- United States

- /

- Healthtech

- /

- NasdaqGS:CERT

Certara (CERT): Assessing Valuation After Fresh Buy Rating Highlights Biosimulation Growth Potential

Reviewed by Kshitija Bhandaru

Certara (CERT) recently attracted fresh attention after Craig-Hallum initiated coverage with a Buy rating, highlighting its well-established niche in the pharmaceutical and biotech space. The move puts Certara’s biosimulation-driven business model in the spotlight as R&D spending trends upward.

See our latest analysis for Certara.

Certara’s recent wave of analyst upgrades and its focus on biosimulation have attracted investor interest, but that hasn’t translated into significant near-term price momentum. Its one-year total shareholder return sits just above flat. While the latest news shines a light on growth prospects, market enthusiasm still seems guarded despite the industry tailwinds.

If you’re interested in uncovering more companies at the intersection of healthcare and technology, it’s a great moment to check out our See the full list for free.

With Certara trading just shy of analyst targets and boasting double-digit growth rates, the market’s cautious optimism is clear. Are shares still undervalued, or has the potential upside already been factored in?

Most Popular Narrative: 3.6% Undervalued

Certara's fair value, based on the most widely followed narrative, is set at $14.11, slightly above the last close of $13.60, suggesting modest upside in the current price. The narrative presents a bullish case, driven by regulatory breakthroughs and platform innovation, but it's based on ambitious assumptions worth double-checking.

The recent qualification of Certara's Simcyp platform by the European Medicines Agency sets it apart as the only PBPK modeling tool with such approval. This is likely to increase customer adoption among global pharma companies seeking regulatory certainty and speed for their drug approvals, supporting future revenue growth. Strong industry and regulatory momentum, such as the FDA's guidance to phase out animal testing in monoclonal antibody development, are rapidly increasing the need for biosimulation and model-informed drug development, expanding Certara's addressable market and driving sustained demand, positively impacting both revenues and bookings.

Curious about the ambitious math behind this price target? The narrative hinges on a forecast of faster revenue growth and margin stability than most would expect from a company fresh off regulatory wins. Want to know which financial levers are assumed to shift so sharply? Unpack all the core projections that drive this premium by starting with the full narrative.

Result: Fair Value of $14.11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, increased cost-cutting by pharmaceutical companies or slower adoption of Certara’s new AI platforms could quickly cool projections for revenue and future growth.

Find out about the key risks to this Certara narrative.

Another View: Revenue Multiples Signal Caution

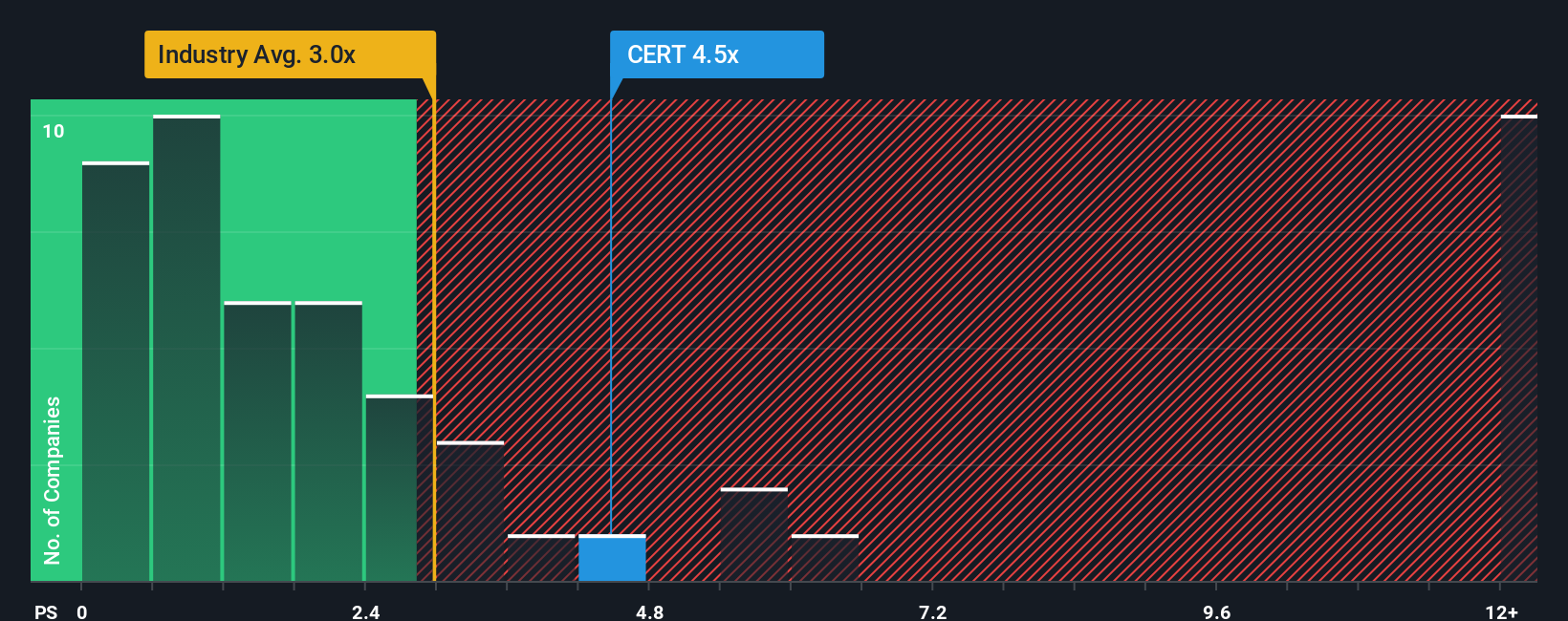

Looking from a different angle, Certara’s current price-to-sales ratio stands at 5.4x, which is notably higher than both its healthcare services industry average (3x) and the peer group (3.1x). In addition, the ratio is well above the fair ratio of 2.3x, implying the stock could be priced for perfection and leaving less room for upside if growth slows. Does this premium signal confidence or call for a careful re-think?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Certara Narrative

If the consensus view does not quite align with your outlook, or you are someone who trusts their own analysis, you can build a fresh Certara narrative yourself in just minutes. Do it your way

A great starting point for your Certara research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Tap into timely themes and stocks flying under the radar using the Simply Wall St Screener. New opportunities emerge every day. Don’t let the next breakthrough pass you by.

- Capture impressive yields. Start with these 19 dividend stocks with yields > 3% to spot companies rewarding investors with payouts exceeding 3%.

- Capitalize on the AI surge and see which businesses might transform tomorrow’s tech landscape by exploring these 24 AI penny stocks.

- Position yourself early in quantum technology with these 26 quantum computing stocks, and watch as these innovators tackle challenges once thought impossible.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CERT

Certara

Provides technology-enabled services and software products for biosimulation in drug discovery, preclinical and clinical research, regulatory submissions, and market access.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives