- United States

- /

- Healthcare Services

- /

- NasdaqCM:ASTH

Astrana Health (ASTH): Valuation Check After Needham’s New Buy Rating on Its Value‑Based Care Strategy

Reviewed by Simply Wall St

Astrana Health (ASTH) just got a fresh spotlight from Needham, which kicked off coverage by leaning into the company’s push toward value based care and full risk deals as a central long term growth story.

See our latest analysis for Astrana Health.

The mixed reaction to Needham’s upbeat initiation, combined with a recent earnings stumble and visible insider activity, helps explain why Astrana’s 30 day share price return is positive while its year to date share price return and one year total shareholder return remain sharply negative. Together, these factors suggest sentiment is stabilizing rather than surging.

If Astrana’s value based care pivot has your attention, it could be a good moment to explore other healthcare names using the healthcare stocks as a starting point for fresh ideas.

With Astrana now trading at a steep discount to analyst targets but still digesting an earnings reset, the key question is simple: is this genuine mispricing, or is the market already baking in its value based care growth story?

Most Popular Narrative: 44.6% Undervalued

With Astrana’s fair value in the narrative sitting well above the last close, the story focuses on how quickly earnings can scale into that gap.

Analysts are assuming Astrana Health's revenue will grow by 23.3% annually over the next 3 years.

Analysts assume that profit margins will increase from 1.0% today to 3.3% in 3 years time.

Curious how modest margins today could support a far richer future multiple, even as revenue accelerates and earnings compound sharply? Explore the full valuation blueprint behind this seemingly aggressive upside case and see which financial levers do most of the heavy lifting.

Result: Fair Value of $40.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stretched Medicaid exposure and potential missteps integrating Prospect Health mean that reimbursement shifts or synergy shortfalls could quickly undermine this undervaluation case.

Find out about the key risks to this Astrana Health narrative.

Another View: Multiples Tell a Different Story

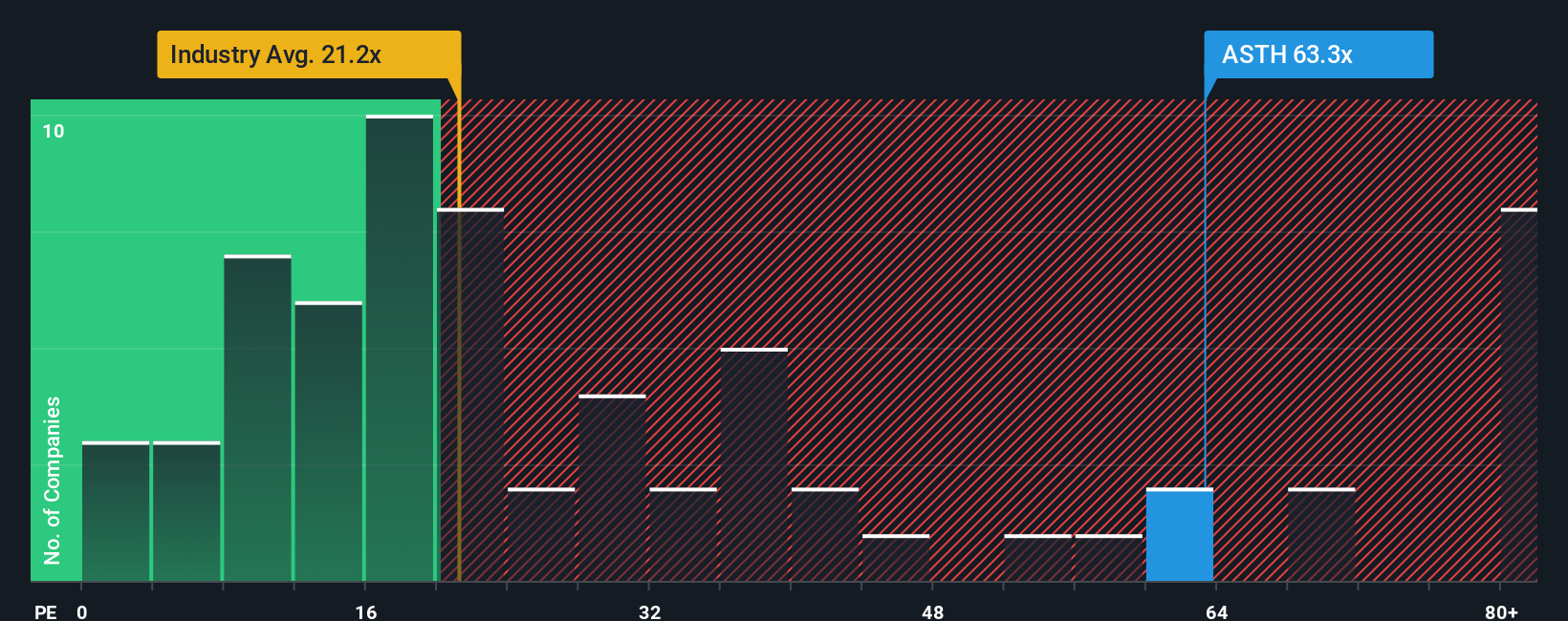

While the narrative and fair value work point to Astrana as undervalued, current pricing looks rich when you zoom in on earnings. At about 117 times earnings versus a fair ratio of 35.7 and an industry average near 24, investors are paying up today for tomorrow’s growth, raising the risk that any stumble could compress the multiple fast.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Astrana Health Narrative

If you see the story differently or want to dig into the numbers yourself, you can create your own narrative in just minutes: Do it your way.

A great starting point for your Astrana Health research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider your next move by scanning targeted stock shortlists that spotlight income, innovation, and potential opportunities you may not want to overlook.

- Review these 13 dividend stocks with yields > 3% that focus on generating income while emphasizing business fundamentals.

- Explore these 26 AI penny stocks with exposure to data, automation, and long term earnings trends.

- Consider these 906 undervalued stocks based on cash flows that may trade below some estimates of intrinsic worth based on underlying cash flow metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ASTH

Astrana Health

A healthcare management company, provides medical care services in the United States.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)