- United States

- /

- Healthcare Services

- /

- NasdaqCM:COSM

Cosmos Health Inc. (NASDAQ:COSM) Might Not Be As Mispriced As It Looks After Plunging 31%

To the annoyance of some shareholders, Cosmos Health Inc. (NASDAQ:COSM) shares are down a considerable 31% in the last month, which continues a horrid run for the company. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 38% in that time.

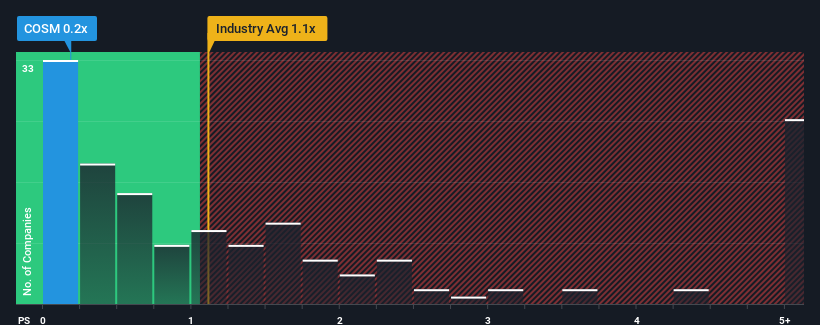

Since its price has dipped substantially, considering around half the companies operating in the United States' Healthcare industry have price-to-sales ratios (or "P/S") above 1.1x, you may consider Cosmos Health as an solid investment opportunity with its 0.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Cosmos Health

How Has Cosmos Health Performed Recently?

Cosmos Health certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Cosmos Health.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Cosmos Health's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 13% last year. However, due to its less than impressive performance prior to this period, revenue growth is practically non-existent over the last three years overall. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 16% during the coming year according to the only analyst following the company. With the industry only predicted to deliver 10%, the company is positioned for a stronger revenue result.

With this information, we find it odd that Cosmos Health is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

Cosmos Health's recently weak share price has pulled its P/S back below other Healthcare companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

To us, it seems Cosmos Health currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Before you take the next step, you should know about the 4 warning signs for Cosmos Health that we have uncovered.

If you're unsure about the strength of Cosmos Health's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:COSM

Cosmos Health

Manufactures, develops, and trades branded nutraceutical products in Greece, the United Kingdom, Croatia, Bulgaria, Cayman Islands, and Cyprus.

Flawless balance sheet slight.