- United States

- /

- Healthcare Services

- /

- NasdaqGS:CLOV

Why Clover Health Investments (NASDAQ:CLOV) has Time to Develop a Superior Product

While a business like Clover Health Investments ( NASDAQ:CLOV ) is developing, it takes substantial funds to invest and produce a model that is going to take off against the competition. That is why companies need cash reserves to fund their business while developing. Clover is working on making their "Clover Assistant" a better and more precise alternative for healthcare practitioners. The company is using AI in predicting outcomes, but is also facing a steep competition, since the technology is not that new and competitors have substantially more capital to invest in development.

So, should Clover Health Investments shareholders be worried about its cash burn?For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth - its negative free cash flow.

First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

Check out our latest analysis for Clover Health Investments

When Might Clover Health Investments Run Out Of Money?

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash.

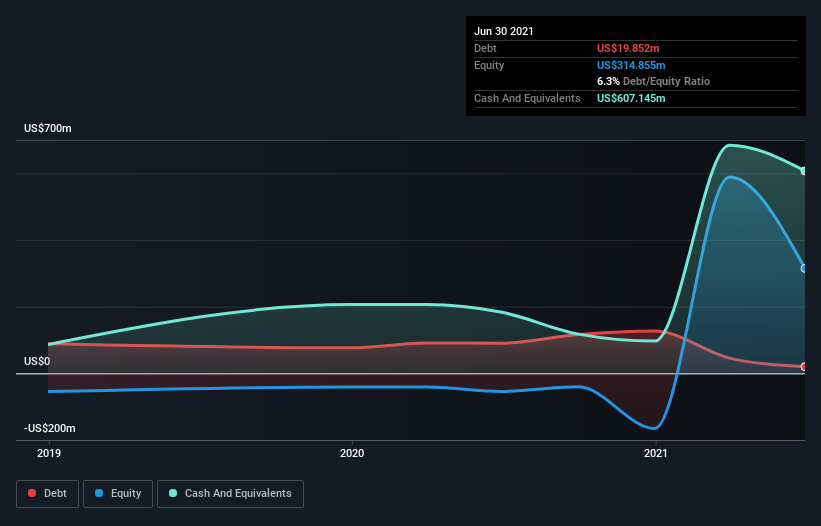

Clover Health Investments has such a small amount of debt that we'll set it aside, and focus on the US$607m in cash it held at June 2021.Importantly, its cash burn was US$252m over the trailing twelve months.

So it had a cash runway of about 2.4 years from June 2021 . That's decent, giving the company a couple of years to develop its business.

The image below shows how its cash balance has been changing over the last few years.

How Well Is Clover Health Investments Growing?

Notably, Clover Health Investments actually ramped up its cash burn very hard and fast in the last year, by 117%, signifying heavy investment in the business. But the silver lining is that operating revenue increased by 24% in that time.

Looking at the fundamental growth prospects is important for Clover. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company .

Is Dilution a Concern?

While Clover Health Investments seems to be in a fairly good position, it's still worth considering how easily it could raise more cash, even just to fuel faster growth.

Clover Health Investments' cash burn of US$252m is about 7.5% of its US$3.4b market capitalization .

That's a low proportion, so we figure the company would be able to consider raising more cash to fund growth, with a little dilution.

Taking on debt may not be a good option for a money losing company, as it will have not tax deduction benefits.

Key Takeaways

Clover can fund up to 2.4 years of operations with the current income and expense structure.

The company is pushing for approval in more states, developing its product and seeking market share. Young companies like this can grow and prosper if they find service or price inefficiencies against competitors, and Clover is currently building its "hello-effect" in-front of healthcare practitioners.

Taking an in-depth view of risks, we've identified 2 warning signs for Clover Health Investments that you should be aware of before investing.

Of course Clover Health Investments may not be the best stock to buy . So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying .

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:CLOV

Clover Health Investments

Provides medicare advantage plans in the United States.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026