We can readily understand why investors are attracted to unprofitable companies. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

So, the natural question for Zevia PBC (NYSE:ZVIA) shareholders is whether they should be concerned by its rate of cash burn. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. Let's start with an examination of the business' cash, relative to its cash burn.

View our latest analysis for Zevia PBC

Does Zevia PBC Have A Long Cash Runway?

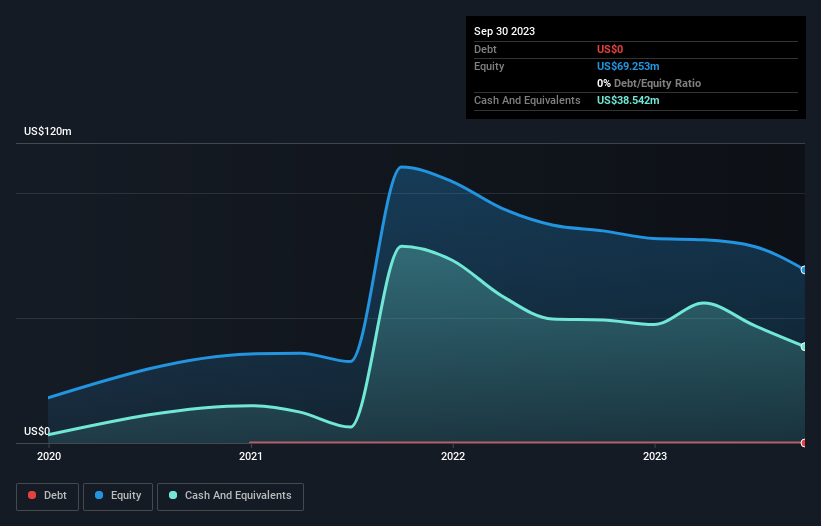

A company's cash runway is calculated by dividing its cash hoard by its cash burn. In September 2023, Zevia PBC had US$39m in cash, and was debt-free. Looking at the last year, the company burnt through US$13m. Therefore, from September 2023 it had 2.9 years of cash runway. Arguably, that's a prudent and sensible length of runway to have. The image below shows how its cash balance has been changing over the last few years.

How Well Is Zevia PBC Growing?

We reckon the fact that Zevia PBC managed to shrink its cash burn by 52% over the last year is rather encouraging. Having said that, the flat operating revenue was a bit mundane. On balance, we'd say the company is improving over time. Clearly, however, the crucial factor is whether the company will grow its business going forward. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Hard Would It Be For Zevia PBC To Raise More Cash For Growth?

While Zevia PBC seems to be in a decent position, we reckon it is still worth thinking about how easily it could raise more cash, if that proved desirable. Companies can raise capital through either debt or equity. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Since it has a market capitalisation of US$114m, Zevia PBC's US$13m in cash burn equates to about 11% of its market value. As a result, we'd venture that the company could raise more cash for growth without much trouble, albeit at the cost of some dilution.

How Risky Is Zevia PBC's Cash Burn Situation?

It may already be apparent to you that we're relatively comfortable with the way Zevia PBC is burning through its cash. For example, we think its cash runway suggests that the company is on a good path. On this analysis its revenue growth was its weakest feature, but we are not concerned about it. Considering all the factors discussed in this article, we're not overly concerned about the company's cash burn, although we do think shareholders should keep an eye on how it develops. An in-depth examination of risks revealed 3 warning signs for Zevia PBC that readers should think about before committing capital to this stock.

Of course Zevia PBC may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you're looking to trade Zevia PBC, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zevia PBC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ZVIA

Zevia PBC

Develops, markets, sells, and distributes zero sugar beverages in the United States and Canada.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives