- United States

- /

- Food

- /

- NYSE:UTZ

Did UBS’s Lowered Outlook and Neutral Rating Just Shift Utz Brands' (UTZ) Investment Narrative?

Reviewed by Sasha Jovanovic

- On October 8, 2025, UBS maintained a Neutral rating on Utz Brands while lowering its outlook in the context of industry concerns over the company's recent performance and management execution.

- Industry observers have highlighted persistently weak organic revenue growth and operational challenges at Utz, sparking discussion about the company’s ability to defend its competitive position in a shifting snack food landscape.

- We'll explore how these analyst concerns about Utz's growth trajectory and management decisions influence the company’s overall investment narrative.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Utz Brands Investment Narrative Recap

To own Utz Brands, investors need confidence that the company can accelerate organic growth while managing operational complexity, particularly as it expands westward and adapts to changing snack trends. The recent UBS price target cut reinforces short-term uncertainty around management’s ability to deliver on these priorities but does not fundamentally alter the key near-term catalyst, next quarter’s earnings report, or raise a new risk beyond the existing concerns over revenue growth and execution.

Of the recent announcements, Utz’s scheduled third-quarter 2025 earnings release on October 30 is most relevant given analyst focus on results and management performance. This upcoming report is widely anticipated, as it may clarify Utz’s progress on revenue recovery, offer more insight on cost challenges, and shape investor sentiment around organic sales trends, a central catalyst for the stock’s outlook.

Yet, against these earnings expectations, investors should consider the ongoing risk that costly expansion and infrastructure investment could outpace market share gains, leading to...

Read the full narrative on Utz Brands (it's free!)

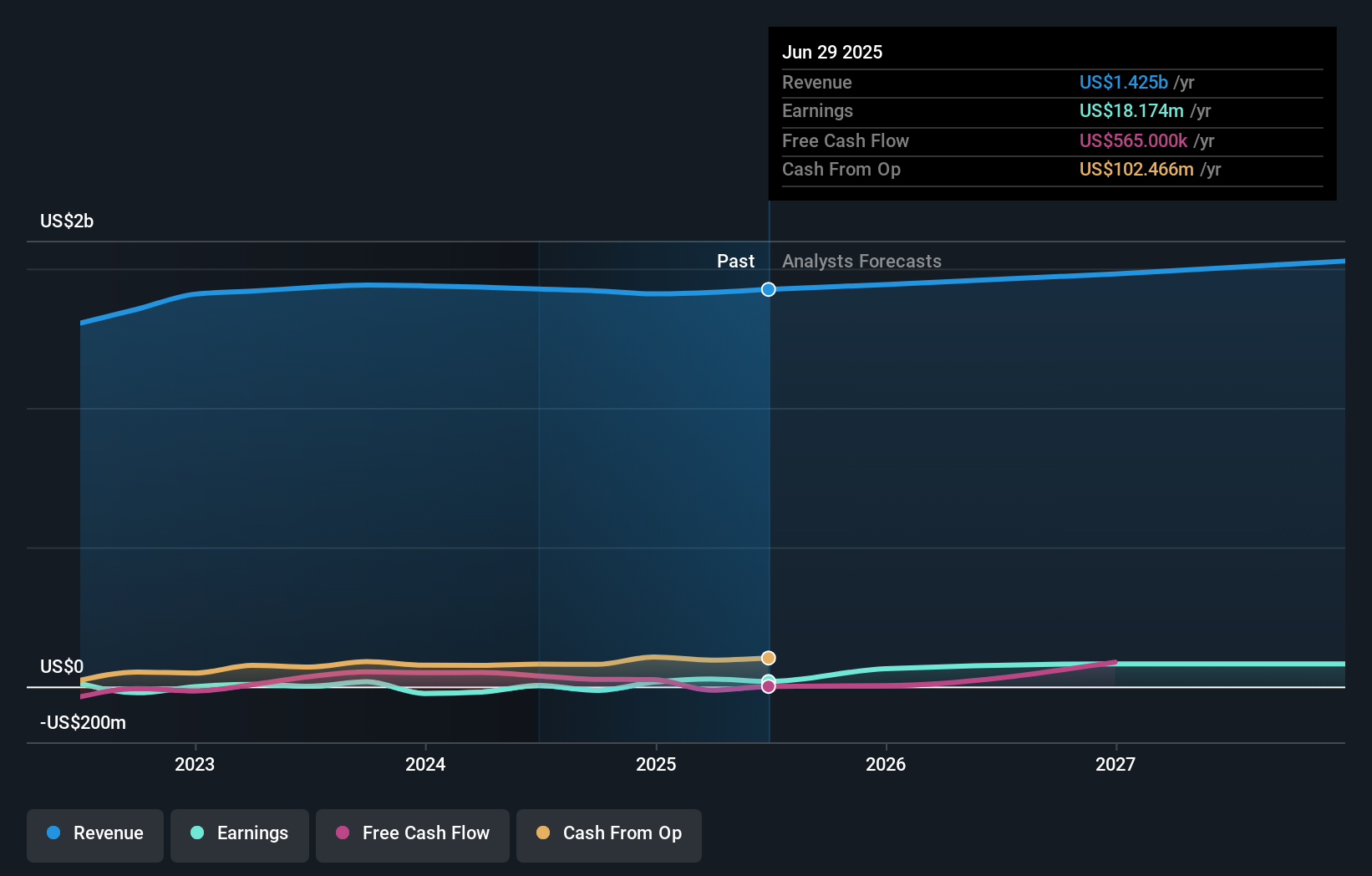

Utz Brands' outlook anticipates $1.5 billion in revenue and $119.7 million in earnings by 2028. This is based on 2.7% annual revenue growth and an increase in earnings of $101.5 million from current earnings of $18.2 million.

Uncover how Utz Brands' forecasts yield a $17.10 fair value, a 40% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community cluster tightly between US$17.00 and US$17.10 per share. In contrast, persistent concerns about weak organic growth keep pressure on Utz’s ability to achieve consistent top-line expansion; opinions across the market can differ widely, so consider reviewing a range of viewpoints.

Explore 2 other fair value estimates on Utz Brands - why the stock might be worth just $17.00!

Build Your Own Utz Brands Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Utz Brands research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Utz Brands research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Utz Brands' overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UTZ

Utz Brands

Engages in manufacture, marketing, and distribution of snack foods in the United States.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives