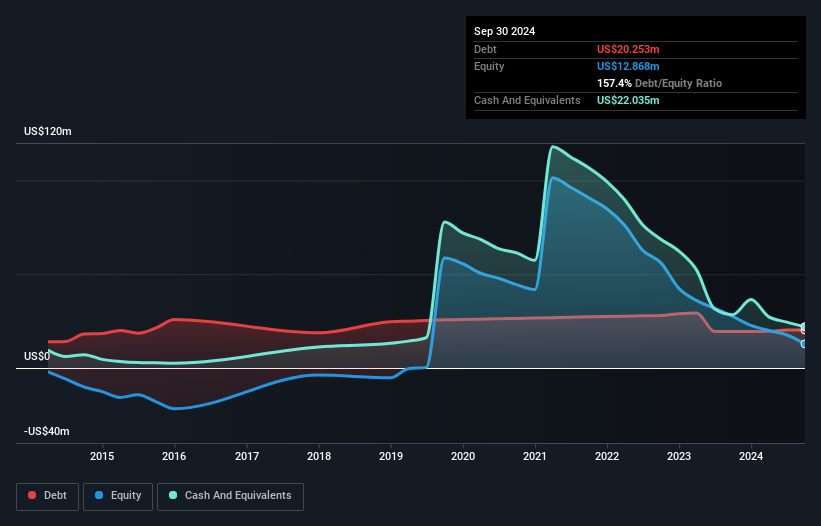

Exagen Inc., with a market cap of US$70.37 million, is navigating the penny stock landscape by advancing its AVISE brand diagnostic products. The company recently received conditional approval for new lupus and arthritis biomarkers, which could enhance its clinical utility and potentially drive future revenue growth. Despite being unprofitable, Exagen maintains a strong cash position relative to debt, with short-term assets covering liabilities comfortably. However, the company's share price has been highly volatile over recent months and it continues to face challenges in achieving profitability within the next three years.

- Click here to discover the nuances of Exagen with our detailed analytical financial health report.

- Assess Exagen's future earnings estimates with our detailed growth reports.

Nerdy (NYSE:NRDY)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nerdy, Inc. operates a platform for live online learning and has a market cap of $299.43 million.

Operations: The company generates revenue primarily from its Educational Services segment, specifically in Education & Training Services, amounting to $197.33 million.

Market Cap: $299.43M

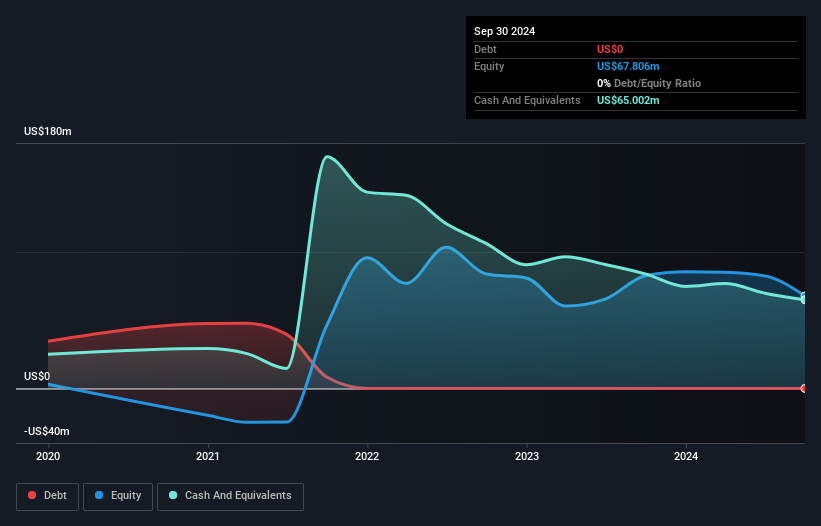

Nerdy, Inc., with a market cap of US$299.43 million, operates in the online learning sector and recently regained compliance with NYSE listing standards after addressing share price deficiencies. The company reported third-quarter revenue of US$37.53 million but remains unprofitable, with losses increasing over the past five years. Despite its financial challenges, Nerdy maintains a healthy cash position with no debt and sufficient liquidity to support growth initiatives. A recent partnership with Clover School District highlights its strategic efforts to expand educational services through its Varsity Tutors platform, potentially enhancing long-term revenue prospects amidst ongoing volatility in share price performance.

- Click to explore a detailed breakdown of our findings in Nerdy's financial health report.

- Gain insights into Nerdy's future direction by reviewing our growth report.

Key Takeaways

- Get an in-depth perspective on all 709 US Penny Stocks by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exagen might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:XGN

Exagen

Develops and commercializes various testing products under the AVISE brand in the United States.

Undervalued with adequate balance sheet.