- United States

- /

- Medical Equipment

- /

- NasdaqGS:CVRX

After Leaping 39% CVRx, Inc. (NASDAQ:CVRX) Shares Are Not Flying Under The Radar

CVRx, Inc. (NASDAQ:CVRX) shares have had a really impressive month, gaining 39% after a shaky period beforehand. Looking further back, the 15% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

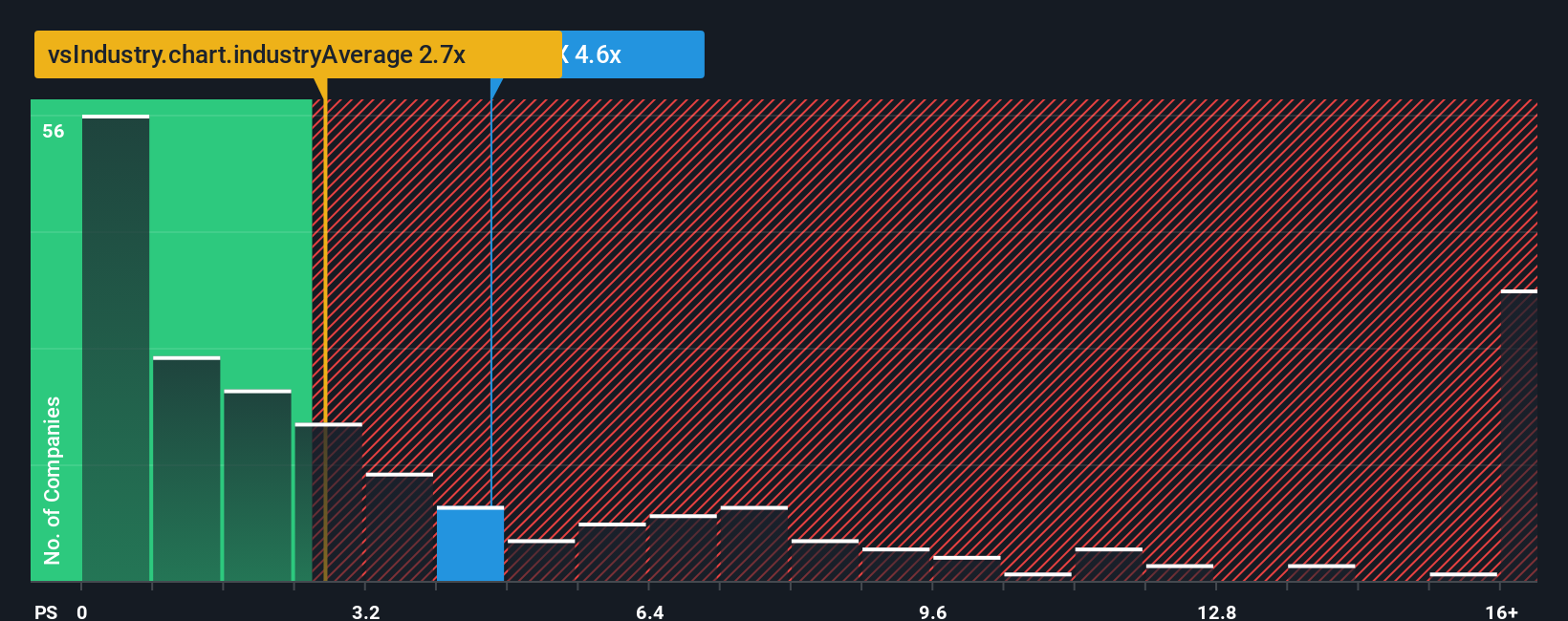

After such a large jump in price, given close to half the companies operating in the United States' Medical Equipment industry have price-to-sales ratios (or "P/S") below 2.7x, you may consider CVRx as a stock to potentially avoid with its 4.6x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for CVRx

What Does CVRx's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, CVRx has been doing relatively well. The P/S is probably high because investors think this strong revenue performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on CVRx.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as high as CVRx's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered an exceptional 23% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 238% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 21% per annum as estimated by the seven analysts watching the company. That's shaping up to be materially higher than the 9.2% per annum growth forecast for the broader industry.

In light of this, it's understandable that CVRx's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does CVRx's P/S Mean For Investors?

CVRx shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of CVRx's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Plus, you should also learn about these 2 warning signs we've spotted with CVRx.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CVRX

CVRx

A commercial-stage medical device company, engages in developing, manufacturing, and commercializing neuromodulation solutions for patients with cardiovascular diseases in the United States, Germany, and internationally.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives