- United States

- /

- Healthtech

- /

- NasdaqGS:CERT

Certara (CERT): Evaluating Valuation Following Launch of Pinnacle 21 Enterprise Plus for Regulatory Data Compliance

Reviewed by Simply Wall St

If you’re watching Certara (CERT) for signs of a turnaround, the latest launch of Pinnacle 21 Enterprise Plus is worth your attention. This product promises a major shift in how clinical and statistical programmers handle complex regulatory data submissions, an area that has been bogged down by manual processes and inefficiencies for years. With the company touting up to a 50% reduction in time spent drafting mapping specifications, this move tackles a core pain point for its key customers and may set Certara apart from its competitors.

This launch comes after a challenging stretch for Certara’s stock and its investors. Over the past year, shares have dipped 7%, and the longer-term view is more sobering, with a 32% decline over three years. Still, the company’s recent efforts, including high-profile presentations at industry conferences, suggest that Certara is committed to driving growth through both innovation and visibility. The potential commercial impact of Pinnacle 21 Enterprise Plus could be significant if adoption picks up, especially given the ongoing demand for more efficient data solutions in clinical trials.

With shares still under pressure, the question now becomes whether the street is giving Certara enough credit for these product gains, or if market expectations already reflect the company’s future prospects.

Most Popular Narrative: 27% Undervalued

The current narrative sees Certara trading well below its estimated fair value. Analysts are forecasting significant upside potential based on future growth and industry trends.

Strong industry and regulatory momentum, such as the FDA's guidance to phase out animal testing in monoclonal antibody development, are rapidly increasing the need for biosimulation and model-informed drug development. This is expanding Certara's addressable market and driving sustained demand, positively impacting both revenues and bookings.

Do you know why analysts are this bullish? The answer might surprise you. The numbers behind this valuation include bold revenue projections, major shifts in profit margins, and an earnings multiple that stands out among peers. If you want to find out what makes this narrative so optimistic and how future growth expectations influence the fair value, keep reading to discover the powerful financial assumptions analysts believe could transform Certara's outlook.

Result: Fair Value of $14.11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing uncertainty around the speed of pharma adoption and the risk of delayed returns from recent acquisitions could quickly alter Certara’s current outlook.

Find out about the key risks to this Certara narrative.Another View: Industry Comparison Puts Certara in a Different Light

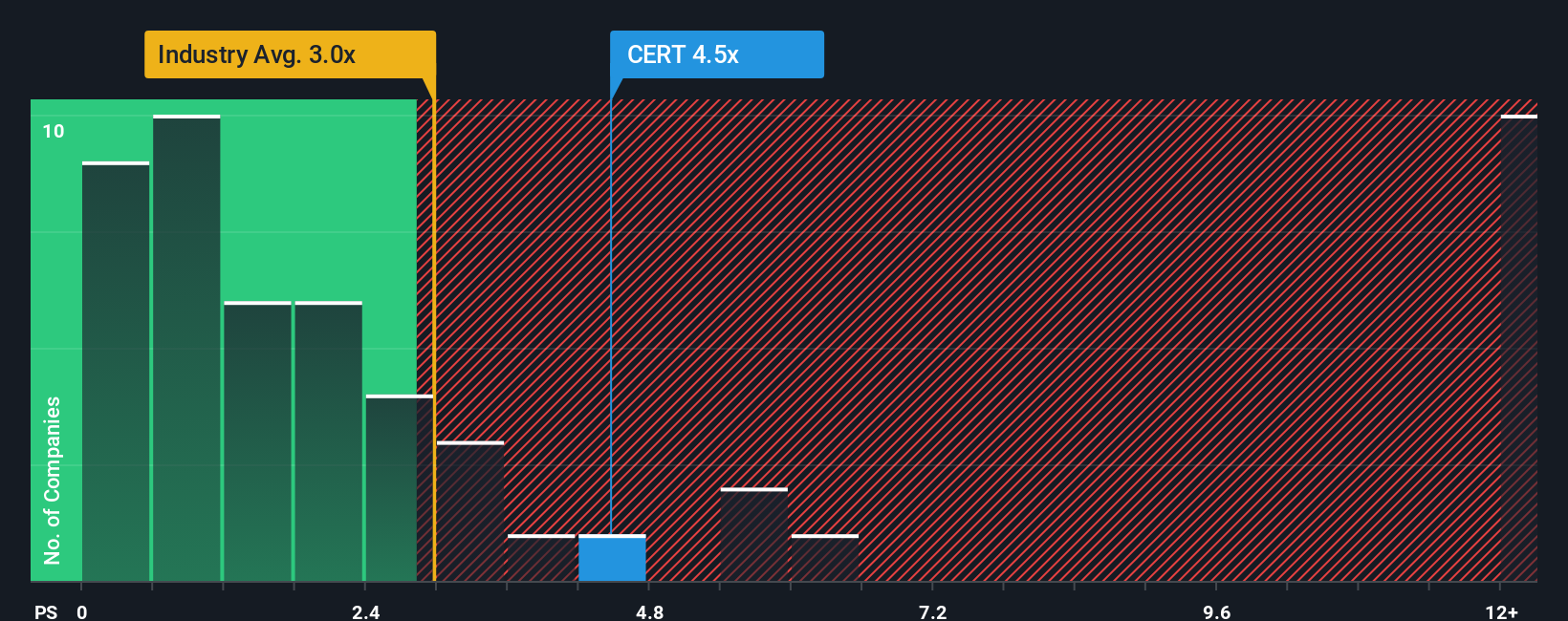

From a valuation based on revenue, Certara looks more expensive than its healthcare services peers. This highlights a disconnect between business fundamentals and what the market is willing to pay. Could this mean risk, or a misunderstood growth story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Certara Narrative

If these perspectives do not reflect your own, or you’re eager to dig into the numbers personally, you can build a unique story with the available data in just a few minutes. Do it your way.

A great starting point for your Certara research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment opportunities?

Smart investing means never settling for just one story. Explore other sectors where real potential could be waiting and capture trends that others may be missing.

- Pinpoint undervalued opportunities by jumping into the market’s best-kept secrets with undervalued stocks based on cash flows.

- Uncover tomorrow’s tech leaders at the intersection of medicine and artificial intelligence through healthcare AI stocks.

- Target steady income streams and reliable yields with a personalized list of dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CERT

Certara

Provides technology-enabled services and software products for biosimulation in drug discovery, preclinical and clinical research, regulatory submissions, and market access in the United States and internationally.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives