- United States

- /

- Medical Equipment

- /

- NasdaqGS:ANGO

Why AngioDynamics (ANGO) Is Up 10.9% After Raising Sales Guidance and Narrowing Quarterly Loss

Reviewed by Sasha Jovanovic

- On October 2, 2025, AngioDynamics, Inc. reported first quarter earnings, announcing sales of US$75.71 million versus US$67.49 million a year earlier and a reduced net loss of US$10.9 million compared to US$12.8 million in the previous year, alongside basic and diluted loss per share of US$0.26.

- The company also raised its full fiscal year 2026 sales guidance, now expecting net sales of US$308 million to US$313 million, reflecting a more optimistic outlook on financial and operational progress.

- We'll examine how AngioDynamics' increased first quarter sales and narrowed net loss reshape its investment narrative and confidence in future growth.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

AngioDynamics Investment Narrative Recap

Being a shareholder in AngioDynamics means believing the company can translate continued sales growth and improving margins into a path to profitability in the competitive medical devices sector. The recent first quarter outperformance and raised sales guidance provide a confidence boost for near-term revenue momentum, yet the biggest risk remains execution hurdles in achieving broad reimbursement and quick adoption for new technologies like NanoKnife. At this stage, the immediate impact of the news on major catalysts and risks is incremental rather than transformative.

The company’s raised fiscal year 2026 sales guidance, now at US$308 million to US$313 million, is the most relevant announcement, reinforcing management’s optimism after a strong quarter. However, unlocking broader reimbursement for its key innovations like NanoKnife continues to be the swing factor for both sustained sales acceleration and investor sentiment.

Yet, beneath the improved outlook, investors should pay special attention to the less visible but critical uncertainties around...

Read the full narrative on AngioDynamics (it's free!)

AngioDynamics' narrative projects $354.4 million revenue and $11.0 million earnings by 2028. This requires 6.6% yearly revenue growth and a $45.0 million increase in earnings from the current earnings of -$34.0 million.

Uncover how AngioDynamics' forecasts yield a $18.25 fair value, a 55% upside to its current price.

Exploring Other Perspectives

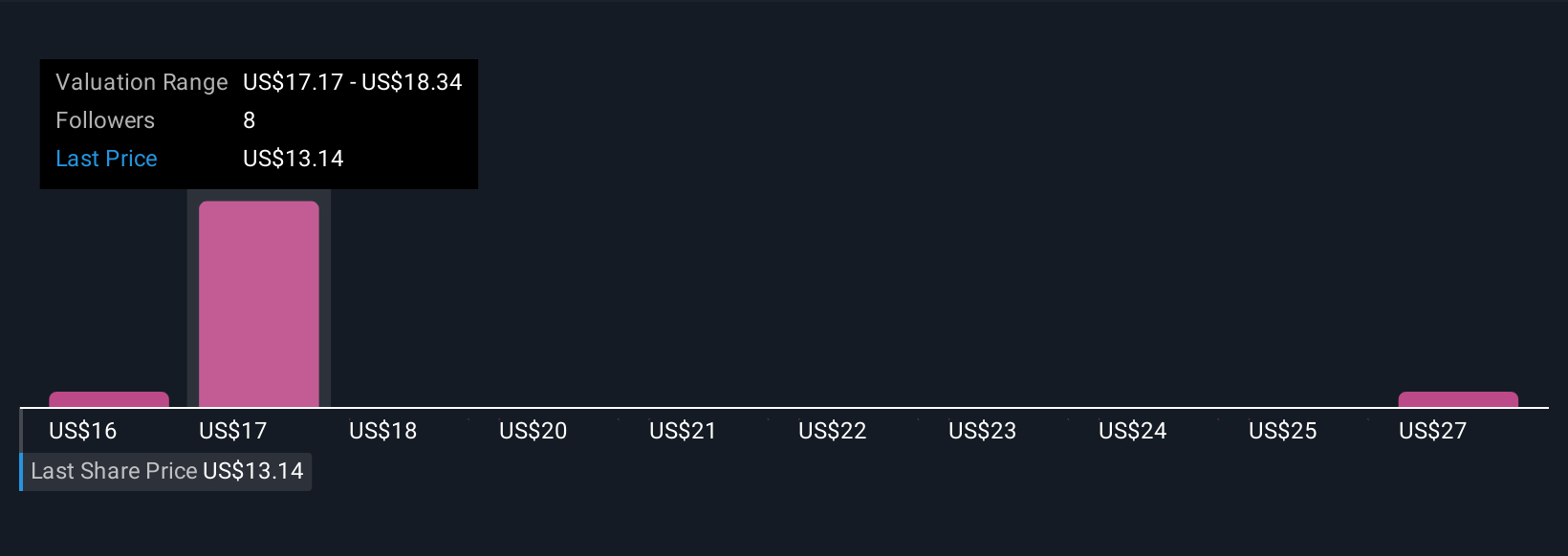

Three members of the Simply Wall St Community set fair value estimates for AngioDynamics stock from US$16 to US$27.72. While some foresee meaningful revenue growth, the unpredictability of widespread NanoKnife adoption could shape overall company prospects in either direction, explore several viewpoints to see how opinions diverge.

Explore 3 other fair value estimates on AngioDynamics - why the stock might be worth over 2x more than the current price!

Build Your Own AngioDynamics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AngioDynamics research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free AngioDynamics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AngioDynamics' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ANGO

AngioDynamics

A medical technology company, designs, manufactures, and sells medical, surgical, and diagnostic devices for the use in treating peripheral vascular disease, and oncology and surgical settings in the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)