- United States

- /

- Medical Equipment

- /

- NasdaqGM:ATRC

AtriCure (ATRC) Unveils cryoXT Device for Advanced Post-Amputation Pain Management

Reviewed by Simply Wall St

AtriCure (ATRC) recently launched its cryoXT device, advancing its cryoablation technology, which could address significant post-operative pain issues—a development that could positively impact its market perception. Over the last quarter, AtriCure's share price rose by 9%, which may have been influenced by this product launch as well as a strong financial showing in its Q2 results with improved sales. This performance aligns with broader market trends, as the S&P 500 and Nasdaq indices reached all-time highs, potentially amplifying AtriCure's upward share price movement amid a positive overall market sentiment.

Buy, Hold or Sell AtriCure? View our complete analysis and fair value estimate and you decide.

The recent launch of AtriCure's cryoXT device could be pivotal, potentially boosting its market perception and reinforcing the company's narrative of innovating in minimally invasive procedures. This aligns well with the broader strategy of expanding global market reach and product adoption. The strong revenue and earnings forecasts hinge on such product launches, which help buoy the company amid regulatory and competitive pressures. The device's introduction may support AtriCure's projected revenue growth of 11.4% annually, although heightened competition remains a risk. As the company maintains its focus on expanding international footprints and successful clinical trials, future revenue streams from new geographical segments and expanded indications could follow suit.

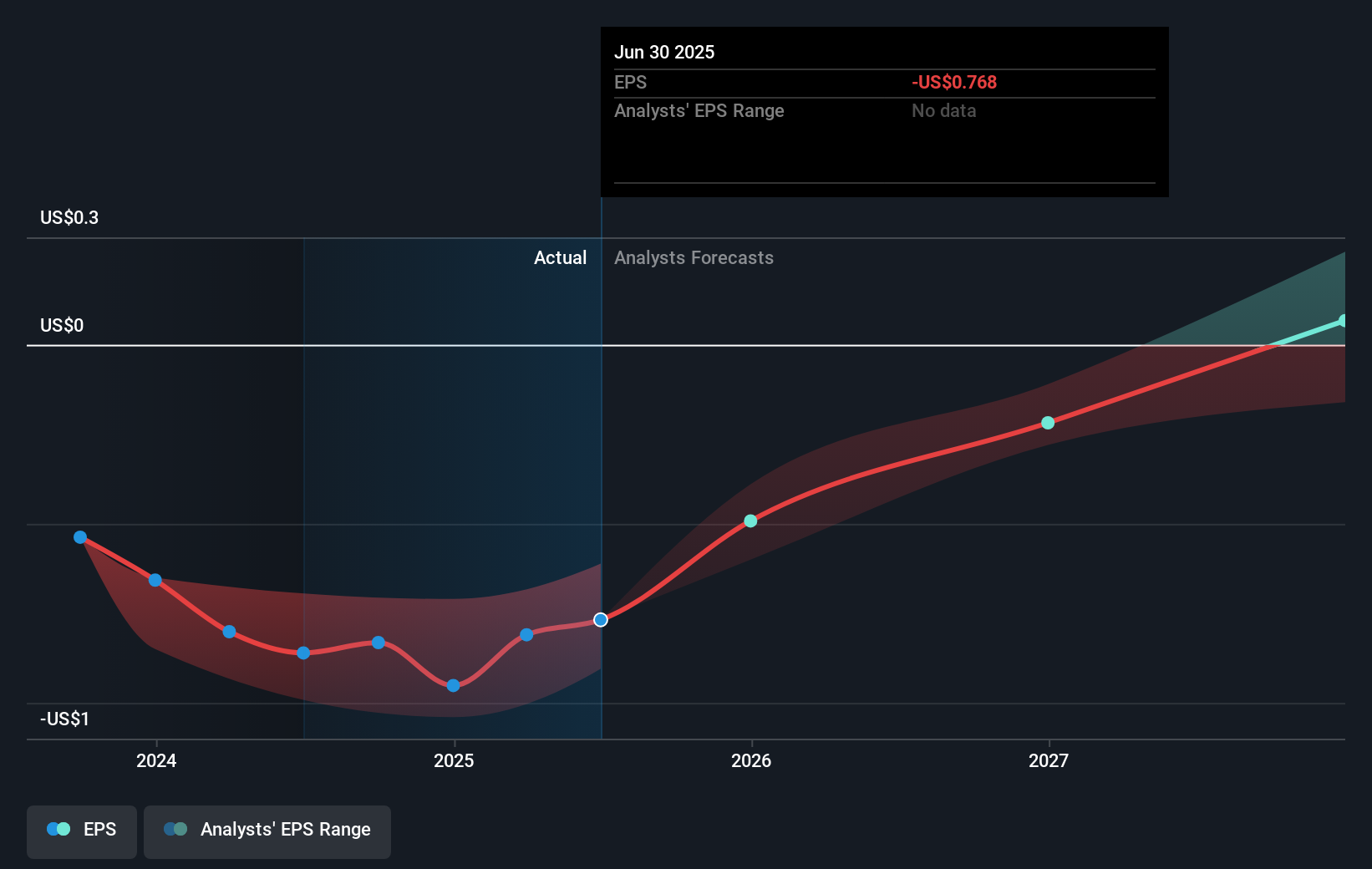

Over the past year, AtriCure's total return, including share price and dividends, was 34.39%. This performance not only exceeds the S&P 500's 20.5% return and the Medical Equipment industry's 3.8% return for the same period, but also positions AtriCure as a formidable player within its sector over this longer time frame. Despite the recent upward movement, AtriCure's current share price of US$36.11 remains below the consensus analyst price target of US$50. This reflects a 38.5% expected upside, suggesting that analysts see potential for substantial growth if the company can meet its forecasted earnings and revenue benchmarks. Investors will be watching to see if continued momentum and successful execution of its strategic initiatives can meet these optimistic expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ATRC

AtriCure

Develops, manufactures, and sells devices for surgical ablation of cardiac tissue, exclusion of the left atrial appendage, and temporarily blocking pain by ablating peripheral nerves to medical centers in the United States, the Asia-Pacific, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)