- United States

- /

- Healthcare Services

- /

- NasdaqGM:CSTL

Is Castle Biosciences (CSTL) Overvalued After Its Recent 3‑Month Rally? A Fresh Look at the Numbers

Reviewed by Simply Wall St

Castle Biosciences (CSTL) has quietly turned into one of this year’s surprising healthcare winners, with the stock up about 68% over the past 3 months and roughly 36% year to date.

See our latest analysis for Castle Biosciences.

That move has come as investors have warmed to Castle’s mix of steady revenue growth and narrowing losses, with a 30 day share price return of just over 10% building on a powerful 90 day rally and stronger multi year total shareholder returns.

If Castle’s run has you rethinking your healthcare exposure, this could be a good moment to explore other potential winners across healthcare stocks and see what else fits your strategy.

With shares now trading slightly above Wall Street’s average target yet still showing a hefty implied intrinsic discount, the key question is whether Castle remains mispriced or if the market is already discounting years of future growth.

Most Popular Narrative Narrative: 7.4% Overvalued

With Castle Biosciences closing at $38.25 against a narrative fair value near the mid 30s, the story leans toward a richer pricing backdrop.

The ongoing shift toward precision and individualized medicine across healthcare systems, combined with Castle's robust real-world evidence (e.g., NCI SEER study showing 32% reduction in melanoma mortality), sets the stage for broader clinical adoption and increased commercial and payer demand, likely boosting test volumes and supporting higher revenues.

Want to see why modest top line growth assumptions still support an aggressive future earnings multiple and richer margins than today, even without near term profitability? The full narrative unpacks how projected revenue mix, margin expansion and share count changes interact to justify that valuation target.

Result: Fair Value of $35.63 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering reimbursement uncertainty and rising competitive pressure could still derail adoption, compress margins, and challenge the growth expectations embedded in this narrative.

Find out about the key risks to this Castle Biosciences narrative.

Another Way of Looking at Value

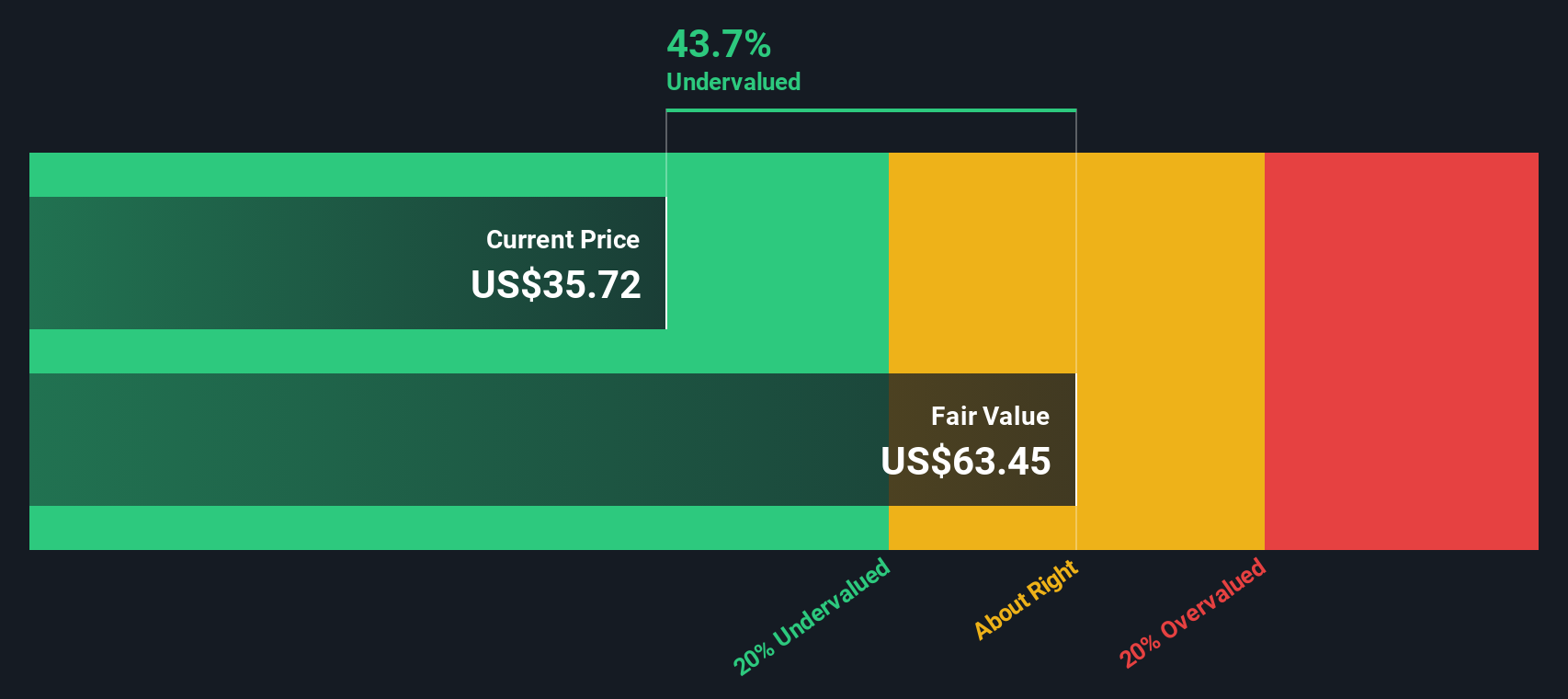

While the consensus narrative pegs Castle as about 7.4% overvalued versus its fair value, our DCF model paints a very different picture, suggesting the shares trade almost 40% below intrinsic value. When one framework sees upside and the other signals caution, which story do you trust with your money?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Castle Biosciences for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 900 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Castle Biosciences Narrative

If you see the story differently, or want to dig into the numbers yourself, you can build a fresh perspective in minutes: Do it your way.

A great starting point for your Castle Biosciences research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you are serious about finding your next edge, do not stop at Castle, use the Simply Wall Street Screener to uncover fresh, high conviction opportunities.

- Capitalize on potential multi baggers by targeting under the radar growth stories with these 3595 penny stocks with strong financials that already show improving fundamentals and market momentum.

- Ride the wave of intelligent automation by focusing on these 26 AI penny stocks that are building real world products, sticky platforms, and defensible data moats.

- Lock in quality at sensible prices by zeroing in on these 15 dividend stocks with yields > 3% that combine reliable income with solid financial health and room for long term appreciation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:CSTL

Castle Biosciences

A molecular diagnostics company, provides test solutions for the diagnosis and treatment of dermatologic cancers, Barrett’s esophagus (BE), uveal melanoma, and mental health conditions.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)