- United States

- /

- Medical Equipment

- /

- NasdaqCM:AWH

Even after rising 18% this past week, Aspira Women's Health (NASDAQ:AWH) shareholders are still down 88% over the past year

Aspira Women's Health Inc. (NASDAQ:AWH) shareholders should be happy to see the share price up 24% in the last month. But that doesn't change the fact that the returns over the last year have been stomach churning. Specifically, the stock price nose-dived 88% in that time. It's not uncommon to see a bounce after a drop like that. The real question is whether the company can turn around its fortunes. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

On a more encouraging note the company has added US$12m to its market cap in just the last 7 days, so let's see if we can determine what's driven the one-year loss for shareholders.

View our latest analysis for Aspira Women's Health

Aspira Women's Health isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Aspira Women's Health grew its revenue by 46% over the last year. That's well above most other pre-profit companies. So on the face of it we're really surprised to see the share price down 88% over twelve months. Something weird is definitely impacting the stock price; we'd venture the company has destroyed value somehow. What is clear is that the market is not judging the company on its revenue growth right now. Of course, markets do over-react so share price drop may be too harsh.

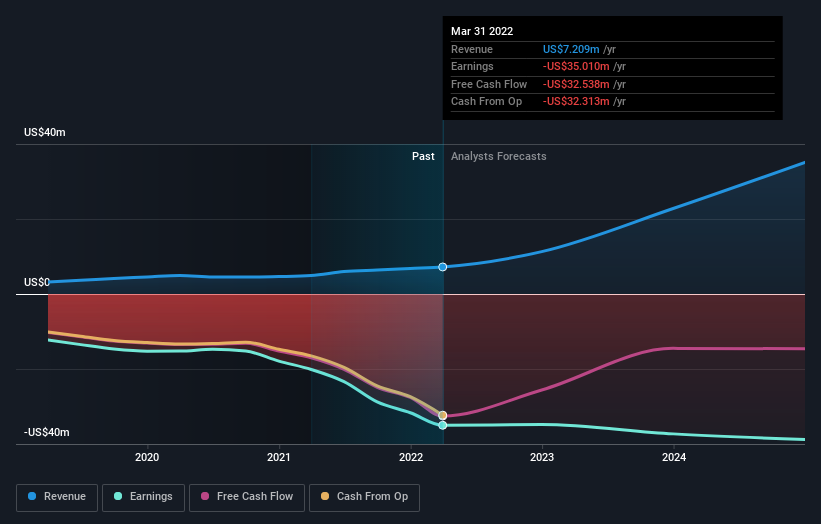

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

We regret to report that Aspira Women's Health shareholders are down 88% for the year. Unfortunately, that's worse than the broader market decline of 18%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 10% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Aspira Women's Health better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with Aspira Women's Health , and understanding them should be part of your investment process.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:AWH

Aspira Women's Health

Aspira Women's Health Inc., together with its subsidiaries, discovers, develops, and commercializes of noninvasive AI-powered diagnostic tests for gynecologic diseases in the United States.

Moderate and slightly overvalued.

Similar Companies

Market Insights

Community Narratives