- United States

- /

- Medical Equipment

- /

- NasdaqCM:CODX

One Co-Diagnostics, Inc. (NASDAQ:CODX) Analyst Just Slashed Their Estimates By A Consequential 14%

One thing we could say about the covering analyst on Co-Diagnostics, Inc. (NASDAQ:CODX) - they aren't optimistic, having just made a major negative revision to their near-term (statutory) forecasts for the organization. There was a fairly draconian cut to their revenue estimates, perhaps an implicit admission that previous forecasts were much too optimistic.

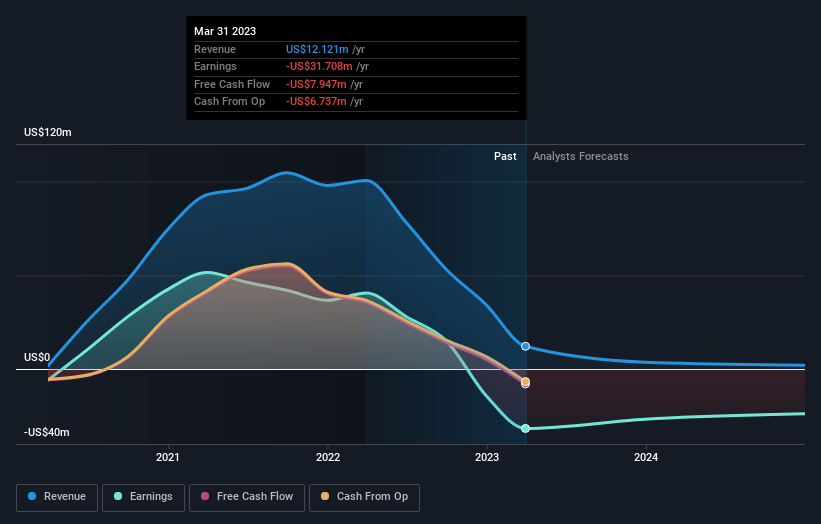

After the downgrade, the consensus from Co-Diagnostics' solo analyst is for revenues of US$3.6m in 2023, which would reflect a disturbing 70% decline in sales compared to the last year of performance. Losses are expected to be contained, narrowing 13% from last year to US$0.90. Yet before this consensus update, the analyst had been forecasting revenues of US$4.2m and losses of US$0.87 per share in 2023. Ergo, there's been a clear change in sentiment, with the analyst administering a notable cut to this year's revenue estimates, while at the same time increasing their loss per share forecasts.

Check out our latest analysis for Co-Diagnostics

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. We would highlight that sales are expected to reverse, with a forecast 80% annualised revenue decline to the end of 2023. That is a notable change from historical growth of 46% over the last five years. Compare this with our data, which suggests that other companies in the same industry are, in aggregate, expected to see their revenue grow 8.3% per year. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - Co-Diagnostics is expected to lag the wider industry.

The Bottom Line

The most important thing to note from this downgrade is that the consensus increased its forecast losses this year, suggesting all may not be well at Co-Diagnostics. Regrettably, they also downgraded their revenue estimates, and the latest forecasts imply the business will grow sales slower than the wider market. Given the stark change in sentiment, we'd understand if investors became more cautious on Co-Diagnostics after today.

Even so, the longer term trajectory of the business is much more important for the value creation of shareholders. At least one analyst has provided forecasts out to 2024, which can be seen for free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:CODX

Co-Diagnostics

Operates as a molecular diagnostics company that develops, manufactures, and sells reagents used for diagnostic tests that function through the detection and/or analysis of nucleic acid molecules in the United States and internationally.

Flawless balance sheet with moderate risk.

Similar Companies

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

SoFi Technologies: The Apex Aggregator and the Infrastructure of the Modern Financial System

CSL: The Dip Is the Opportunity

DHT Holdings, inc: Strait of Hormuz Risk Amidst US-Israel vs Iran Tensions Spikes VLCC Rates.

Recently Updated Narratives

A Case For NeXGold Mining Corp, a 20+ bagger by 2030 (C$40-70) or a 10 bagger by Christmas 2026 (C$16), or both?

A Company Preparing for the Future: Charles River Laboratories

The Birth of a High-Grade Canadian Gold Powerhouse

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks