- United States

- /

- Healthcare Services

- /

- NasdaqGS:CCRN

Cross Country Healthcare, Inc.'s (NASDAQ:CCRN) Shares Bounce 30% But Its Business Still Trails The Market

Cross Country Healthcare, Inc. (NASDAQ:CCRN) shareholders would be excited to see that the share price has had a great month, posting a 30% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 30% over that time.

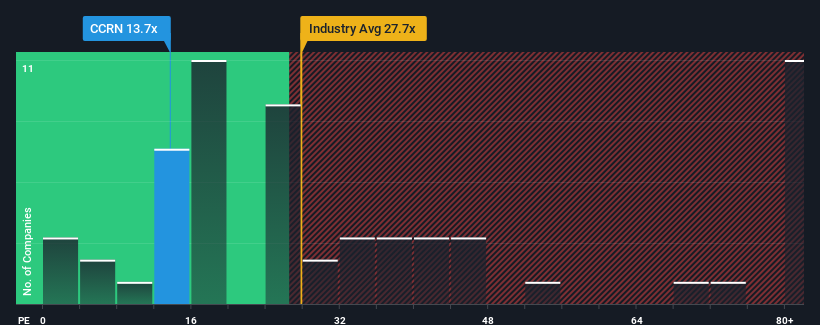

Even after such a large jump in price, given about half the companies in the United States have price-to-earnings ratios (or "P/E's") above 19x, you may still consider Cross Country Healthcare as an attractive investment with its 13.7x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Recent times haven't been advantageous for Cross Country Healthcare as its earnings have been falling quicker than most other companies. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

View our latest analysis for Cross Country Healthcare

How Is Cross Country Healthcare's Growth Trending?

There's an inherent assumption that a company should underperform the market for P/E ratios like Cross Country Healthcare's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 69%. Still, the latest three year period has seen an excellent 457% overall rise in EPS, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the nine analysts covering the company suggest earnings growth is heading into negative territory, declining 6.1% per annum over the next three years. That's not great when the rest of the market is expected to grow by 10% each year.

In light of this, it's understandable that Cross Country Healthcare's P/E would sit below the majority of other companies. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

What We Can Learn From Cross Country Healthcare's P/E?

Despite Cross Country Healthcare's shares building up a head of steam, its P/E still lags most other companies. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Cross Country Healthcare maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 3 warning signs for Cross Country Healthcare (1 doesn't sit too well with us!) that you should be aware of.

Of course, you might also be able to find a better stock than Cross Country Healthcare. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CCRN

Cross Country Healthcare

Provides talent management and other consultative services for healthcare clients in the United States.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives