- United States

- /

- Medical Equipment

- /

- NasdaqGM:CERS

Cerus Corporation's (NASDAQ:CERS) Shares Leap 26% Yet They're Still Not Telling The Full Story

Cerus Corporation (NASDAQ:CERS) shareholders are no doubt pleased to see that the share price has bounced 26% in the last month, although it is still struggling to make up recently lost ground. Taking a wider view, although not as strong as the last month, the full year gain of 14% is also fairly reasonable.

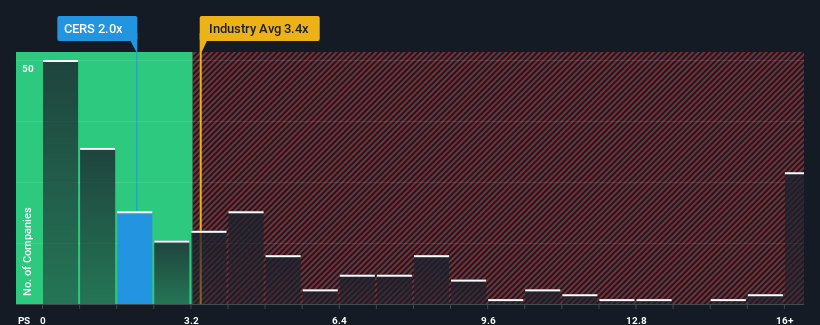

Even after such a large jump in price, Cerus may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 2x, considering almost half of all companies in the Medical Equipment industry in the United States have P/S ratios greater than 3.4x and even P/S higher than 8x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Cerus

How Cerus Has Been Performing

Cerus certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Cerus.Is There Any Revenue Growth Forecasted For Cerus?

In order to justify its P/S ratio, Cerus would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 15% last year. Pleasingly, revenue has also lifted 48% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 14% as estimated by the five analysts watching the company. That's shaping up to be materially higher than the 9.1% growth forecast for the broader industry.

With this information, we find it odd that Cerus is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

Despite Cerus' share price climbing recently, its P/S still lags most other companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Cerus' analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

You always need to take note of risks, for example - Cerus has 2 warning signs we think you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:CERS

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives