- United States

- /

- Medical Equipment

- /

- NasdaqGS:COO

Cooper Companies (NasdaqGS:COO) Q1 Earnings Rise With US$965M Sales Strong 2025 Revenue Guidance Given

Reviewed by Simply Wall St

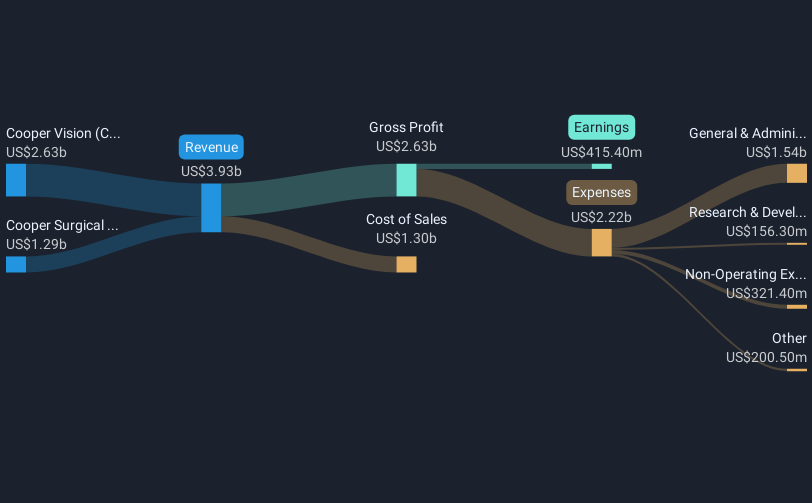

Cooper Companies (NasdaqGS:COO) recently reported improved financials with Q1 FY2025 sales rising to $965 million and net income growing to $104 million. The company's projection for fiscal 2025 revenue suggests 6% to 8% organic growth, which could have bolstered investor sentiment, leading to the stock's 1.24% price increase over the past week. This gain is notable against a backdrop of significant market declines, with the Dow and S&P 500 both down amid tariff and economic concerns, reflecting broader investor uncertainty. While Cooper's advances contrast the 2.7% market drop, the upward revision of its earnings guidance stands out, positioning it attractively in a volatile market. Overall, the combination of strong earnings and forward-looking guidance likely contributed positively to Cooper's stock performance during a challenging period for the broader market.

Unlock comprehensive insights into our analysis of Cooper Companies stock here.

Over the past five years, Cooper Companies (NasdaqGS:COO) has achieved a total return of 30.02%, encompassing both share price appreciation and dividends. During this period, Cooper undertook a stock repurchase program, acquiring approximately 4.66 million shares, which might have supported its stock price by showcasing confidence in the company's value. Additionally, earnings growth in the past year significantly outpaced the 5-year average, reflecting stronger recent performance. Legal challenges arose in 2024, with lawsuits concerning defective embryo culture media, which could have temporarily impacted investor sentiment.

In 2023, the company shifted its primary exchange listing from the NYSE to Nasdaq, aligning itself with a platform more central to technology-driven sectors. Despite its 5-year achievements, Cooper underperformed the broader US market and the Medical Equipment industry over the past year, partly due to its earnings declining by approximately 20.2% annually over the wider timeframe. Nonetheless, improved net profit margins and corporate guidance in recent months may have positioned Cooper for a potential turnaround.

- See whether Cooper Companies' current market price aligns with its intrinsic value in our detailed report

- Assess the downside scenarios for Cooper Companies with our risk evaluation.

- Are you invested in Cooper Companies already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COO

Cooper Companies

Develops, manufactures, and markets contact lens wearers.

Excellent balance sheet with proven track record.